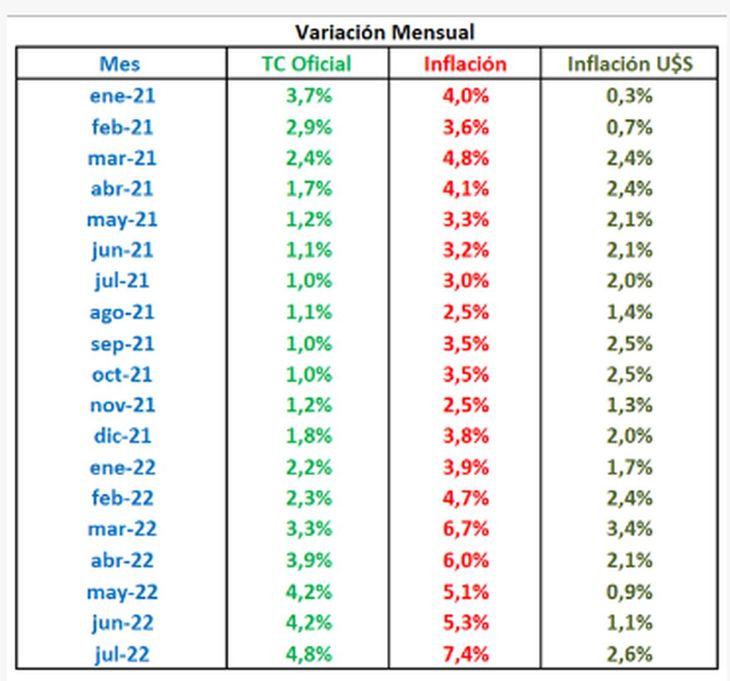

While eyes are on prices, we have tried to observe what happens with the evolution of the official exchange rate, where the Central Bank has a mean look, since this indicator climbs the ladder, while inflation does so by the elevator.

The dollar wholesaler (which is taken as a reference to settle exports and imports) rose in the last year almost half that of inflation, since it increased by 35.7%. This implies that inflation in dollars stands at 35.3%, a record figure for the analyzed series.

Clipboard01.jpg

To the extent that inflation increases twice as much as the wholesale exchange rate, it will be very difficult for exports to be activated and it is understandable that imports will be boosted. We already know that imports will not be able to grow because the State itself limits the entry of merchandise from abroad, something that ends up affecting the country’s growth.

If we look at the evolution of inflation and the exchange rate in recent months, we have seen how inflation took on an upward dynamic from February 2022 onwards, while the official exchange rate accelerated from December 2021 onwards. However, it starts from such low levels that it cannot neutralize the increase in prices.

Clipboard01.jpg

The government believes that if it increases the exchange rate it boosts inflation levels, therefore, it tries to use it as an anti-inflationary anchor and increases it below the expected inflation. On the other hand, between August and September, the State has to make very important disbursements of dollars when buying regasification ships to supply gas to the internal market. There is talk of disbursements for US$2.4 billion. If the Central Bank were to devalue the peso, it would make it more difficult for the Treasury to obtain the pesos to pay for the ships. It is speculated that after September the exchange rate policy could take another course.

Conclusions

Delaying the exchange rate against inflation is suicidalthe government should take into account that many products that are exported have high retentions, with which the general delay should be added to the export duties that are charged and affect the prices of the products that are marketed abroad.

The multilateral exchange rate index measures the competitiveness of the Argentine peso with the average of the countries with which you have trade abroad. If we measure the series from 1997 to date, the average exchange rate is around $164.25, approximately $30 higher than the price of the current exchange rate, however, it should be taken into account the huge number of products that, because they are affected by export duties, have lower exchange rates, for example, soybeans with export duties of 33% have a dollar of $88 as of July 29.

Clipboard01.jpg

In the graph we can see that the exchange rate that was $4.00 in 2002, at current values represents $279.84, which is a price very similar to the MEP dollar or Cash With Liquidation in the local market.

If the government were to devalue the official exchange rate, we do not believe that this would imply a rise in alternative dollars, on the contrary, we believe that the gap would narrow. The government should devalue, raise the interest rate, reduce the fiscal deficit and stop issuing money.

In summary, the devaluation of the official exchange rate could be the solution to many problems, since it would encourage greater exports, discourage imports and could increase reserves. The rise in the exchange rate is a necessary but not sufficient condition, it should be accompanied by a reduction in the fiscal deficit, with a view to leaving it in balance, since the virus of all ills is the deficit and the collateral damage is Argentina’s competitiveness , product of using the exchange rate as an anchor to control prices and not as a tool to accompany the productive sectors to be more competitive, generate more employment and increase economic activity.

financial analyst

Source: Ambito