image.png

This last week has been a very positive one for the ecosystem, as well as the world macroeconomy. With a positive inflation result by the Federal Reserve of the United States with a 0% inflationary variation of the last month. This does not mean that the United States does not have more inflation, but rather that what they have published refers to a partial stability. Which stimulates all financial markets.

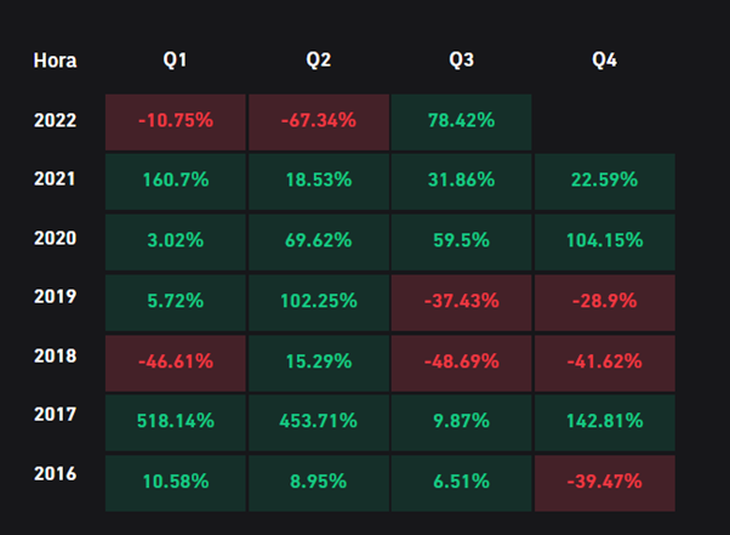

Taking into account these factors, and the speculation generated by the tentative date in which The Merge event could occur within the Ethereum network. The market accompanies, thus having several “green” days for this ecosystem of cryptocurrencies. The Native currency of said network has increased by 78% so far this quarter.

image.png

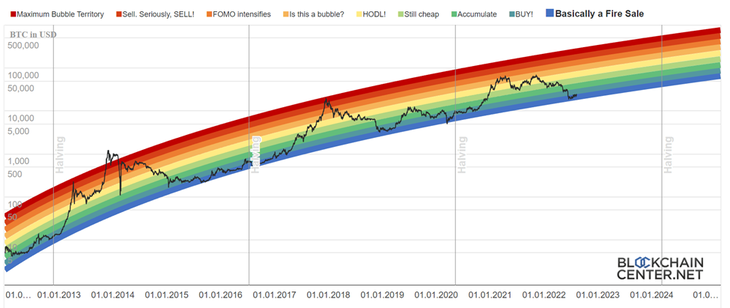

Previously we have analyzed indicators that have been valid to predict future movements, I feel these are the Rainbow Chart as well as the Fear & Greed Index. Here are the following:

The Rainbow Chart indicator determines, through technical analysis tools, a logarithmic scale that marks an expected trend of the movements that Bitcoin may have in the future. Thus establishing certain levels where it indicates that the price in real terms is “cheaper” or more “expensive”. This graph also shows the dates of the future “halvings” which are the moments where the emission of each Bitcoin block is adjusted. In each adjustment said emission slows down, this is one of the pillars of the flagship currency of the crypto ecosystem. Until the moment after all the Halvings the currency experienced a great performance, this does not necessarily mean that it will happen again, however, it is still the precedent that we have.

image.png

On the other hand, taking a more fundamental analysis stance from last week to today, we noticed a change in investor sentiment in cryptocurrencies. To make this statement we use the indicator “Fear & Greed Index” (Index of Fear & Greed), which determines through an analysis of many factors, as well as the predominance of the Bitcoin for other currencies, Google searches on the price of said currency, volatility, market volume, among others. If the average investor’s overall sentiment tends to be one of greater fear or high greed, it is done on a scale of 0 to 100 with 100 being extreme greed and 0 being extreme fear.

Last week said indicator reflected a value of 31, and last month it was located at 15. But today it is at 42. So the conclusion obtained by this indicator is that the average investor is losing this fear that one may have at the time of investing and would tend more to choose to make said investment. Which is a good sign for the coin in question.

image.png

Crypto & Financial Analyst at the N&W Professional Traders Institute.

Source: Ambito