-In the year the flow of dollars that is generated through the exchange market of the Central Bank gave us a positive balance of US$ 2,316 million, the trap is that many imports were postponed, and exporters advanced money.

Q.: How do you explain it?

-Very simply, exports measured through INDEC add up to US$ 88,445 million, but what is effectively collected by the Central Bank amounts to US$ 90,532 million, therefore, exporters advanced US$ 2,087 million in 2022. On the other hand, something different happened with imports, INDEC says that imports were US$ 81,522 million, while the Central Bank paid imports for US$ 68,715 million, postponing the rest. Since the valuation of imports by INDEC differs from how they are valued by the Central Bank, we estimate that the difference would be US$ 12,807 million, the Central Bank’s debt to importers could be US$ 10,000 million.

Q.: So?

-The Central Bank asked exporters to advance USD 2,807 million, and postponed payments to importers for almost USD 10,000 million, this implies that the positive exchange market balance of USD 2,316 million is not real.

Q.: What can happen in the future?

-With this debt that the Central Bank has with importers, it is very likely that the exchange rate will deepen, this implies that many inputs will stop entering or will do so at a slower rate, this implies that the economy will hardly be able to grow in the year 2023 , despite the fact that the IMF says otherwise.

Q.: What happened to the balance of services?

-The services collected add up to U$S 7,657 million, while those paid are U$S 17,558 million, this shows us a deficit of U$S 9,901 million, of which U$S 5,490 million correspond to the deficit of the tourism balance.

Q.: What happened to interest, plus capital and financial transfers?

-The interest red amounted to US$ 3,498 million, while the transfer account resulted in a deficit of US$ 6,102 million.

Q.: What is your opinion of these numbers?

-The flow of dollars from the Central Bank is positive at U$S 2,316 million, but for the advancement of exports and postponement of imports there is a liability for the year 2023 of approximately U$S 12,087 million. My impression is that we are very short of gross and liquid reserves.

Q.: How much do reserves represent as a percentage of GDP?

-Reserves as of December 30 total US$ 44,597 million, and represent 7.4% of GDP. The sum of the fiscal and quasi-fiscal deficit is $6,834,402 million and represents 8.4% of GDP. This implies that the flow of deficit pesos in a year is greater than the stock of gross reserves. This is a very sensitive data for the future of the economy. There are pesos left over, dollars are missing, inflation, high interest rates, and a rising exchange rate gap are the signs of the times to come.

Q.: What happened to the debt?

-Very simple for that we prepare this synthetic table expressed in millions:

image.png

As can be seen, the government of Mauricio Macri increased the public debt by US$ 79,861 million, a product that during his term incurred a high fiscal deficit, which is the reason for all the evils in this economy. In the government of Alberto Fernandez, in three years, the debt increased by a figure similar to that which increased in 4 years under Macri’s mandate, totaling US$ 73,522 million. When he ends his term, Alberto Fernandez will have a new public debt record, for 4 years of government, and the largest amount in history.

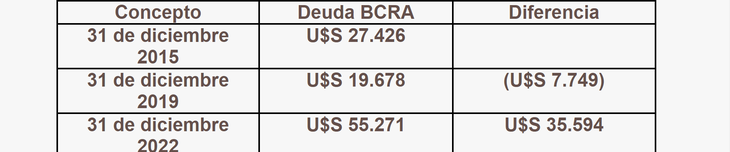

Q.: What happened to the Central Bank’s debt?

-Under the Kirchner governments, credit is absent because contracts are not honored, however, under Mauricio Macri’s mandate, international credit was recovered, which made it possible for the Central Bank to deleverage. We will now show the evolution of the debt in the Central Bank in the last mandates.

image.png

In the Kirchner governments, fiscal deficits are financed via monetary issue, this generates an inflationary spiral, and led us to this 3-digit inflation with which we live. In the mandate of Mauricio Macri, the Central Bank managed to lower its debt, since it resorted to a lesser extent to issuance and more to indebtedness. Kirchnerism does not take debt by vocation, what happens is that when it manages it does so badly that it does not qualify for financing, even when it restructures the debt.

Q.: How do you see the economic scenario?

-I see a government that is losing a lot of reserves in the month of January, the soybean dollar has passed and it is difficult for the countryside to contribute dollars in the following months, we will have to wait for the harvest of prime corn and soybeans, which begins to have an impact between the months of April and May. We don’t see any chance of a soybean or corn dollar at the current juncture simply because there is not a large stock of soybeans and corn in the field.

The deficit and the monetary issue is overflowing, the sum of the debt in pesos of the treasury, the debt of the Central Bank and the monetary base adds up to the equivalent of 47.2% of the GDP, it is an overflowing amount of pesos, against some reserves that add up to the equivalent of 7.4% of GDP. The value of the dollar should be through the roof, if the market does not renew the credit to the State.

We see a large concentration of debt in pesos in the treasury, at a variable rate it amounts to the equivalent of US$ 63,247 million and inflation-adjusted debt amounts to the equivalent of US$ 67,934 million, in total US$ 131,181 million, with a term very short maturation.

Inflation for the month of January points to levels above 5.5% per month, and with the rise in meat, fuel and electricity, February points to inflation of 6% per month. We are far from reaching inflation of 3% in April, the political credit of the Minister of Economy is beginning to be consumed by leaps and bounds.

Conclusions:

- The bovine meat began to rise due to the lack of finished animals, many heads in the pasture, a very high price of corn, months of working at a loss in the field, and at some point the prices readjusted. The farm has not gone up yet, because at the moment it is recovering prices since it increased less than inflation in the last 12 months. The impact on the price index will be very high, and February will see it fully. The increase in beef will drag alternative meats up, also hampered by low profitability.

- The implementation of the soybean dollar made the feeding of cattle, pigs, poultry and cows linked to the dairy more expensive, this generated bankruptcies that forced many producers to close feedlots and dairy farms, there would be a lack of meat and milk, therefore, more than Careful prices, be careful with prices.

- Inflation is a monetary phenomenon, since Alberto Fernandez took office, monetary liabilities (paid and unpaid) increased 5.5 times, there is still room for more inflation, rate hikes and an increase in the exchange rate gap.

- Reserves in the month of January fell sharply, in December they were at US$ 44,597 million, as of January 30 they were at US$ 41,517 million, a drop of US$ 3,080 million. In the same period, monetary liabilities went from 15.0 million million to 15.6 million million, an increase of 4.0%.

- The government cannot carry out a devaluation of the official dollar because it lacks reserves, and it does not have credibility. Such a move could lead the economy to an inflationary overflow with inflation rates that are projected to double digits per month.

- The government will not seek to devalue, it will continue to validate a scenario of fiscal deficit, financed with a monetary issue. In the coming weeks there will be political developments, which will be decisive in the evolution of the economy. Hyper inflation can be avoided, what cannot be avoided is the precariousness of public accounts, a decapitalized Central Bank, high levels of inflation and alternative dollars that soon showed prices beginning with 4.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.