This attraction occurs in a more turbulent context, compared to the pre-pandemic periods of Covid-19. If we consider, in addition to the still high inflation, the war affecting Europe, the disorder caused in the supply chains and the new outbreaks of Covid in China, perhaps we are in the presence of a new regime of volatility.

Stocks That Promise High Dividends: The Implied Volatility of the S&P500

criteria 1.png

Source: Bloomberg

The VIX index as a measure of implied volatility for the S&P 500 reflects a marked change. During the three years prior to the start of the pandemic, the VIX had an average of 14.4, while in the three subsequent years the average is 24.9. If we exclude the period of greatest uncertainty due to the advance of Covid-19, between January and May 2020, we see that the VIX stabilizes in order to an average value of 23.6.

This turbulence in the markets was not present exclusively in the stock markets. The fixed income and currency markets also succumbed to the rise in interest rates by the Central Banks in their fight against inflation. Fixed income failed to fulfill its counterweight role in portfolios in the face of a decline in equities, reflecting a positive correlation for both asset classes in 2022.

Stocks That Promise High Dividends: Navigating the Turmoil in 2023

Corrective market processes generate confusion among investors and lead them to reduce their exposure to risky assets, even taking losses on positions with solid “fundamentals”. However, historical market corrections have always been accompanied by bullish rebounds, which allowed investors to recover the value of their portfolio, and even accumulate positive returns in the process.

The focus will be on economic growth. The question revolves around the duration and depth of the economic slowdown, while the Central Banks do their homework. If it were mild and limited, with inflation slowing down, a favorable scenario for risk assets could once again take shape.

A context of economic slowdown has a negative impact on the future cash flows of companies, but not all equally

In a turbulent scenario, such as the one that occurred in 2022, high-dividend stocks offer a margin of safety amid high volatility through dividend payments.

As we pointed out, although the unknown is the duration and depth of the economic slowdown, even in a recession scenario these types of stocks look attractive relative to their peers. In three of the last four outright recessions in the United States, the return of dividend stocks represented by the S&P 500 Dividend Aristocrats Index outperformed the S&P 500. The return was only below, albeit by a small margin, in the last particular recession Declared in 2020, of short duration and very favorable in its context to “growth” stocks.

Stocks That Promise High Dividends: Recession Yields

criteria 2.png

Source: Criteria based on NBER and Bloomberg

Contemplating that the monetary policy works with a lag and central banks may raise their benchmark interest rates more than expected, dividends help offset the deterioration in real returns in a context of high inflation while it stabilizes.

Unlike bonds with fixed income coupons, the nominal increase in dividends can help offset inflation and protect the investor.

Performance 2022: S&P500 vs. S&P500 “Dividend Aristocrats”

criteria 3.png

Source: Bloomberg

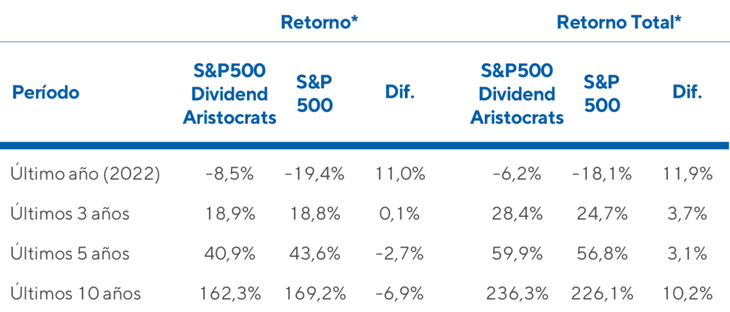

Always thinking of a long-term investment portfolio, dividends have contributed almost 40% of the total return of the S&P 500 in the last 90 years. As the chart evidences, dividend growth stocks, represented by the S&P 500 Dividend Aristocrats Index, have outperformed the S&P 500 in the turbulent 2022 with lower volatility.

If we consider the total return (including dividends) of the last three years of both indices, the S&P 500 Dividend Aristocrats obtained 28.4% against 24.7% for the S&P 500, surpassing it by 3.7%. If we consider the last five and ten years, the return differential is 3.1% and 10.2% respectively.

Historical performance table

criteria 4.png

Source: criteria

The only environment in which this category tends to underperform is immediately before and in the early stages of a new economic cycle, when the market is already pricing in a recovery. Scenario that seems unlikely for the beginning of 2023.

investment recommendations

In times where volatility is present, the Stocks that generate high dividends and are sustainable over time offer the investor a margin of safety. They cushion the decline in the markets, protecting against inflation, and maintain the potential for revaluation if the performance in the markets turns out to be better than expected.

Dividend stocks may continue to perform stronger with less volatility, especially in a slowing economic environment.

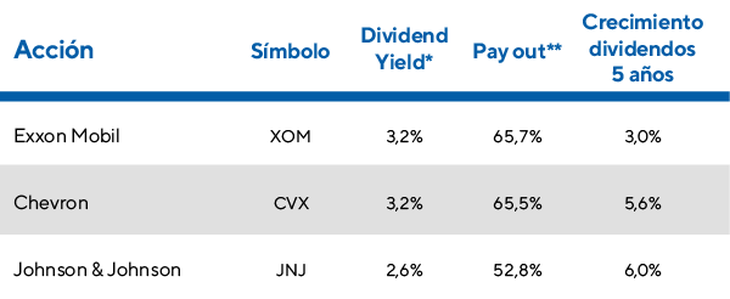

In this context and with a view to 2023, the recommended portfolio of Cedears Criteria maintains in its portfolio assets that offer a margin of safety through the payment of dividends. As can be seen in the table, these assets obtained a higher-than-average growth rate of their dividends in the last 5 years:

Dividend Shares in the Criteria Portfolio

criteria 5.png

*Data as of 1/13/2023 **Rate of distributing the company’s profits as dividends

Source: criteria

- Exxon Mobil distributes 65.7% of its earnings as dividends, which pays the investor on a quarterly basis. It offers at current prices a dividend yield of 3.2%.

- Chevron distributes 65.5% of its earnings in dividends, which pays the investor on a quarterly basis. It offers at current prices a dividend yield of 3.2%.

- Johnson & Johnson distributes dividends on a quarterly basis offering a return on them of 2.6%. Share your earnings 52.8% as dividends that it also distributes on a quarterly basis.

Criteria Asset Management Director

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.