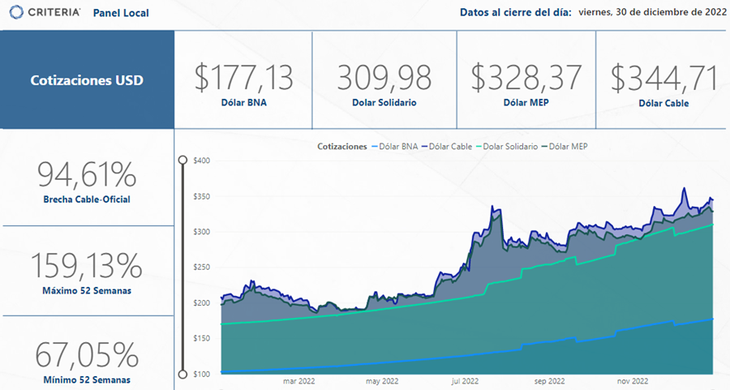

However, after the volatility peak after the change of the economic team in August, the variables found some stability and a favorable environment in emerging markets has supported the recovery of Argentine assets since then.

From very depressed levels after the political crisis, both dollar sovereign bonds and stocks made very significant improvements. This to such an extent that the S&P Merval, measured in dollars, registered an accumulated increase of more than 40% in the year, where the world stock markets averaged a 20% drop.

Starting the year at around 412 points and reaching annual lows below 340 points in July, it resumed its bullish strength in the second half of the year, reaching 589 points and rising 43% in hard currency. A relatively stable path in the “financial” dollar in recent months also contributed to this improvement.

The S&P Merval recovers after the political crisis and accumulates a return in dollars of more than 40% in 2022

Merval Index, measured in dollars after settlement.

image.png

Source: criteria.

In the sovereign bond curve, the Argentine papers denominated “hard dollar” have been performing well in recent months. The external climate at the moment is more favorable for the emerging world in general. In Argentina, the year began with a country risk of around 1,700 basis points, with peaks of 2,900 after the resignation of Martín Guzmán in July. Currently, there has been a marked decline to 2,200, although still above levels prior to the political crisis.

The rally of sovereign bonds in dollars was particularly high in the fourth quarter of the year, with increases of between 25% and 30% in foreign currency for Global and Bonare titles.

The CER-adjusted bond curve

In 2022, the eyes of the local market were attentive to this category of bonds. The year began with a CER curve that showed a good performance, with real returns in negative terrain. In January, to obtain positive real returns, you had to position yourself in maturities after 2024.

In April, and despite the good demand in the government’s primary tenders, a break in the curve was already beginning to be seen between those bonds maturing before and after 2023, given the uncertainty that the electoral calendar brings with a new political scenario and the experience of the “reprofiling” of the previous administration.

For June the stress This market is evidenced by a sharp fall in prices in all maturity tranches, driven by significant redemptions in the FCI industry. This situation could only be stabilized after the interventions of the BCRA to support prices, a strategy that the monetary authority maintains until today. Said issuance of pesos estimated at $1.3 trillion put pressure on financial exchange rates. At that time, the exchange rate gap went from 86 to 160%, exacerbated by the political noise of Guzmán’s departure and the ephemeral passage of Batakis.

After the relative calm brought about by the arrival of the new minister, interventions in the BCRA secondary market returned in October (already reaching half of what was issued to alleviate the mid-year crisis) and the rate differential between bonds with previous maturity to the elections and 2024 returned to historic highs.

image.png

Source: criteria.

The main variables for 2023

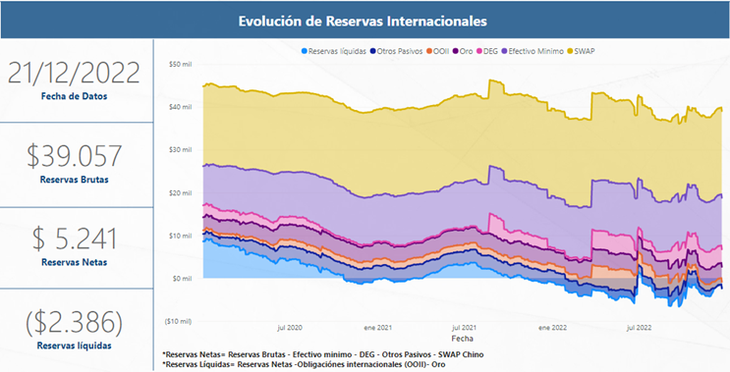

Throughout 2022, in addition to the ups and downs of financing in pesos, all eyes were on the limited reserves of the Central Bank. Although it was not possible to reconfigure a resounding change in expectations, the truth is that there was creative management in managing scarcity.

Based on the tightening of the stocks and temporary improvements in the export price for soybeans, the economic team managed to get around 2022 with a meager stock of international reserves, but which achieves the proposed goals.

However, this factor will be a risk that will predominate in the coming year, as the government tries to optimize the supply of foreign currency, affecting the economic activity that is nourished by imported inputs. On the other hand, hehe drought that is already affecting wheat production is an additional headwind that could subtract, according to preliminary calculations, more than 10 billion dollars from the foreign exchange settlement of agriculture in 2023.

image.png

Source: criteria.

In the debt market in pesos, it will also be important to attend to the renewal rate of maturities. So far, private holders have already begun to show signs of some exhaustion to renew stock. If this trend consolidates, we could expect a greater monetary issue in 2023, where 8% of GDP will have to be faced in maturities with private holders.

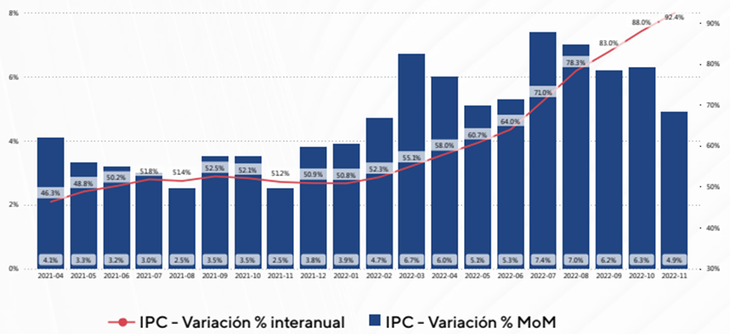

Undoubtedly, one of the main risks next year is the inflationary component. The latest data published on this variable seems to take a breather, in a dynamic that appears to be complex. In November, the consumer price index had a variation of 4.9% compared to the previous month, accumulating a rise of 85.3% in the year.

Beyond this drop in pace, the market is cautious in its expectations.

After 2022 has seen the highest inflation since hyper 30 years ago, it will be urgent to chart a clear path forward for anti-inflationary policies. Although sound more moderate fiscal spending policy is in sight after the changes in the economic policy team, future actions remain highly uncertain, especially given political developments around the 2023 presidential election.

Inflation

Monthly variation of Consumer Price Index, interannual variation CPI.

image.png

Source: criteria.

Director Asset Management of Criteria.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.