After several weeks, the government took a turn. Serge Massa assumed as “Superminister”being in charge of Economy, Production and Agriculture, Livestock and Fisheries.

This generated a significant drop in the price of the dollar:

Boggiano1 31-7.png

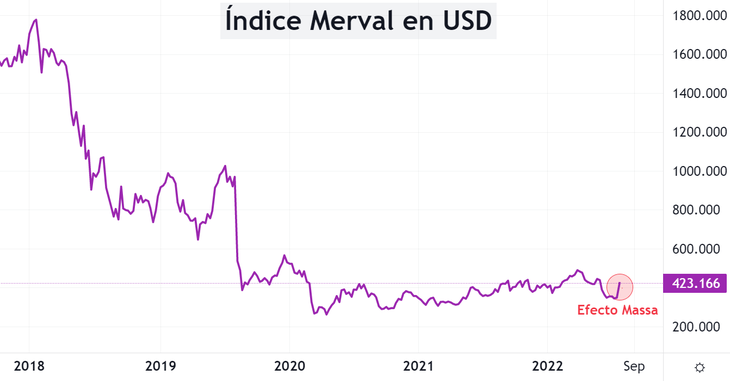

In line with this improvement on the currency front, stocks and bonds also rallied. Since the rumors of Massa’s assumption, the Merval in dollars rose 24%, as did the AL30, the most traded bond.

Argentina, whether for its shares or bonds, is extremely cheap. Although now the panorama seems to be different. Massa’s appearance looks like a turn towards orthodoxy, showing a little more rationality. That’s why the dollar calmed down and stocks and bonds came out of the bottom of the sea.

In addition, the blue dollar had reached $350, in full uncertainty. For your reference, the 4 pesos of October 2001 are equivalent to $310, adjusted for inflation. It had never been so expensive. Can you keep going up? No plan or positive signs, clearly yes. But for now, being at extremely high levels and given a change in expectations, it went from $350 to $295 in a few days.

With some name changes and the expectation of an economic plan, the perspectives changed. But we must not forget the situation in which the country finds itself. Let’s see the long-term Merval Index in dollars:

Boggiano2 31-7.png

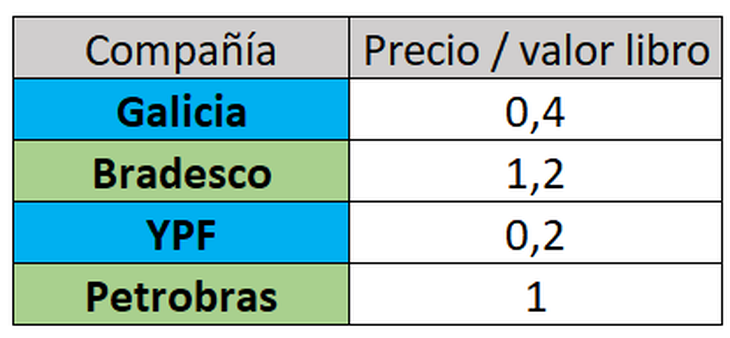

The huge rise that stocks had is very small if one looks at the long term. Argentina is still at the offer price, there is no doubt about that. I want to share a table that compares the market price in relation to its book value (P/B: price to book). I took the examples of Galicia and YPF, together with their counterparts in Brazil: Banco Bradesco and Petrobras.

Boggiano3 31-7.png

While Banco Galicia has a P/E of 0.4, Brazil’s Banco Bradesco has a ratio of 1.2. Regarding the oil companies, YPF has a P/B of 0.2 and Petrobras one of 1. Huge difference between the valuations of Argentina and Brazil.

It is worth noting that with just one announcement, stocks and bonds rose more than 20% and the dollar plummeted. It is not yet to claim victory, but it provides a guideline of the upward path that Argentine assets have.

Not to mention the huge risks involved, investing now can deliver juicy returns. It is clearly not for conservative profiles. It seems that Argentina is always silver or lead.

To finish, I want to invite you to download a report with all the variables you need to know to understand the price of the dollar in Argentina. I really recommend it to you. You can download it at this link: Financial Letter – dollar.

Source: Ambito