The S&P 500 index registered gains of 5.3% in the month, cutting the negative return accumulated by the index so far this year to -14.4%. The Dow Jones, on the other hand, rose 5.7% and presents a smaller cumulative fall, of the order of -4.8%.

In this context, the head of the Federal Reserve, Jerome Powell, He stated that a slowdown in the pace of rate increases could be considered in the next meetings. The strong monetary tightening carried out by the US central bank has been a negative catalyst for assets, as it feeds the risks of an economic recession on the horizon.

Powell’s signals were also welcomed by the bond market. The 10-year US Treasury rate cut 50 basis points to the 3.70% zone from peaks of 4.20% in mid-October.

In the fixed income universe, the improvement was extended: Treasury bonds registered an advance of 3.9% in the month, while those of Investment Grade grew by 7.2%. In turn, the debt of High Yield increased by 3.9% and the emerging bonds did so at 10.1%. Despite these improvements, however, all of these asset types have also posted a negative return so far this year.

The inflationary deceleration also gave some respite in Europe. Inflation in the Euro zone countries fell to 10% from 10.4% in the previous month, the first time in more than a year. In this context, the shares in the Eurostoxx 50 presented an improvement of 10.1% in November. In the year they lose -7.3%.

Finally, on the Chinese side, there was a significant improvement. Its shares rose 34.4% in November, according to the FXI ETF. A combination of better relations with the United States, government aid to the Chinese housing market and the possible relaxation of the zero COVID policy in 2023 were all good news for the markets.

November in global markets

criteria 1.jpg

What are the big investment houses saying?

With returns not seen 10 years ago, Fixed income is once again attractive. Since its fixed income recommendations report, the investment house MFS clarifies that it is time to reconsider fixed income as a type of asset in portfolios. This is because current yields, especially in US and European investment grade bonds are the highest they have been in a decade. This is demonstrated by the following graph:

US & EUROPEAN INVESTMENT GRADE DEBT, CORPORATE (annual return by asset type, historical)

criteria 2.jpg

On the other hand, from the entity they clarify that there are almost no bonds that have negative returns anymore. It is the resounding change: Two years ago, 30% of the fixed income universe had a negative rate, according to MFS.

Also, From the investment house they clarify that the difference between the 10-year rate and the dividend of the shares in the S&P500 was extended and a lot.

Currently the bonds yield 2% more compared to what is distributed by the main companies in the United States. This fact, Demand for corporate debt will increase to the detriment of risky assets.

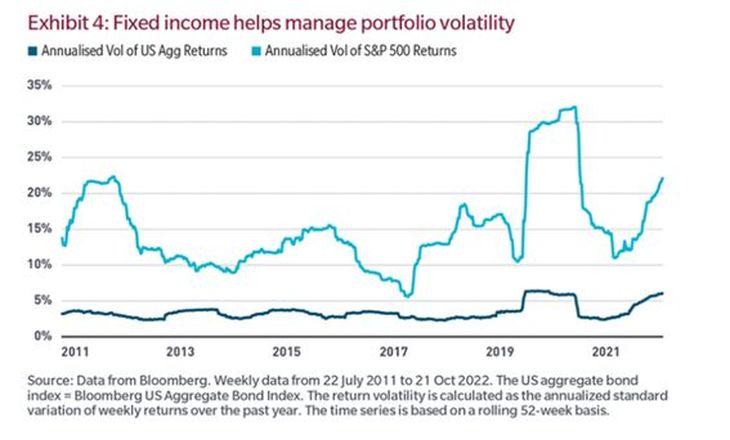

The management of volatility is a more than important issue in the management of investment portfolios, and fixed income is one of the main ones in charge of reducing the volatility of the portfolios despite what has been experienced in this 2022. This graph, demonstrates the above:

Fixed income as a moderator of portfolio volatility: US AGG ANNUALIZED VOLATILITY VS. S&P 500

criteria 3.jpg

Finally, They clarify that it will be important to have managers experienced in fixed income and in reading the prevailing economic cycle to take full advantage of possible appreciations in the different universes of bonds.

Asset Management Director at Criteria

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.