After peaking at the start of 2018, Argentine stocks have been mired in a ferocious downtrend.

Every year they were mercilessly beaten by the market, with different events that sank them more and more.

First there was the crisis of the government of Mauricio Macri and the rescue of the International Monetary Fund (2018), then the collapse after the primary elections (PASO) of 2019, and finally the global fall due to the coronavirus crisis of 2020.

The phrase is commonly heard: “Argentina goes against the world”. In terms of financial assets it seems that it is not the exception.

While the world was in an impressive uptrend (except for the fall of the coronavirus that was global) Argentine stocks were bleeding.

Now, in a very tough 2022 for the global stock markets, Argentina seems to be starting to rise from its ashes.

While the main indices of the US stock market are experiencing heavy losses (the S&P 500 is -15% and the Nasdaq -27% so far this year), the Merval in dollars rose +28%.

In the graph below we can see the evolution of the Merval index measured in dollars in recent years:

B1 4-12.png

The most interesting thing, as can be seen in the graph, is that after bottoming out in 2020, the Merval has begun to recover. And better yet, we could be at the beginning of a new uptrend.

But not all stocks performed similarly. Some broke it while others continue with heavy losses.

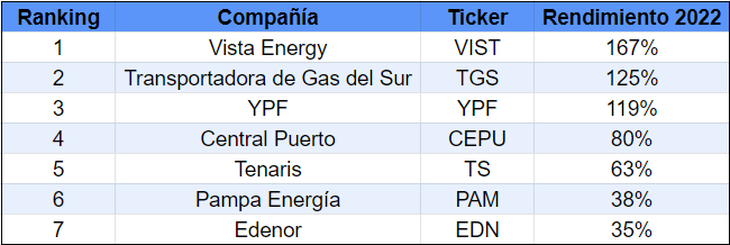

That is why I prepared this ranking with the Argentine stocks that rose the most in 2022. It is worth clarifying that these are returns in dollars. Let’s see:

B2 4-12.png

I want to clarify that I included Vista and Tenaris, which are strictly registered outside of Argentina, but are usually considered shares of this country because they belong to Argentine capital.

As we can see, energy-linked stocks were the stars of 2022. This is no coincidence, as global inflation and the war in Russia were the engines for a spectacular recovery in oil and gas prices.

To give you an idea, the XLE energy ETF (an ETF is an investment fund listed on the US stock market like any stock) is +64% so far this year.

Undoubtedly, in 2022 the Energía + Argentina cocktail was devastating.

Very different is the situation in other sectors, for example, banks. Some actions were heavily punished, such as Grupo Galicia (-11%) and Supervielle (-7%).

In conclusion, it seems that the trend in Argentine shares is changing. There could be a historic investment opportunity in these assets. But you have to be careful, knowing how to choose what to invest in and how to manage the capital will be key.

Finally, if you want to know what to invest in in 2023, I invite you to download a report that I prepared with the 7 best investment ideas for next year. They download it by clicking on this link: Financial Letter – Investments.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.