. – Neutral behavior, it arrived on Friday and impacted 50%, they sent us US$5.300 million, but we owed the quota for the month of March which amounted to US$2.578 million. In the first days of April we must pay US$ 2,528 million, with which bye inflow of foreign currency. In the month of May we did not pay anything, and in June U$S 2,578 million expire, of which we do not have a dollar to pay it.

Are we going to default with the IMF?

. – I think a negotiation window is opening where Argentina is going to propose restructuring payments, today there are not enough reserves.

How do you see the interest rate issue?

. – Simple, the monetary policy rate and fixed term is 78% per year, this implies an effective rate of 113.2% per year, if inflation in March is 7.5%, in annualized terms it would be 104.6 % annual. Although the effective monetary policy rate is higher, it would be convenient to raise it, since in monthly terms it is negative. The fixed-term monthly rate is 6.5% and March inflation would be 7.5%, you save to lose money in real terms.

To what level should the monetary policy rate rise?

. – At levels close to 85% per year, that would give you an effective rate of 127.3%. If inflation settles around 7.0% per month, this would give annualized inflation of 125.2% per year.

It seems to me a lot to raise the rate from 78% to 85% per year.

. – Well, then it could be in two tranches, raising it now to levels of 81.0% per year, and in the month of May to 85% per year. What is clear is that the rate will have to rise, that will make financing for the private sector more expensive. Hurry to take financing.

At what rate is the national government treasury borrowing?

. – The treasury is paying 127.8% per year to take money in 28 days, and 125.7% per year to take money in 57 days. Both letters are designated S28A3 and S31Y3. They can be bought at banks or stock brokers. Both yield more than the fixed term rate that is at 112.9% per year.

What can happen to the dollar?

. – The wholesale dollar increased 5.5% in the months of January and February, to increase 6.0% in the month of March. We believe that in April this rate should increase to 6.5%, therefore, by the end of April we see the wholesale dollar at $222.6, today the future April dollar stands at $225.50.

What happened in the quarter and in the year?

. – The official dollar increased 18.0% in the first quarter and 88.3% in the last year, much less than inflation and the interest rate in both cases. A fiasco the bonds tied to the wholesale or linked dollar.

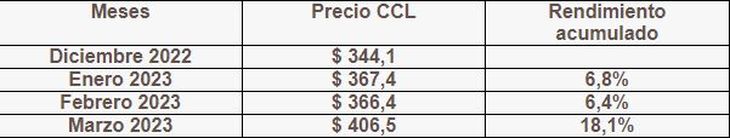

How do you see the MEP dollar?

. – Let’s progress

clipboard01.jpg

In the quarter the MEP dollar comes with a rise of 21.1%, if we compare it in the last 12 months the rise is 108.52% per year. Increase above inflation, which would be 104.6% per year, according to our estimates.

How do you see it for the month of April?

. – We believe that from now on we will have a rise similar to inflation plus an additional plus. The MEP dollar should look for a value close to $450 as a target. However, government intervention keeps it below $400. We believe that by the end of April it could be around $430. We believe that it can return to beat inflation.

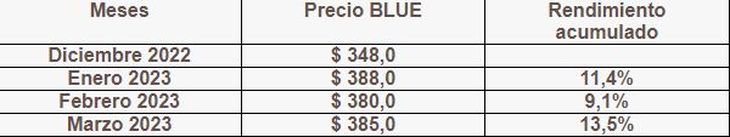

Cash With Liquidation takes off

. – Withdrawing money from the country costs you 2.3%, it is the difference between the MEP dollar and the CCL that today is listed at 406.54, I will show you the progression

clipboard02.jpg

In the last year, the CCL increased 112.5% annually, increasing more than the MEP dollar and inflation, it is consolidated as a safeguard of value.

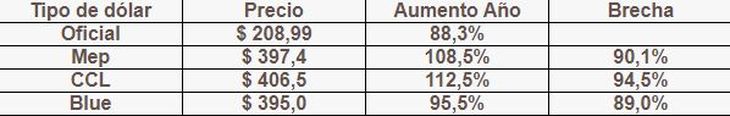

What happened to the Blue dollar?

. – We are going to get a surprise

clipboard03.jpg

It is striking but the blue dollar rises less than the MEP and CCL dollars, its comparison to one year gives us an increase of 95.5% below inflation.

What about the blue dollar?

. – It is the most informal dollar of all, the one that most Argentines save. When there is demand for dollars, it is the one that rises the most, and when there are periods of greater supply, it is the one that finds it the most difficult to rise.

I don’t understand

. – Most of the population does not make it to the end of the month, the dollar is what an Argentine saves the most. To buy a letter from the treasurer you have to go to a stockbroker, to make a fixed term to a bank, in both cases it has to be declared money. To buy dollars you have to go to the cave, and you can buy a minimum amount without anyone charging you a commission, it is the most accessible for most.

will continue to be offered

. – To the extent that the government continues to contract the monetary base that grows at a rate of 45% per year, when inflation would be around 104.6% per year, there will be fewer pesos in the economy and more recession, people will sell dollars to meet your needs.

How much has the wholesale dollar grown in the last year?

. – I show you the ranking.

clipboard04.jpg

The gap parked around 90% per year. The official dollar increases much less than inflation, as does the Blue dollar (12-month estimated inflation 104.6%). In the case of alternative dollars such as the MEP and the CCL, they increased above inflation and more than the blue dollar.

conclusions

. – Blank alt dollars have increased at a faster rate than inflation, and the gap widened from a year ago. Everything suggests that as we get closer to the electoral process, the gap will continue to grow if we do not know the electoral result.

. – The wholesale dollar grows less than inflation, which shows us that the government continues to use it as an inflationary anchor, this makes us pessimistic with investments tied to the wholesale dollar or linked.

. – The blue dollar is the people’s dollar, it rises less than inflation and just above the official dollar, it is behind in its evolution, today it should be worth at least $450 and it is the one with the most to go up. The problem is that it is the most widely offered dollar given the great recession that this economy is experiencing. For example, those who can’t make ends meet go out to exchange dollars to cover their needs, this applies to a family, merchant, industrialist, agricultural entrepreneur, and others.

. – The black economy is more than 50%, and if you have to look for savings with informal money, the only alternative is the blue dollar, hence its high volatility. When the black economy leaves no profit, it grows less than the average of the alternative dollars, and vice versa if the informal economy earns money.

. – A timid rise in rates will tone the rise in alternative dollars. If the interest rate does not rise to at least 81% per year, dollars could rise at a higher percentage rate than in recent months.

. – The government has few reserves, and continues to dangerously postpone import payments, something that at some point could aggravate the exchange scenario, with consequences for the real economy, but I’ll leave that for the private report.

financial analyst

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.