After decades in a clear fall, the interest rate woke up with force.

B1 11-12.png

What caused this huge rise in interest rates? Due to the record inflation that was generated due to the enormous monetary issue, accelerated by the Covid.

The Federal Reserve was the one that generated the great rally of technology companies in recent years, due to the enormous injection of liquidity. And now? The opposite has been happening lately: the Federal Reserve has a restrictive stance and is being very aggressive in fighting inflation.

How did this affect the market? It is known that a rise in rates is not friendly to the stock market, especially technology ones. Why is this happening?

Companies are not valued by their history, but by their future expectations. That is why flows are projected and discounted at a certain rate, to arrive at a theoretical price. By raising the rate, the discount is greater, so it negatively influences the price. This effect has a greater impact on technology companies than on more mature ones, such as Coca Cola, McDonalds, Procter & Gamble, among many others.

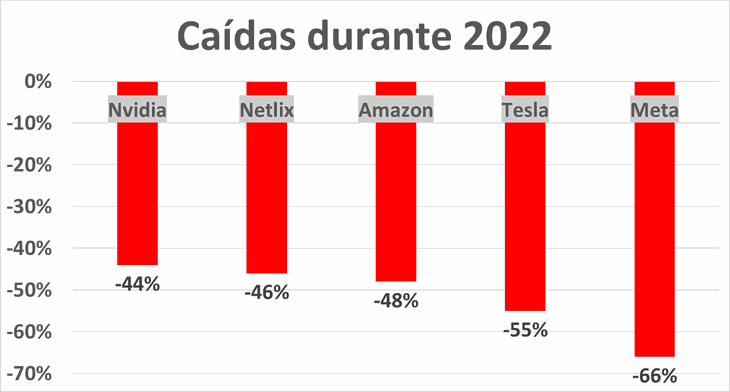

The Nasdaq, the index that groups technology shares, accumulates a 30% drop. However, these 5 companies underperformed:

B2 11-12.png

- nvidia: is the leading company in the development of video cards. And the finishing touch was the end of Ethereum mining that affected its results. It accumulates a drop of 44% so far in 2022.

- Netflix: registered the worst growth in recent years. The fierce competition impacted their results. Accumulate a 46% drop so far in 2022

- Amazon: the cloud and online commerce sector are suffering from the recessive context. Furthermore, at a fundamental level, it continues to have a high valuation. It accumulates a drop of 48% so far in 2022.

- Tesla: Elon Musk’s company suffered the impact of cuts in the supply chain. Will you be losing the magic? Let’s remember that it is still “very expensive”, under any valuation metric. Accumulate a 55% drop so far in 2022.

- Goal (ex Facebook): Investors are not enthusiastic about the increased costs for investments in the Metaverse. His future is unknown. It accumulates a 66% drop so far in 2022.

What can happen? The main factors to take into account are the evolution of the interest rate and inflation in the US (on Tuesday, December 13, the inflation data for November will be released). If the context does not improve, technology shares have room to continue falling. To be careful.

The current situation is very challenging: record inflation, rising interest rates and stocks suffering huge losses. Therefore, I prepared a report with 3 ideas to take advantage of the context. I really recommend it. Download it here: Financial Letter – actions.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.