Starting from the base, This theory arises from the existence of asymmetric information between us, the investors, and those who manage the companies where we invest Logically, they have more and better information than we do because they are involved in its daily management. Consequently, this asymmetry has a cost, which is reflected by the uncertainty component within the interest rate of a company’s debt or within the expected rate of return of equity. The less access to information a company has for its investors, the greater the uncertainty component, and therefore the greater the cost of financing. On the contrary, the more detailed, clear and frequent the information provided by the company, the lower its cost of capital.

Then, What is the ideal order to consider when defining the best sources of financing? In the first place, a company should be financed from its accumulated results. This is explained by the fact that it is not only the source with the lowest cost, since it has the least information asymmetry and does not pay interest or dividends, but also indicates to its investors that the entity is solid and its operations generate a sufficient flow to finance its growth. In other words, in addition to being the most economical source, it reports positively to the shareholder.

In the event that internal financing is insufficient, the theory proposes taking on debt as an alternative resource.. The reasoning behind this move is that it signals to the market that the management He trusts that the company can be financed at favorable rates and that he will not have problems in meeting the periodic payments. The theory mentions that the issuance of shares should be considered as a last resort for many reasons. On the one hand, it could denote an inability to take on debt at reasonable rates or distrust from the management of being able to meet their flows, which would lead investors to think that they might be overlooking something. On the other hand, it could signal that management believes the stock is overvalued and is looking to take advantage of the momentum, which is also not a good sign for investors. This is particularly true in cases where the issuance of new shares is combined with the sale of additional shares by majority shareholders. Although it is normal to hear that this strategy of cash out is carried out to improve the liquidity of the action, it is always advisable to be cautious.

Order of Priority of the Theory of Picking Order

ppi 1.jpg

Font: Personal Portfolio Investments (PPI)

Now, Why should I care about this theory? Basically because it will impact the valuation of the companies in which we would invest our money. Whether due to changes in the company’s capital structure or because of the signals that its financing method provides to the market, the value of the equity is subject to the way in which the company is capitalized. Turning to practical examples, let’s look at what happened with Mercado Libre in 2021.

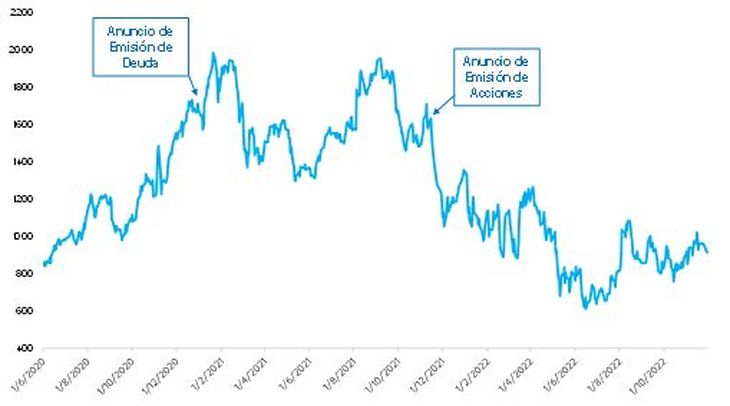

On January 4, 2021, it announced its first issuance of conventional (non-equity) debt. At that time, its price was around US$1,640. Just seventeen days later it would reach its maximum valuation at US$2,019. While the ad didn’t necessarily trigger the action, it definitely didn’t hurt it either. Conversely, at the close of November 15, 2021, MELI announced a new round of share issuance. As of that date, his share had culminated in US$1,610. The following day, the date on which they announced that the issue price would be US$1,550, its share already opened at US$1,515 and began a decline whose stop was found at US$1,050 just twenty-one days later. Once again, while the market did not necessarily take the issue as a sign of weakness, the reaction was unequivocally negative.

Evolution of the MELI Share after its Announcements

ppi 2.jpg

Font: Personal Portfolio Investments (PPI)

In short, although the interpretations are not always linear, nor are their effects so direct (generally a debt issuance will not be linked to a rise in share price, although an additional issuance of shares could lead to a drop in its price due to its dilutive effect), These are signs to watch out for, particularly for our holdings as their impact can be immediate. In this sense, it is also important to analyze how companies have been financed in the past to understand how they have performed in different periods, and to remain alert to similar scenarios.

Analyst of PPI

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.