Dear reader, don’t get me wrong, economic policies are not part of a game. However, thinking of them as such is often helpful in the world of finance to understand the path and make better investment decisions. Let’s get started.

After a first semester in which the Treasury maintained its limited fiscal deficit and the Central Bank accumulated reserves taking advantage of the trade surplus, the economy entered “electoral mode”. Greater fiscal deficit financed by monetary issue and delay in the official exchange rate using it as a nominal anchor are the main characteristics of this plan. As an example, the issuance of the months of July and August, exceeded that of the first 6 months of 2021 (See graph 1).

COLUMNA1.jpg

After the adverse result in the PASO, the ruling party accentuated this plan with different measures that aim to improve economic activity and the real salary of the inhabitants. Now 12 to boost consumption, greater opening of the economy to prop up sectors affected by Covid-19, increase in parity and bonuses for retirees and beneficiaries of social plans are some of the measures.

The other side of this is a higher fiscal deficit that must be financed largely by monetary issuance from the Central Bank. That is, more pesos in the street.

On the dollar side, we have already commented on the exchange rate delay policy (official dollar rising at a slower rate than inflation) which, together with the seasonal drops in liquidations in the agricultural sector, cause the BCRA to sell reserves. Reserves that are not abundant

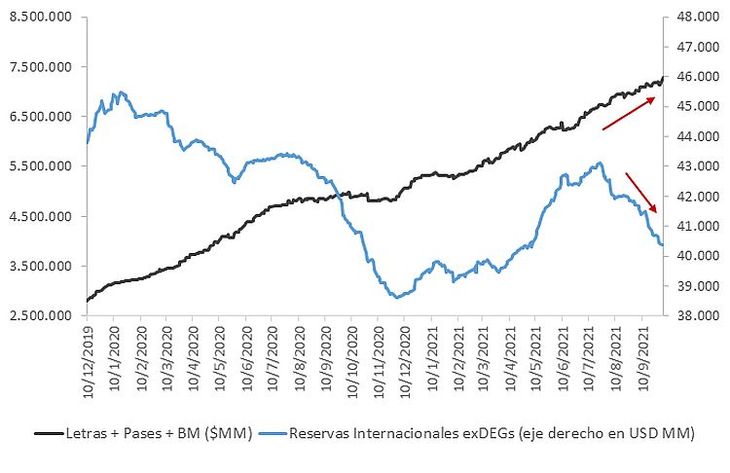

In short, un An increase in BCRA liabilities (pesos) caused by the monetary issue and a reduction in assets (dollars) caused by sales both in the exchange market and in financial dollar interventions. (See graph 2)

COLUMNA2.jpg

The market reacted with an increase in the exchange rate gap (rise in financial dollars), devaluation expectations and the demand for coverage against inflation. Bonds linked to the official dollar have negative yields and those tied to inflation compressed spreads with a rise in their prices. The movement is natural, the excess of pesos will be channeled to the purchase of goods whose demand will also impact inflation.. It should be added that the dollar can be considered as an additional good, so the demand for it also increases along with its price.

In this way, the pre-electoral economic policy poses a game in which the abundance of pesos and the reduction of reserves push investors to demand coverage. As we mentioned earlier, bonds that track inflation and the exchange rate are positioned as the best alternatives until the elections.

The final question we ask ourselves is what rules there will be after the November generals when an additional player will appear, the Monetary Fund. Will they repeat the turn towards orthodoxy made in the first half of 2021 of lower fiscal deficit, monetary issue and a not so appreciated exchange rate?

Graph 2 suggests that a prolongation of the electoral plan beyond November would be dangerous for the macroeconomic situation. On the one hand, the continued growth of monetary liabilities would generate pressure on inflation, which is already at high levels. On the other hand, the BCRA needs to accumulate reserves to meet external commitments and cushion possible external shocks, so the downward trend should be reversed.

In conclusion, Everything seems to indicate that after the elections there should be a shuffling and giving of the economic plan again. New rules and a new game. However, it is not clear whether it will achieve this to moderate inflation and avoid a devaluation jump as it did in 2021. For now, we prefer prudence via hedged instruments.

Gerente de Research and IEB.