In theory, the investor has dollars (or borrows them at a low rate), which he exchanges for pesos, invests them in any asset in pesos that brings him a profit, and after a certain time, he buys dollars again. Carry is called the return that is obtained while we have the investment. In Argentina, this strategy is known as a financial bicycle.

image.png

Of course, you can invest in any asset in pesos. And the capital market offers good instruments for this, such as Treasury bills at a discount (TNA yields 83% in January), sureties, CER instruments (which adjust capital and interest against INDEC inflation).

The important thing is that the profit is high. How tall? Greater than the variation of the exchange rate. And here comes the weakness of this strategy in countries like ours, where exchange rate stability is short-lived.

What happens if the exchange rate runs away? Let’s assume that the MEP goes to $325, which represents a rise of 9.4% in the month.

image.png

So, the conclusion is that this strategy will only give us profits if the exchange rate remains stable, falls or rises less than the profit that the investment in local currency gives us.

What is the breakeven exchange rate?

We have to resort to the interest rate parity formula (or common sense). In this hypothetical case, it gives us that the indifference exchange rate is the one that equalizes the rates of return between currencies, that is, $315.3, an increase of 6.16%, the same as the fixed term yields in one month.

Is it time to enter?

Currently, the rates in pesos are high and tempting, but the answer lies in the expectation regarding the evolution of the exchange rate that each investor has.

We believe that, throughout September, the month of profits for soybeans pesified at $200, the pesos resulting from these sales of soybeans will end up in blue, mep or financing for the next campaign. We have seen that by the end of September the MEP rose more than 4.5%. More measures are expected in October.

What does recent history say?

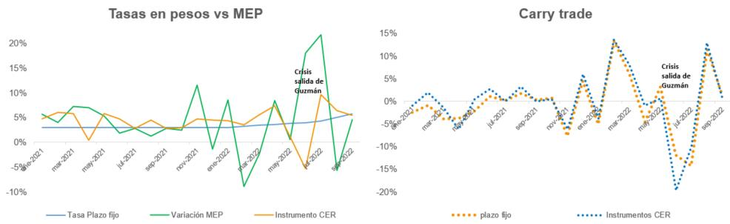

In the first graph we see the rates in pesos of fixed terms and CER instruments (FCI). At first glance you can see the benefits of the fixed term: the yield (light blue line) is stable over time, in addition to being known in advance by the investor. The yields of the CER instruments (orange color line) are more volatile: at times they beat the fixed term, but at others they are well below it, as in the recent crisis that began with the departure of Guzmán, Batakis and the arrival of Massa , where the FCI lost 10% in a few days and the mep jumped to $320. Therefore, it is important to choose an instrument in pesos with which the investor feels comfortable, the CER securities yield more at times, but they are tied to market volatility. So, when we look at the second chart, we see that at times the carry of CER instruments was better than that of fixed terms (and at times, the other way around).

Another conclusion that we reach by looking at history is that, in our country, this strategy cannot be maintained for many months, since exchange rate stability does not last long.

image.png

Logically, the past does not have to be repeated and the future is impossible to anticipate.

What should be clear is that this strategy is risky and its result ends up depending on the evolution of the exchange rate and each investor has their prediction or opinion.

It is a strategy for investors who are encouraged to take risks. As we have seen, a jump in the exchange rate, something recurrent in our country, erases all gains in pesos in less than a month.

Financial advisor.

Source: Ambito