2022 is proving to be an extremely difficult year for stocks, especially technology ones. After decades of injecting money, inflation was once again a problem in the US So the Federal Reserve had no choice but to start raising interest rates, affecting company valuations.

Until Wednesday of this week, at which time they presented balance, Microsoft (26%) and Google (-28%) accumulated significant falls. Let’s see its evolution during 2022:

Google Microsoft Balances.jpg

Microsoft balance sheet

Microsoft recorded sales of USD 51.9 billion, marking the slowest growth in the last 12 years, with 12% year-on-year. The Office segment grew by 9%, Linkedin by 26% and cloud services by 19%.

Earnings, on the other hand, were USD 16.7 billion, which implies an improvement of 2% year-on-year. However, they were lower than expected by the market.

The company expects double-digit sales growth by 2023, despite the bad economic climate, especially due to possible signs of a recession.

Google’s balance sheet

Google’s sales grew by 13%, reaching USD 69.7 billion. The YouTube segment continues to grow, but not as fast (+5% year-on-year). And the cloud service (Google Cloud) increased by 37%.

The negative, without a doubt, was its earnings, which fell by 14% year-on-year, reaching USD 16,000M. There are already two consecutive quarters of decline, a situation not seen since 2015. The fact that profits have decreased despite the growth in sales is explained by the increase in operating costs, which rose by 20% year-on-year.

The surprising pace of search ad sales demonstrates Google’s resilience against results reported by similar companies. This speaks of its great competitive advantage and market dominance.

Now, the day after the balance, the shares of Microsoft and Google rose 7% and 8%, respectively. Why so much rise?

A valid explanation is that, despite not having shown outstanding results, they were not very bad either. What needs to be analyzed is the expectation that the market had. Google and Microsoft continue to show resilience, and that can lead to significant gains in a very bearish climate.

In addition, on Wednesday the 27th, the Federal Reserve announced the fourth increase in interest rates of the year, of about 75 basic points. The market expected that figure and celebrated it, which caused Microsoft and Google to accelerate their rise even more.

What can happen in the future? The US economy is showing huge signs of recession. For now, Microsoft and Google do not strongly evidence these recessive consequences. It may be that, given their dominance in the market, they take longer to do so.

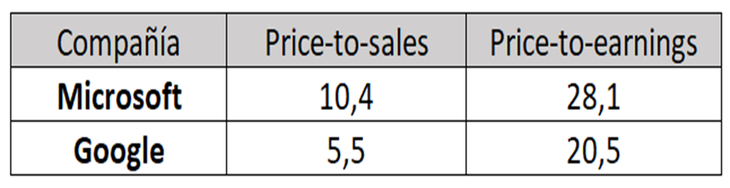

It is also worth noting the high valuations of both companies:

image.png

For reference, the S&P 500 has a Price-to-sales 2.5 and a Price-to-earnings of 20.3. If the recession hits hard, Microsoft and Google’s sales and profits will decline, so valuation ratios would be even higher. Therefore, you have to be careful.

To finish, I want to invite you to download a report that I prepared so that you can face this global crisis and have the tools to know how to beat the market. You can download it at this link: https://informes.cartafinanciera.com/duplicarcapital-inicio?utm_medium=referral&utm_source=ambito&utm_campaign=funnel-duplicar-crash&utm_term=msft_goog_29_07_22&utm_content=acciones

Source: Ambito