Small banks are in danger because the Commercial Real Estate sector is not going to be able to pay their mortgage loans.

It is estimated that 31 million square meters of offices will become vacant in the coming years. And that puts the small banks that financed the properties in check. How do they collect the money if the offices are still empty? That is the big question.

The Commercial Real Estate market was suffering from the increase in interest rates, which raised the cost of loans and reduced the value of properties. Also, the home office it was a great enemy. And the icing on the cake came: the banking crisis, which weakened all the banks.

clipboard01.jpg

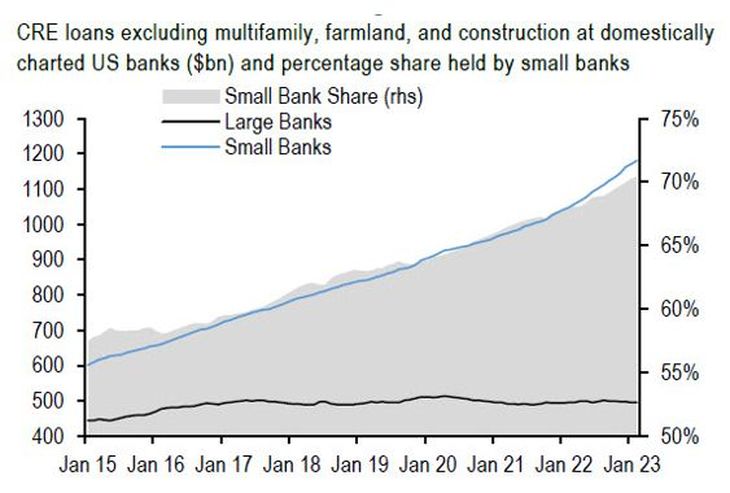

In the next 5 years USD 2.5 mature trillions in commercial mortgages. And most of it is held by banks.

Who are the main banks that have these mortgages? The Small Banks (small banks), which have 70% of the total:

clipboard02.jpg

Smaller banks began to increase their exposure to Commercial Real Estate (CRE) after the 2008 financial crisis.

Although during the pandemic many people stopped going to businesses in the main areas and did not pay their rent, these banks continued to lend money to the sector. Let’s remember that, at that time, the rates were close to 0%.

What can happen? Commercial Real Estate (mainly offices) has a lot of headwinds: remote work, rising interest rates, difficulty refinancing. Forced sales of properties with large price drops are expected in the coming years. It is worth clarifying that the mortgage rate currently exceeds 6%.

Let’s see the evolution of the main REITs (Real Estate Investment Trusts) of offices, which do not stop falling:

clipboard04.jpg

The fall is dramatic and accelerated after the recent banking crisis. This deterioration puts small banks at risk, due to the exposure they have in loans as a percentage of their assets.

You can get into a very dangerous feedback loop between Commercial Real Estate and small banks:

clipboard03.jpg

Also, the occupancy rate for offices is around 50% in major cities in the US What if homeowners start defaulting or foreclosures?

Undoubtedly, small banks would suffer greatly, because they would have to recognize those losses, generating a huge deterioration in their capital.

Let’s remember that the collapse of Silicon Valley Bank originated when it recognized a multimillion-dollar loss to finance the outflow of deposits. Prevention is better than cure. How will small banks collect on all those loans? Who knows.

Finally, I invite you to download a report that I prepared with “7 Investment Ideas for 2023”, an extremely challenging year. Download it here.

CEO of Financial Letter

Note: The material contained in this note should in no way be construed as investment advice or a recommendation to buy or sell any particular asset. This content is for educational purposes only and represents the author’s opinion only. In all cases it is advisable to consult a professional before investing.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.