The Global Risk Perception Survey (GRPS) uses two time frames to understand global risks. The first part considers the growing impact of current crises on the more severe global risks that many expect to unfold in the near term (two years). The second analysis considers a selection of risks that are likely to be more severe in the long term (10 years), exploring new emerging or rapidly accelerating economic, environmental, social, geopolitical, and technological risks that could become the crises of tomorrow.

image.png

The response to these risks must be prompt and determined. It calls for the realignment of initiatives and improvements in governance structures, which are mobilized by the use of enriched data and tools that capture the interdependencies of food, climate, energy and ecosystems. The cost of living dominates global risks in the next two years, while the failure of climate action dominates the next decade.

At a global level, there are already signs that indicate some changes in this direction. The world community recognizes the risks associated with the loss of natural spaces, food production, energy generation and climate change.

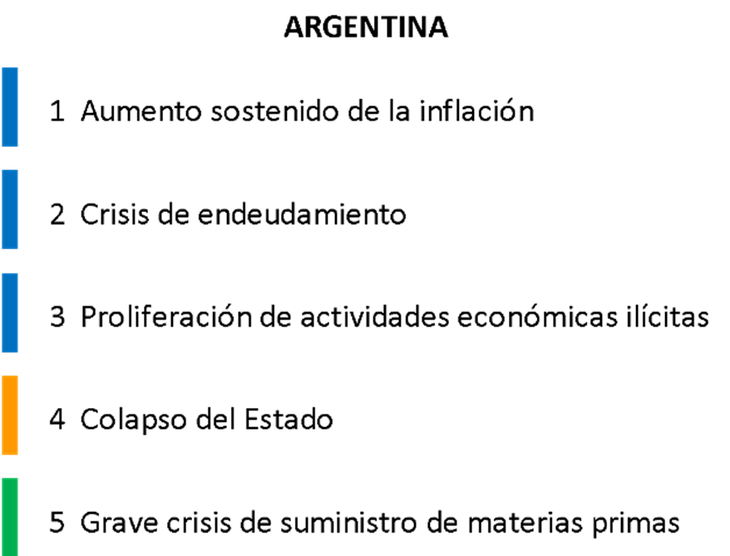

In Argentina, the main short-term risk is persistent inflation, which registered alarming accelerations after the pandemic, registering high rates and low growth in the economy. In fact, this risk is one of the five main ones in 89 of the countries analyzed, although it places Argentina in the group of the most affected.

image.png

Although these are risks that are not new to organizations, this view means that they are sustained both in the short and long term, without neglecting other emerging risks that can continuously generate drastic changes or crises.

In conclusion, organizations should in their administration and risk management consider, among other issues:

- Take action for workforce pressures in light of the inflationary rush on health care and basic necessities.

- Being aware of entrenched geopolitical friction and the implications for economic dynamics, to avoid losing market advantage and offset rising costs.

- Incorporate ESG and climate change matrices into corporate strategies to avoid reputational and legal risks.

- Invest in holistic resilience frameworks to anticipate future crises and improve coping capacity. Multidisciplinary and permanent analysis. Positive strategic and proactive monitoring.

- Prepare for further cyberattacks and data theft by investing in cybersecurity measures and privacy frameworks to limit your exposures to continuity, reputation, and crime risks.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.