Journalist: How will the economy receive the next government?

-You will have three problems to begin with: a high fiscal deficit, several foreign exchange arrears, and high debt, especially in pesos.

Q.: Let’s start with the deficit

-The fiscal deficit today is 4.2% of GDP. As we can see, in a GDP contraction scenario, this deficit is likely to grow to levels of 5.5% of GDP. To this we must add the quasi-fiscal deficit that today stands at 4.2% of GDP and, at least, could grow to 5.5% of GDP, this implies a total deficit of 11.0% of the product.

P.: Let’s go to the delays

-We have a delay in exchange and energy rates: the official dollar is behind at least 30% and the rates by 50%. If you update both inflation would be very important, we will see what the next government does, if it takes the path of gradualism or shock policy.

Q.: How does the debt come about?

-I inform you in this table as of December 31, 2022:

image.png

image.png

Values are expressed in millions of Argentine pesos.

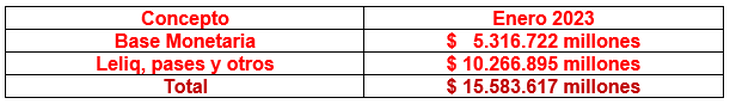

Q.: How much is the monetary base and the indebtedness of the Central Bank?

-I inform you in another painting on January 31:

image.png

image.png

Values are expressed in millions of Argentine pesos.

Q.: How much is the total amount?

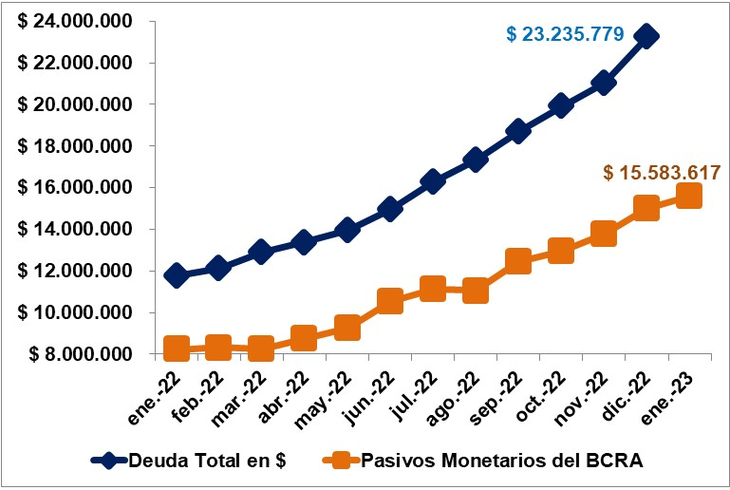

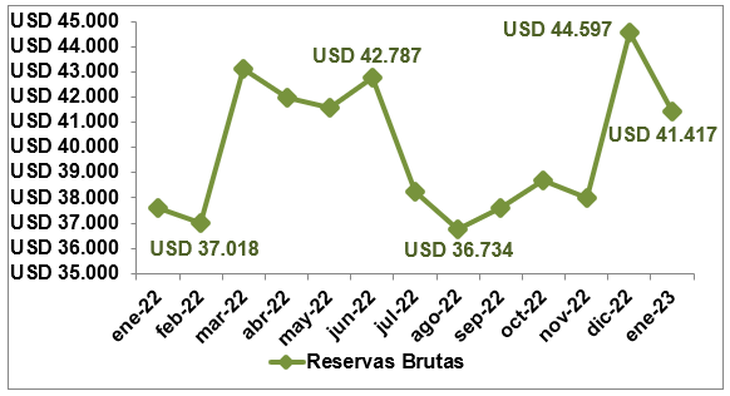

-The total of the monetary base plus the leliq and the debt in pesos adds up to a whopping $40,098.66 million, if you compare this figure with the reserves that as of January 31 total U$S 41,417 million, the equilibrium dollar rises to $968.15.

image.png

Values are expressed in millions of dollars.

Q.: It’s crazy, would it reach that figure?

-It’s crazy, I don’t think it will reach that figure if there is a will to renew the debt in pesos, if there is no renewal of the stock of debt and it has to be issued, there we would have a collapse.

Q.: Suppose that 10.0% of the debt stock is not renewed

-Well there, the monetary liabilities plus that 10.0% would give us monetary liabilities for approximately $18,000,000 million, which, if contrasted with reserves of around U$S 40,000 million, would give us a balance dollar of $450, something very reasonable in the medium term.

Q.: Many measure the exchange rate with inflation

-Correct, when Alberto Fernández took office the blue dollar was $170, if you adjust it for inflation it gives us a value of $510, in the case of the official dollar it was $84.15 and if you adjust it for inflation it gives us $252 ,Four. Five. Note that if you take the average of the multilateral exchange rate index from 1997 to date, it gives you a value of $228.0.

Q.: With these values there is no doubt that the exchange rate is behind

-Not to mention the blue dollar, wherever you look at it should be adjusting. The official dollar, on the floor, should rise 20.0% to start talking.

conclusions

-We see a clear exchange rate delay, as well as in the price of the tariffs, something that the next government should adjust.

-The market worries about the liabilities of the Central Bank, and the debts of the Treasury grow at a much higher rate. Within the Treasury debt there are less CER-adjusted debt renewals in pesos, and more fixed-rate and short-term debt placements in pesos.

-When Alberto Fernández took over the Merval Index was at 34,101 points, as of January 31, 2023 it was at 253,548 points, it rose 7.44 times, it should be noted that a year ago the Merval was at 90,907, and in one year it rose 2 .78 times, generating the great advance in prices. The bottom line is that the market is pricing in a change of government, so stocks are beginning to recover, especially energy-related stocks.

-The AL30 Bond was released on the market on September 7, 2020 and was listed at $6,270. Inflation, measured from January 2023 to September 2020, gives us 227.0%, this implies that this bond should be worth $20,503 and in the market it is worth $11,369. It is clearly an asset that is long overdue.

-Obviously investors have been changing their preferences. Until 2021, the dollar dominated investment preferences, then they changed to shares, they despise investments in pesos and also sovereign bonds.

-In order not to follow the herd, it would seem that investments in bonds would not be discouraging in the future, today a bond like the AL30 measured in dollars is trading at US$ 31.50 parity and it would not be strange that, with the arrival of a new government, these bonds trade above said value.

-With the repressed inflation that we have, investors position themselves in actions in search of the price adjustment having an impact on business results, which is why energy investments lead the rise. Apart from this, there are strong investments in the sector that would boost its growth much more.

-Clearly, if you are convinced that we are going to a change of government, you have to invest in assets and not in tickets, you have to rethink strategies, real estate prices are behind schedule and a new rental law, plus a recovery of the purchasing power of the salary in the years 2024 and 2025, would leave the real estate sector with better profitability ratios.

-In summary, you have to get to work, it is no longer enough to buy dollars, you have to look for a business that gives you more profitability, it is clear that nobody wants bonds in pesos, there are doubts about sovereign bonds in dollars and it is very clear that the market takes shares.

-For the next 12 months, inflation will be three digits, companies that accumulate stock will have a significant profit, purchases and the tax balance will have to be astutely managed.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.