The gain is even more significant in stocks that took a formidable hit in 2022, such as the big tech companies listed on the Nasdaq.

While this recovery is not enough to compensate for a very adverse 2022 for risk assets, it reflects a relative improvement in the global environment. The good start to the year was based on the downward trend in inflation in most global economies, and the expectation that, although most of the rate adjustment cycle has been completed, it is still far from over.

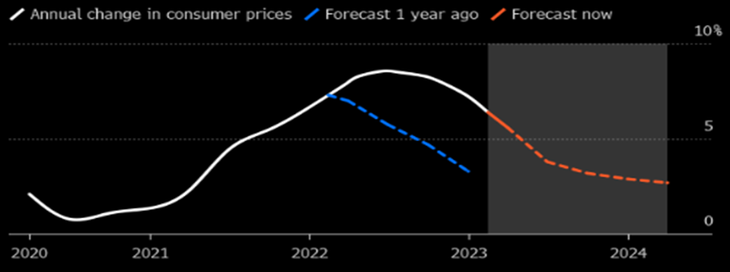

As can be seen in the following graph, inflation in the United States seems to have peaked in mid-2022, and then began a slowdown. From the peak in June, when the CPI in the United States reached 9.1% per year, the following 7 months showed falling inflation.

US year-on-year inflation peaks in June 2022

CPI Interannual variation.

image.png

Source: criteria.

Despite this trend, however, the reduction in the general level

of prices has been more gradual than expected. The last record for January was 6.4% year-on-year, barely one tenth less than in December and above the consensus of 6.2%. For its part, core inflation marked a year-on-year record of 5.6% in January, down from 5.7% in December 2022.

Observing the PCE, the main indicator followed by the FED to measure the evolution of prices and the impact of its monetary policy decisions, a record above expectations was observed. After 4.4% year-on-year for December, the core PCE for January registered 4.7% year-on-year. Disaggregating the indicator into “goods” and “services”, it is observed that the former show a considerable drop, while the latter continue to show increases, mainly due to the items “housing services” (rentals) and the effect of higher labor costs that generates the shortage of workers in the sector.

As seen in the following graph, the disinflation expectation is beginning to adjust. Such a precipitous decline is no longer expected, but rather a very gradual process with persistent inflation.

Declining inflation expectations, but more persistent

Current inflation in the United States and future estimate. (Blue: estimate one year ago; Orange: estimate today).

image.png

Source: Bloomberg.

In Europe, the process is relatively similar. Inflation has been declining after reaching a maximum of 10.6% in October, the CPI for the Eurozone fell in January, standing at 8.6% annually.

A less “cold” winter than expected helped the work of the European Central Bank. This in turn contributed to a better asset climate: EuroStoxx 50 stocks are up 12% year-to-date.

Risks of new adjustments

Going forward, although the work of the Federal Reserve has contributed to lowering the inflationary fever, the resilience of some factors does not allow us to rule out new interest rate hikes. This could be a headwind for the recovery in assets that we have been registering.

The job market is still strong, giving the Federal Reserve arguments to deepen its tightening cycle. The latest data shows an unemployment rate of 3.4%, the lowest since 1969.

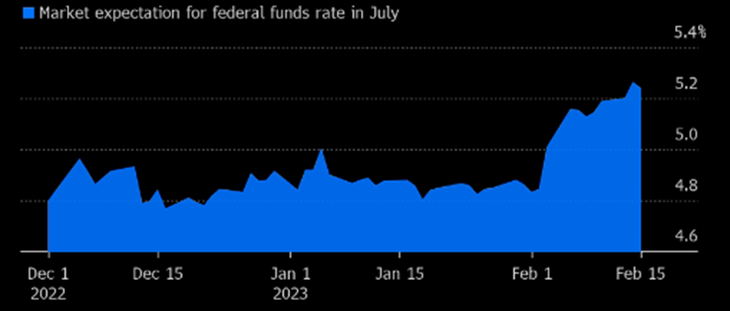

Following this news, the market changed its expectations in recent weeks. It assigns an 80% probability to a new 25 bp increase in the benchmark interest rate by the Fed, and a 20% probability of a 50 bp increase. In previous weeks, the market assigned only a 6% probability that the reference rate would increase by 50 bp, while at the beginning of the month the probability was almost nil. Investors expect three additional hikes taking the monetary policy reference rate to the range of 5.25%-5.5%.

For the market, the rate adjustment cycle has not ended

Expectation for the monetary rate in July 2023.

image.png

Source: Bloomberg

investment recommendations

In summary, global inflation is declining, but far from the objectives of the central banks. On the other hand, we can expect an environment of high rates that will not give way, given a labor market that remains robust and aggregate demand that sustains economic activity.

The risk of a modest return for the S&P 500 in 2023 still persists as a result of a higher rate environment, with tight monetary and fiscal policies, which could push the economy into recession. The inverted curve in the yields of the American Treasury Bonds indicates that said risk is still present.

On the fixed income side, despite the fact that further rate hikes are expected, there are selective opportunities, particularly in high credit quality bonds. Even with the risks of further tightening by the Federal Reserve, current levels of yields on high-quality bond curves are attractive, particularly in the short run.

*Nicolás Max, Director Asset Management at Criteria

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.