With this, in the first nine months of the year, agriculture has already liquidated the same as all of 2021, a year that had been a record. The challenge will come from October given that, with all the soy liquidated, the foreign exchange market is left without the main engine of supply; We estimate that the liquidation of the sector would be around USD 1,500 M per month (for the remainder of corn and wheat).

image.png

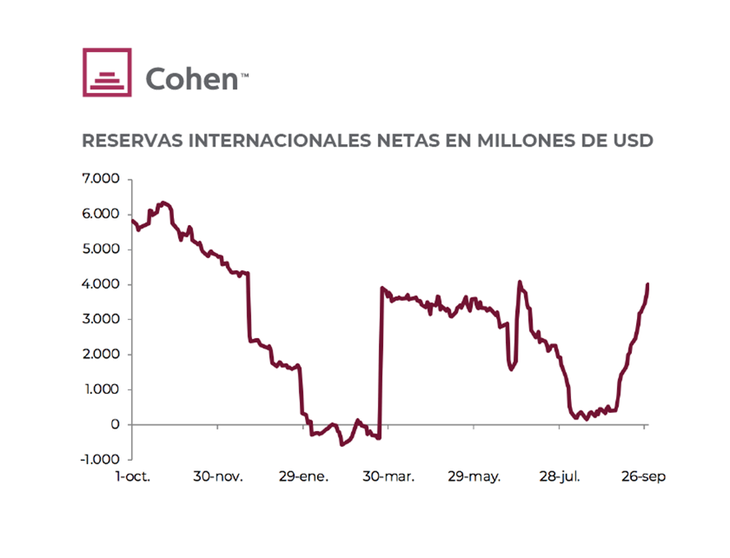

BCRA recovers reserves. With the greater supply of agriculture, lower energy payments and an exchange control that does not yield, the BCRA took advantage of the greater liquidation of agriculture to buy foreign currency in the exchange market and recover international reserves. In fact, while in the first eight months of the year the balance of operations in the foreign exchange market was practically neutral –against net purchases of more than USD7,000 M in the same period last year–, in September it will have bought more than USD 4,000 M. Although it does not manage to meet the reserve target for the third quarter agreed with the IMF, which pointed to a stock of USD 6,500 M, with these interventions the stock of net international reserves rose to USD 4,500 M and gives it greater firepower to the BCRA to contain the pressure of abrupt adjustment of the exchange rate facing a fourth quarter in which the lack of foreign currency will be accentuated.

image.png

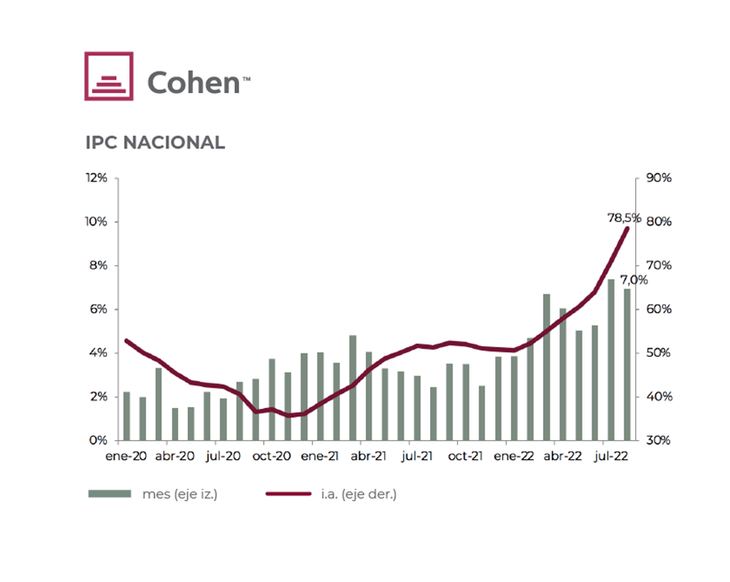

Inflation does not yield. The National CPI for August reflected the high and persistent inertia shown by inflation without an abrupt correction of the exchange rate or adjustment of tariffs. Specifically, it marked an increase of 7% m/m (vs. 7.4% in July), slightly above expectations, accumulating an increase of 56.4% so far this year and 78.5% compared to a year back (accelerating from 71% yoy in July). With this performance, in the last 3 months the IPC averaged an increase of 6.6% m/m (114.3% annualized). At the same time, wholesale prices rose 8.2% m/m in August and 75% yoy, while the construction cost index rose 7.2% m/m and 66.7% yoy. This puts a high floor on retail inflation for September, which we estimate at around 6.5% m/m. If it is sustained at 6% in the last quarter of the year, inflation would close at 98% in 2022; At 6.5%, inflation would exceed the 100% barrier for the first time since 1991.

image.png

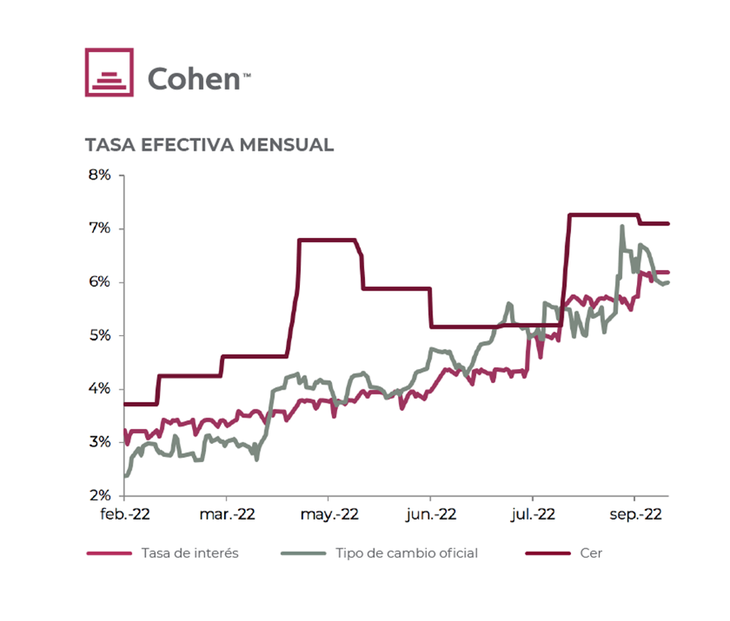

Devaluation accelerates and interest rates rise. Despite the improvement in the foreign exchange market, with inflation accelerating, the BCRA accelerated the rate of devaluation of the official exchange rate and made a new adjustment to interest rates. Specifically, after beginning the year devaluing at 2%, it gradually accelerated to 6.3% m/m in September, accumulating a rise of 45% in the last year. At the same time, the reference rate was raised again –revalidated with Treasury debt issues– by 550 bp, which was transferred to time deposits in local currency. With this new adjustment, the LELIQ rate rose to 75% of TNA (TEA of 107.3%, which is equivalent to a monthly rate of 6.2%). For retail time deposits (up to $10 million) the interest rate floor rose to 75% of TNA (107.1% of TEA) while for the rest of private sector time deposits the minimum guaranteed rate rose to 66.5% TNA (TEA of 91.1%, which is equivalent to a monthly rate of 5.8%).

image.png

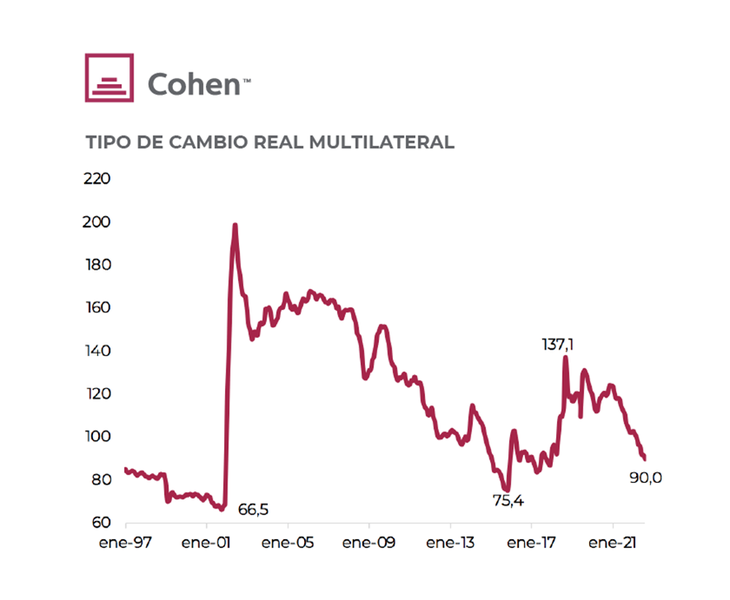

More exchange delay. With the official exchange rate losing against inflation and in a global context in which the dollar is strengthening against all currencies, the Argentine peso loses competitiveness, despite the commitment to prevent it from moving away from the values at the end of last year that had assumed the Government within the framework of the agreement with the IMF. Specifically, in September the Real Multilateral Exchange Rate (TCRM, which measures the competitiveness of the peso against the main trading partners) fell 2% and accumulates a loss of 12% so far this year, and 20% compared to a year behind. In this way, the TCRM is at the lowest level since March 2018, which will undoubtedly be a risk factor for the medium term.

image.png

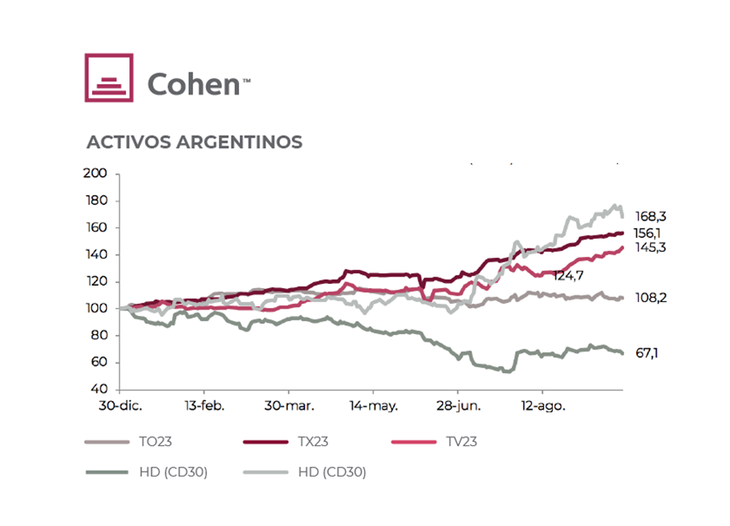

Hit markets. Even with a more stabilized internal front, in which the BCRA recovers international reserves while the Treasury moderates fiscal expansion (although it is insufficient to correct the imbalance in public accounts), given the complex global scenario and the uncertainty about upcoming government measures local assets did not have a good month. The exchange rate gap rose again, sovereign bonds in foreign currency and the Merval fell significantly, while bonds in pesos rose along with inflation. Specifically, as of Wednesday, September 28, sovereign bonds in foreign currency marked falls of 10.4%, with those of foreign legislation being the most affected with falls that exceeded 11%; the Merval measured in CCL dollars accumulated a drop of only 7% since YPF compensated for the strong declines of the rest of the panel by registering an increase of 15% (in the year it accumulates a gain of 68%). On the side of the bonds in pesos, the most demanded were those adjustable by CER, which rose 8% -hand in hand with the longest tranches that gained more than 10%-, closely followed by bonds adjustable by type of interest. change (DLK and Duals) that recorded increases of around 8% (only the T2V2 was out of tune, which rose less than 2%). The big losers of the month were fixed-rate bonds, which averaged 4.2% declines.

image.png

Outlook. The October scenario is challenging. without him spell of the soybean dollar, we expect the BCRA to strengthen exchange controls and add a differentiated exchange rate for tourism, in order to contain the loss of reserves and avoid the exchange rate jump. Inflation will remain very high and we expect it to rise 6.5% in September and then drop moderately to 6% per month in the last quarter. The government will have to face the last part of the year with an external front that will become more tense due to the drop in exports, as well as a fiscal front with a slowdown in income and upward pressure on spending. In this framework, our recommendations for the month are:

- Sovereign bonds. By parity and by flow of funds, we see the GD35 as the best option within the sovereign bonds in foreign currency. It closed at USD 20.2 on September 27 and although in 2023 it pays an annual coupon of 1.5% (biannually on 01-09-23 and 07-09-23) in 2024 it would pay a annual coupon of 3.625% determining an annual current interest of 18.68%. The GD38 is another interesting option that stands out for its flow of funds and offers a more robust legal structure as it is an indenture of 2005. It is worth USD 25.4 and pays an annual coupon of 3.875% semi-annually and 4.25% in 2023. and 2024 respectively.

- Sub-sovereign bonds. Unlike sovereign bonds, a large part of those of the provinces recovered the maximums achieved last May. Knowing the fiscal data for 1Q22 published by the DNAP, Córdoba and Mendoza continue to surprise for their fiscal solvency, presenting a Financial Result in relation to their current income of 10.4% and 7% respectively, being that the Financial Result of the last 4 quarters was USD 737 M and USD 198 M. Córdoba’s total debt as of 1Q22 is USD 2,755 M while that of Mendoza is USD 1,213 M. Both provinces have a high stock of liquidity within the financial system (USD 935 M, Córdoba and USD 307 M, Mendoza as of July-22) and a healthy stock of Debt with Private Parties (37% and 35% of their current income, respectively). Santa Fe 2027 (USD 73.5 clean price, MD 3.08 and IRR 16.1%) is an excellent alternative given the province’s low level of debt (USD 700 M as of 2Q22); Debt with Privates, 9.7% of their current income; and the liquidity that said province possesses (USD 767 M as of July-22 of deposits in the local system between pesos and dollars, plus CER bonds for $151,800 M of technical value as of May-22). Tierra del Fuego 2027, guaranteed by oil royalties, continues to be attractive since the province has a total debt of USD 197 M, resources within the financial system for USD 142 M and Debt with Private Parties is only 18% of its current income. . The bond yields 14.8% and although it has a high parity (88.7) its duration of 1.94 is low since it amortizes capital on a quarterly basis.

- Corporate Bonds. The international context conditions the evolution of corporate bonds which, despite everything, have been performing very well so far this year. US corporate bond yields continue to rise, widening the sread vs US Treasury bonds in the face of fears of a sharp economic slowdown. The Bloomberg Caa US High Yield index has a yield of 15.12% –comparable with 7.12% at the beginning of 2022– and a spread vs. Treasuries of 10.7%. The balances as of 2Q22 reinforced the concepts that we had been holding about the loans that we had been recommending. In the case of Aeropuertos Argentina 2000, the strong recovery in air activity so far this year has led to Net Debt / EBITDA falling to 2.8x in 2Q22, versus 15.2x in 2Q21. Its 2031 and 2027 bonds continue to be attractive options given their yield and given the guarantees provided by the trust with collections of airport fees, among others. YPF’s 2Q22 balance, obtaining EBITDA of USD 1,500 M and FCF of USD 310 M, bringing net debt to USD 5,800 M, consolidates our recommendation for the YPF 2026 export-guaranteed bond. Bonds from said issuer with parity close to 60% and high coupons may be an interesting option. We maintain a positive view of Pampa Energía (ON 2027 / 2029) and Transportadora de Gas del Sur (ON 2025).

- Bonds in local currency. With inflation winning the nominal race, beyond the adjustment of interest rates and the acceleration of the devaluation of the official exchange rate, we continue to recommend being positioned in short-term CER bonds. They are closely followed by the short Ledes that present attractive yields with TNA of 75%. With the BCRA having greater strength in its international reserves, we believe that exchange-rate adjustable bonds are less attractive, although we recommend maintaining a proportion in the portfolio as currency hedging. Outside of them, we find value in CER instruments with pre-PASO expiration, such as the TX23 and the January and February Lecers. In terms of devaluation coverage, dual bonds seem to us the most attractive given the advantage of having devaluation and inflation insurance.

- Actions. The Merval index is at $450 after reaching $525 in mid-September. We continue to see VISTA as the best vehicle to invest in Vaca Muerta’s potential. Production data for August 2022 shows that the company would increase its production by 15% vs. 2Q22. The existence of Warrants with an exercise price of USD 11.5 and maturity on April 23 for almost 40% of the share capital was a conditioning factor for the evolution of the share. With the proposal discussed at the meeting on October 4, where the company offered to exchange them for 3.2 million shares (of which 2.8 million are in portfolio due to the last repurchase made), this condition would be eliminated (the proposal has time until October 10 to be accepted). As of October 5, the stock valued at USD 11.4 trades at EV/EBITDA 23 of only 1.68x and PER 23 of 2.29. Although we continue to prioritize companies that produce tradable goods such as TXAR, ALUAR, and others such as MIRG (which is worth USD 210 million in market capitalization, has USD 141 M in cash net of debt at the official TC as of 2Q22 and will earn USD 170 M in this 2022 in nominal terms), PAMP and CEPU. We have to mention CVH as an excellent dividend play and an interesting asset to position yourself thinking about the change of mandate. CVH is currently worth USD 422 million, its 39.08% stake in TECO2 is valued at USD 695 million at market prices, and it is a way of being invested in TECO2 at a significant discount, since we would be paying an Enterprise Value / EBITDA trailing of 2.24x. In turn, we must remember that CVH has distributed GD30 / GD35 as dividends at a rate of USD 60 M annual average cable from 2020 to date.

Cohen’s chief strategist

Source: Ambito