Clipboard01.jpg

Those that make up the ranking are YPF, Vista Oil, Banco Supervielle, Edenor and Bioceres. Logically, they all depend on what happens in the country. What happened recently? Massa took office as Minister of Economy, he gave certain positive signs from the fiscal point of view, the dollar calmed down and important maturities of debt in pesos were cleared.

These factors gave a fresh air to the actions, mainly to the recently named ones (YPF, Vista Oil, Supervielle, Edenor and Bioceres). But don’t forget that most Argentine stocks are well below their highs, so it’s not uncommon for even a little bit of positive news to show impressive returns.

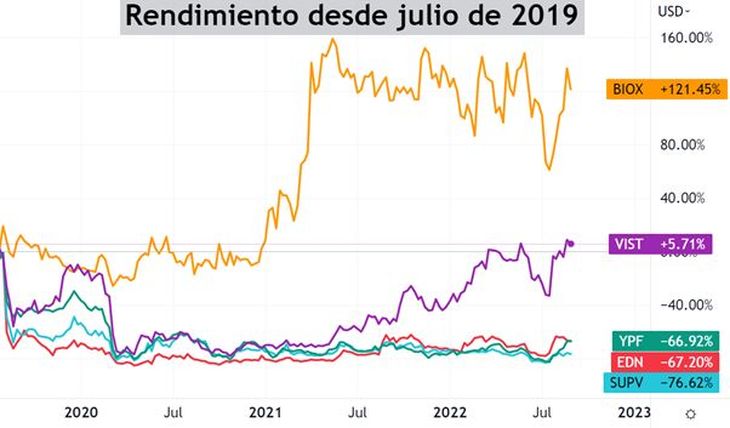

Let’s see the performance of these actions since before the PASO of 2019, the date on which the current ruling party (Kirchnerism) began to take power:

Clipboard02.jpg

YPF, Edenor and Supervielle have lost more than 66% of their value since July 2019. Without a doubt, the most notable are Bioceres (+121) and Vista Oil (+6%).

Let’s look at each case one by one:

- YPF (YPF): the famous oil company had a great rally in recent weeks, motivated by the good balance it presented. However, looking at the long term, it generated such distrust in investors due to political management, which is more than 90% below its maximum. If you continue to show good results, you will certainly be able to have remarkable returns.

- Edenor (EDN): provides electricity distribution and marketing services. As is known, their income strongly depends on what the State allows them to charge for their services. Recently, the cut in subsidies generated better expectations for the company. For all this, it is a very political trade, with the risks that this entails.

- Survival (SUPV): the bank accumulates a drastic fall of 94% from its maximum. It recently presented its balance sheet with poor results: it worsened margins, increased losses and increased uncollectibility. In addition, like all banks, they have the latent risk and uncertainty due to the situation with the Leliqs. Being so deep in the sea, a minimal positive driver can cause a strong move to the upside.

- View Oil (VIST): the company has conventional and unconventional oil and gas assets. It became one of the most important producers and operators in the country. In 2021 it had a return of 111% and so far in 2022 it exceeds 80%. It has a very serious management and a valuation that, despite the recent big rise, continues to be attractive.

- Bioceres (BIOX): This company, founded in 2001 in Rosario, is dedicated to biotechnology and revolutionized the seed market, obtaining significant improvements in soybean and wheat yields. In addition, they achieved mergers with important companies, thus becoming a leading company in the field. Have a Market Cap of “only” USD 850M, so the potential is enormous considering its sales.

It is very important to look at the situation of each particular company, understand its business model and the risks. Also, do not miss the long-term charts.

For example, investing in Banco Supervielle is not the same as investing in Bioceres or Vista Oil. While the former does not have the capacity to innovate and grow, the latter do. Although this does not mean that, from now on, Supervielle cannot have a better performance than Bioceres or Vista Oil in a certain period of time. Its price is so depressed that it can have interesting movements in the face of certain positive news.

At the end of the day, it is all a relationship between risk and return. Those who invest in Argentina know what it is about. The country moves to the beat of the political and in the face of minimal changes, the actions can have interesting movements.

But it is also worth noting the enormous destruction of capital that occurred in most Argentine companies in recent years. The risk is always latent and no one should forget it.

Next year there are elections and surely the assets will be anticipating what may happen. The reward can be huge. The cost too. As always, invest carefully.

To finish, I want to invite you to download a report with all the variables you need to know to understand the price of the dollar in Argentina. I recommend it to you. You can download it at this link: https://informes.cartafinanciera.com/

Source: Ambito