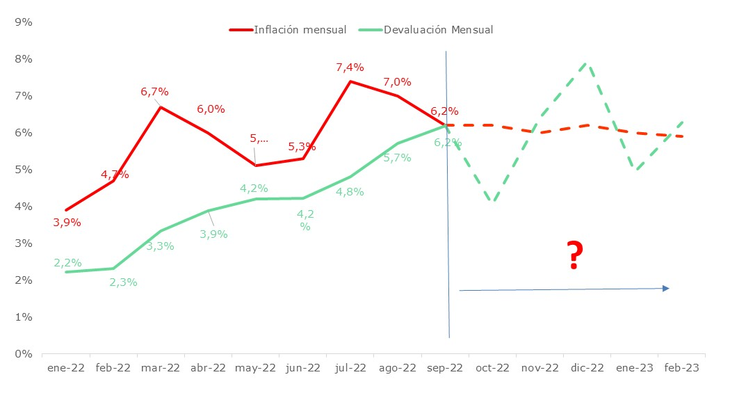

With the FCI crisis and the subsequent departure of Guzmán, the MEP reacted to calm down only in August and rose at a rate of around 5% per month. We can also infer that inflation (measured on the red line) was greater than the devaluation of the official dollar (green line). In the last month, these rates have aligned. Regarding the rates in pesos, the BCRA gradually increased them (after knowing the inflation data), to tempt savers towards the fixed term and not end up in dollars.

image.png

But these are data from the past and when it comes to investing we have to consider expectations. Regarding the devaluation of the official, a good barometer is the implicit rates of future dollar contracts in the Matba Rofex term market. For example, the March 2023 dollar contract is quoted at 235, which implies a direct rate of 53.4% and 119% in annualized terms. Currently, except for the October and November positions, the rest of the futures strip discounts an annualized devaluation greater than 100%.

Regarding inflation expectations, we can resort to the BCRA survey of the main market players (REM). High rates of around 6% per month are expected for the coming months. The REM also offers information on devaluation and rates in pesos.

Lastly, there are no official sources that can give us information on MEP dollar expectations. Let us remember that its value arises from purchase operations in pesos and sale of titles in dollars.

image.png

Who wins the race? Impossible to know. Devaluation is a variable controlled by the BCRA. The decision to devalue in one jump or to increase the pace (speed) ends up being made by the makers of economic policy. The same as the rates in pesos: they are decisions of the BCRA. We believe that in the coming months inflation will be high and that the BCRA will try to bring the rates in pesos and devaluation towards that level.

How do I cover my savings in each case?

To cover ourselves from a devaluation we can:

- Buy dollar futures. Guarantees are integrated and liquidity must be available to deal with daily differences.

- Subscribe Dollar Linked Mutual Funds.

- Treasury bonds dollar linked.

- Dollar-linked Negotiable Obligations (in the primary market).

- Dollar-linked stock notes.

To cover savings from inflation:

- UVA fixed installments.

- Lecer: are treasury bills that adjust principal and interest against CER (inflation) with maturities of less than one year.

- Boncer: they are CER Treasury bonds.

- Common investment funds inflation linked.

Dual bonds are issued by the Treasury and pay inflation or devaluation, whichever is higher, so the investor has coverage.

Of course, you can also keep the savings in dollar bills (MEP or CCL), but they do not earn interest. Negotiable Obligations are bonds of companies that have gone public in search of financing. In return they offer the investor interest.

Financial advisor.

Source: Ambito