The soybean harvest has already begun in Argentina, and the yield and quality data that is known tends to level off even with respect to the most pessimistic projections. International news and local announcements regarding a new Dollar Agro influence the prices of this oilseed. Low yields, poor quality and distorted prices seem to offer a triple blow to the 22/23 harvest.

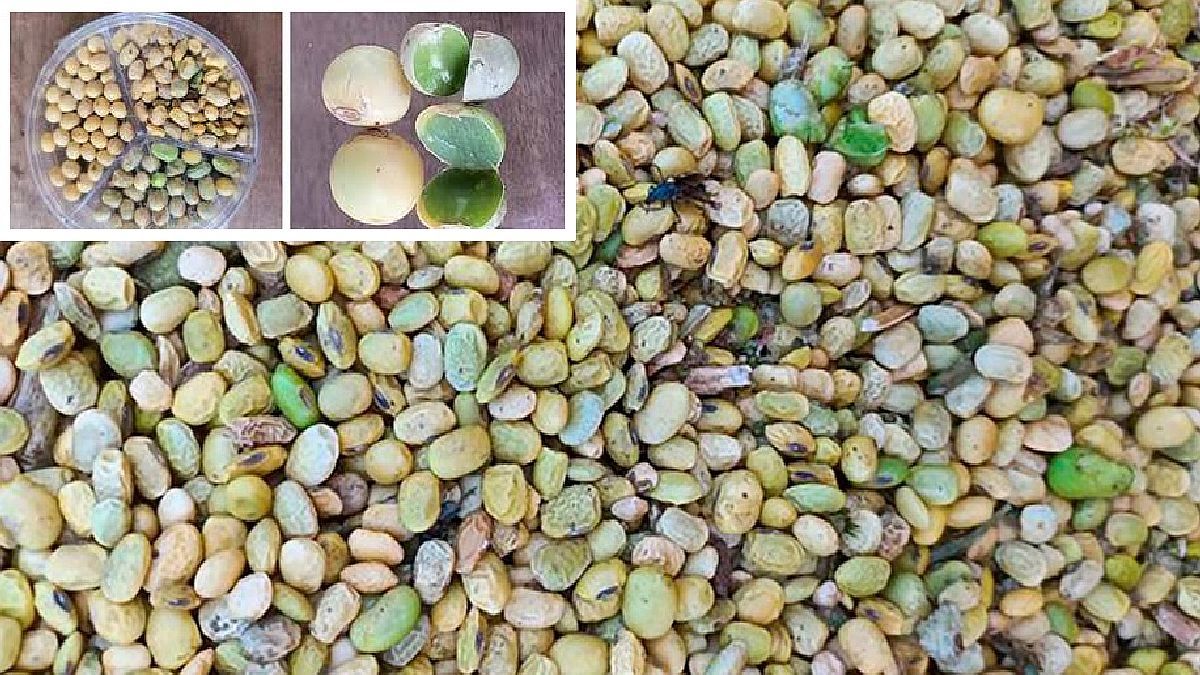

The first lots harvested in the core zone of Argentina, reported average yields lower than expected, with ranges that show floors of 6 quintals per hectare. The discussion in many areas seeks to resolve the feasibility or not of harvesting this type of lots, given the high cost. Harvest, mostly contracted. Another condiment that the harvest brings is the poor quality of the grain, very heterogeneous grains and a high proportion of green grains are reported, a typical feature of campaigns that suffered stress due to high temperatures and drought.

The soybean quality standard indicates that the merchandise can be received with up to 5% green beans, and tolerate up to a maximum of 10%, in which case a loss of 0.2% corresponds to each point that exceeds 5%, on the sale price of the merchandise, exceeding 10% tolerance, the merchandise may be rejected. It means that, if a lot has 10% green grain, a discount of 1% will be made on the sale price of the merchandise. There are reports of an increase in the tolerance for receipt both for damaged grains, up to 20%, and for green grain, by 30-40%, given the strong production cuts caused by the drought, which would result in greater flexibility for the receipt of green grain and in more attenuated discounts, but given the reality of lots with up to 85% green beans, the commercial and agro-industrial complexity of the campaign increases. It is worth noting that these quality problems will also occur in lots destined for seed, so there could be problems with the supply of quality seed for 23/24.

On the other hand, the international market continues to move based on geopolitical aspects, such as the international rise in oil, due to announcements of supply cuts from countries in the East, and based on the upcoming North American planting, whose announcements regarding the area of planting 23/24 soybeans slightly lower than expected for this year, and almost unchanged compared to last year’s area, finally, old soybean stocks lower than expected, which, with active exports from that country, better reinforce international price level.

At the local level, last week’s announcement regarding an agricultural dollar, to be formalized next Wednesday, April 5, prior to Easter, projects a differential exchange rate for soybeans, and it is discussed that other grains would be added to this rate. of differential exchange, of $300/US$, with a period of validity that would run from mid-April to the end of May 2023. This announcement, which must be completed this week, once again generates strong debates, mainly due to the contractual difficulties that this generates, as was experienced last year with the soybean dollar, where the exchange rate for the payment of rents and other goods or services linked to the price of soybeans, went in one direction and the exchange rate for exports went in another. Let’s see the reality of the evolution of the local available soybean price, regarding short-term futures, according to these announcements, still as green as the soybeans that are being harvested.

The available soybean price, published by MATBA-ROFEX, advanced the last three days of last week, the last week of March 23, from $419 to 500/TNin PESOS went from $87,000 to 105,000/TNwhile the future May 23 closed at U$S 400/TN. The complete sample of distorted prices is this, where, for an agricultural dollar of $300/US$the price of US$ 370/TNclosing value of the future May 23 last Friday March 31, equals $111,000/TNabove $105,000/TN offered last Friday by the available MATBA-ROFEX, price jump that shows the graph, the difference then between the available price and May 23 in Dollars, US$ -130/TN, reflects the agricultural dollar to come. Meanwhile, the SIO grains registered operations in the available market between $85,000 and 88,000/TN the last week of March 23, widening the spread between the physical market and the MATBA-ROFEX.

image.png

The question is, is this price paid if I sell to MATBA-ROFEX? The answer is yes, and while the average sales prices registered by SIO grains during March 23 registered values between $78,000 to 92,400/TNMATBA-ROFEX offered prices available between $86,500 and 91,000/TNreason for which some producers that had not operated until now in the local Forward Market, MATBA-ROFEX, began to do so to avoid price losses.

conclusions

The week will be very short, on the eve of Easter, and early announcements bring available price offers and futures very distant from each other. In many areas, the weather will allow the soybean harvest to advance, and yields and quality will continue to report, with the problem of green beans bringing price discounts to discounted yields due to drought. Added to this are international increases and a new Agricultural Dollar, which would bring improvements in prices in PESOS, but lower prices in Dollars.

The challenge is to know the purchasing power of the merchandise to be harvested, and the proportions of costs 22/23 and 23/24 that will have to be refinanced and financed respectively. With these numbers on the table, it will be possible to discern the commercial decisions that must be taken in the short term, given a harvest with quantity and quality problems and a differential exchange rate.

Ing. Agr. msc. Agribusiness

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.