The Central Bank continues to sell reserves, we do not see an improvement in liquid and available reserves on the horizon, and we have payments of US$ 2.4 billion in gas vessels. This makes those who make economic projections more jealous looking at the medium and long term.

The projections of the Market Expectation Survey (REM) reported by the Central Bank show us that the averages of the consultants see inflation at 90.2%, with forecasts that were at a maximum of 118.5% and a minimum of 61 .9%.

The first distinct feature of the REM forecast is that for the first time it shows that the devaluation rate will be slightly higher than the Badlar interest rate.

From our point of view, we believe that these figures could be at higher levels, inflation could be at levels of 100.5%, while the interest rate would be around 78.0% per year, and the interest rate devaluation at 74% per year.

We believe that inflation will be higher, and that the Central Bank does not have the tools to contain the rise in alternative dollars, therefore, it will have to resort to a strong increase in the interest rate. On the other hand, the government is clinging to a backward exchange rate almost like a religious belief, therefore, we see the official dollar growing below the rate of inflation.

In the month of August, the wholesale exchange rate is projecting a rise of no more than 6.0% in the month, with a high probability of tying up inflation, we will see how the game ends.

Clipboard01.jpg

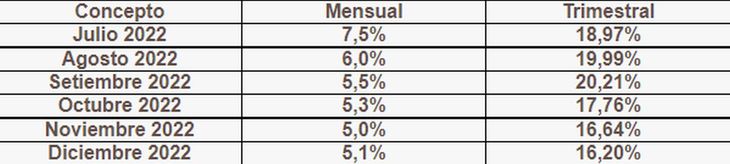

It is very interesting to see the monthly projections of inflation, as can be seen in the second semester an inflation of 39.7% is expected, when in the first semester it was 36.2%.

If we look at the quarterly projections, we see a slight decline by the end of the year, but If we look at the returns that a UVA fixed term can leave us that we renew every 3 months, we have interesting returns ahead.

REM monthly inflation rate projection

Clipboard02.jpg

A government letter that expires on October 31, 2022 with a term of 82 days, yields us 10.86%, when a fixed term adjusted for inflation in 3 months leaves us a yield that can be double what it leaves us a discount bill from the national government.

The Lecer (inflation-adjusted discount bills) with a term of 105 days maturing on November 23, 2022 yields inflation minus 4.8%, clearly these bills are outperformed by an inflation-adjusted fixed term made in a bank, since they pay inflation plus 1% per year.

Conclusions

. – The REM projections are below the price increase expectations of our projections. We believe that the market average expects an economic improvement, which, from our point of view, we do not appreciate in the short and medium term.

. – The supply of bills that the State makes available to investors have unattractive rates, therefore, only State agencies or private organizations that necessarily invest in these instruments invest in them. Mutual funds that are investing in these instruments have turned out to show unattractive returns. A traditional fixed term at a rate of 61% per year yields more than the set of these instruments.

. – The national government punishes savers in pesos by offering them interest rates that are very low compared to expected future inflation. Savers seek to protect themselves by choosing fixed terms adjusted for inflation, but not all banks are open to receiving these pesos, many put limitations on this operation, with which all roads lead to alternative dollars.

. – For longer terms, you can invest in inflation-adjusted bonds such as T2X3 maturing on August 13, 2023 (almost a year ahead), it pays you inflation plus 1.67% per year, it does not have much difference with fixed terms for inflation offered by banks, but you can put as much money as you want. The danger is that the government decides on a compulsory restructuring, something that should not happen, but this is Argentina.

. – The dollar today trades at $280.00, if at the end of the year it stands at $350, the profit would be 25%, and it would be below the expected inflation in the next 5 months, which according to the REM projection would be 29 .95%.

. – If the dollar traded at $380 at the end of the year, the gain would be 35.7% and would exceed inflation for the next 5 months.

. – From our point of view, placements in pesos pale against the dollar. Not to mention if the forecast of the dollar at $ 400 is fulfilled, which would leave you with a return of 42.9% in 5 months, leaving the alternatives in pesos far behind.

. – The debt swap will be a success, it is like playing solitaire, most of the swap is State versus State, it is always good to voluntarily restructure debt, in this case we will see how much the private sector contributes. Success is discounted, it does not change the scenario or expectations.

. – On Thursday the Central Bank would decide on a rate increase, the market average reflected in the REM data does not seem to notice it. If the rate hike is timid, the dollar could start a very bullish rally. If the rate hike is strong, this could start to discipline the market. The current Central Bank authorities are more pigeons than hawks, it remains to be seen what the new Economy Minister will impose, will it be a hawk or a dove? We will know shortly.

financial analyst

Source: Ambito