Actions take a rally from mid july

Stock index performance S&P 500, EuroStoxx 50, Emerging and Nasdaq.

Criteria 1.png

Source: Criteria

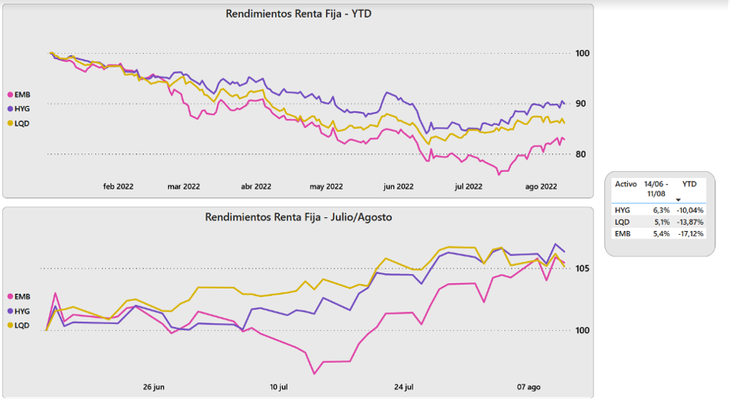

In the fixed income market, high yield bonds rose 6.3% in the period, while US investment grade debt rose 5.1%. Unlike equities, emerging market US$ debt did catch on from the better environment with a 5.4% jump in prices.

Although less vertiginous, the bonds also register a rally

High Yield, Investment Grade and Emerging Bond Yields.

Criteria 2.png

Source: Criteria

In this context, it is worth asking the following question: Are we facing a turning point? Or rather what we perceive is a marginal improvement in a market that remains fundamentally down?

To put into perspective, the vast majority of asset classes remain in negative territory so far this year: corrections for 2022 to date range from 12.3% in the case of the S&P 500 to 21.3% for European stocks (measured in US$). In bonds, the negative performance moves in a similar range.

As we pointed out earlier, the struggle between inflation, interest rates and economic recession is the fundamental axis to determine the performance of assets. In this sense, there are reasons that invite us to think about a scenario that, if consolidated, could become favorable for global assets.

The latest inflation record in the US gave investors a break. Consumer prices in that country grew by 8.5% year-on-year in July, a moderation in the pace of expansion compared to the previous month, when it was 9.1%. In month-on-month terms, inflation was nil.

Almost without exception and with the Federal Reserve in the lead, central banks throughout the world have undertaken an adjustment via interest rates and monetary contraction to contain pressures on prices. Although in almost all cases the year-on-year figure continues to be very high, the consolidation of a disinflation trend would be welcome news for the markets.

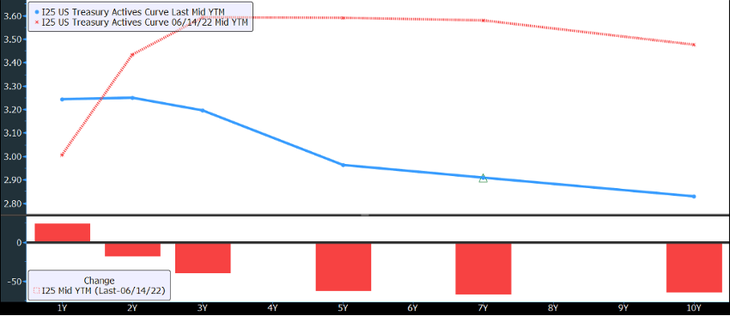

For now, the Federal Reserve is not expected to discontinue its aggressive rate-hike program. However, the interest rate on 10-year Treasury bonds has already shown a slowdown in the last two months: it is below 2.9% per year after yielding a peak of 3.5% in mid-June.

Inflation expectations measured by the relative yields of US Treasury bonds at a fixed rate and those adjustable by the price index, show that Wall Street gives credit to the FED in meeting its objective, showing an average expected inflation of 2.5% average for the next 10 years (versus a target of 2%).

Of course, a contractionary monetary policy has its cost in terms of economic growth. The strong inversion in the US yield curve suggests no less probability of an economic recession on the horizon. However, the market consensus expectation today is for a shallow, short-lived contraction.

As can be seen in the following graph, since mid-June the yield on the 10-year bond has fallen from 3.5% to 2.9% as a result of lower inflation expectations. Meanwhile, the 1-year bond rose from 3.0% to 3.2% following the sharp rise in rates by the Federal Reserve. The result? A yield curve with an “inverted” shape, which anticipates relaxation of rates after 2023.

Recession on the horizon? Yield curve inversion deepens

Treasury bond yield curve.

Criteria 3.png

Source: Criteria

In this sense, one of the transitory elements that added pressure to international prices was the global supply chains. As a consequence of the pandemic first and the war in Ukraine later, many of them suffered and presented bottlenecks that raised the costs of important inputs, from energy products to food and technological goods.

In recent times, there has been an improvement in the restoration of these chains, as the obstacles in each link are resolved. At the same time, a drop in the price of global raw materials is perceived, which, although still high, allows us to foresee an improvement.

All these elements invite us to think of inflation that could lose momentum in the coming months. The Federal Reserve has not changed its speech: just two weeks ago it increased the interest rate by 0.75% for the second consecutive month to combat pressure. However, signs in asset prices suggest lower-than-expected inflation expectations than peaked in March, when the conflict erupted in Ukraine.

The element that still does not allow us to lower our guard is the tight labor market in the US, which remains strong and shows wages growing above 5.6% annually in July, a rate that cannot last if prices are to cool down.

If this trend is confirmed in the coming months, and a moderation in the labor market is verified due to the effect of higher interest rates, a scenario like the one experienced in the first half of the year – with sharp falls in prices throughout the entire spectrum of assets – could have been left behind.

According to recent remarks by the head of the Federal Reserve, Jerome Powell, “there is no option of failing” in the attempt to restore price stability. The markets are recovering with the same expectation on the horizon.

Asset Management Director of Criteria

Source: Ambito