For those savers who every month look for alternatives to protect their pesos against inflation or a possible devaluation of the peso, or who want to grow their assets in the medium and long term, an interesting option -and perhaps outside of the traditional ones , which are always talked about, such as the fixed term or the dollars- are the CEDEARS.

The Argentine Certificates of Deposits (CEDEARs) have been booming in recent years as a result of interest from investors, which has logically boosted their volume. But what are the reasons? Basically, we highlight three:

The latter also, always taking into account that since they are variable income assets, as well as high profitability can be obtained, it can also be low, null or negative. This will depend on the context and situation of each Cedear. And hence, the suggested investment horizon is always medium/long term and for a moderate or aggressive investor profile, who has solvency and who can withstand losses of his capital in the short term.

Figures or amounts related to the Cedears

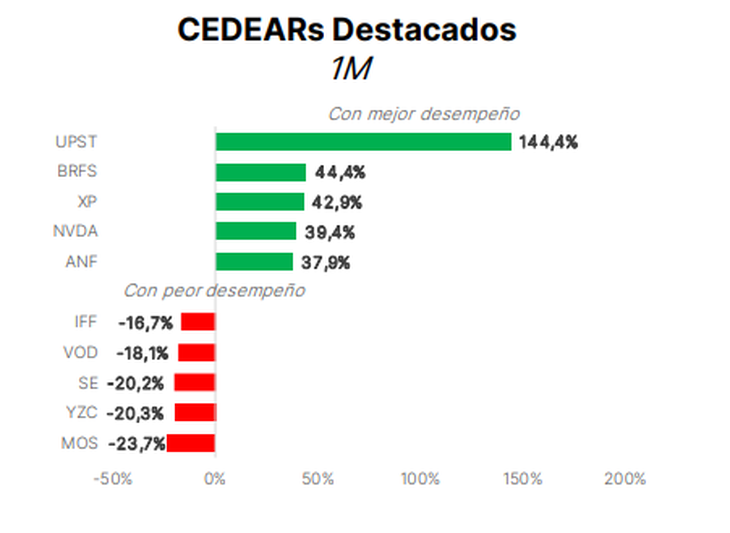

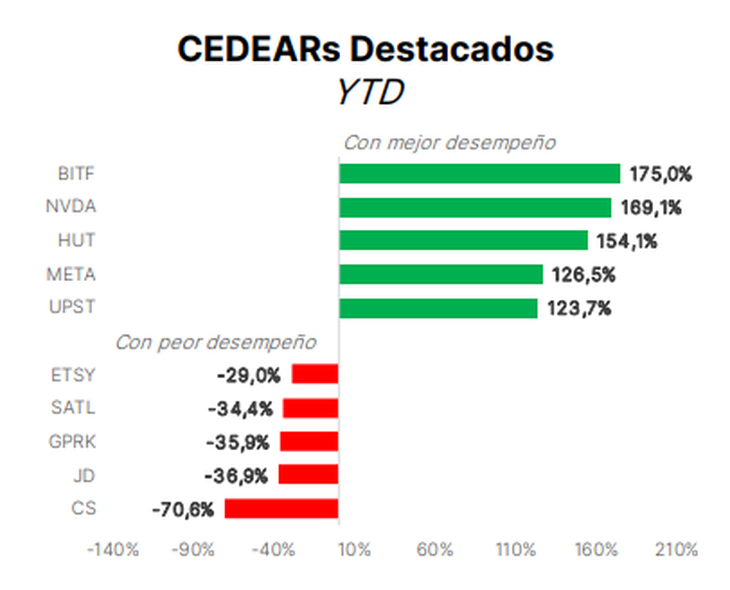

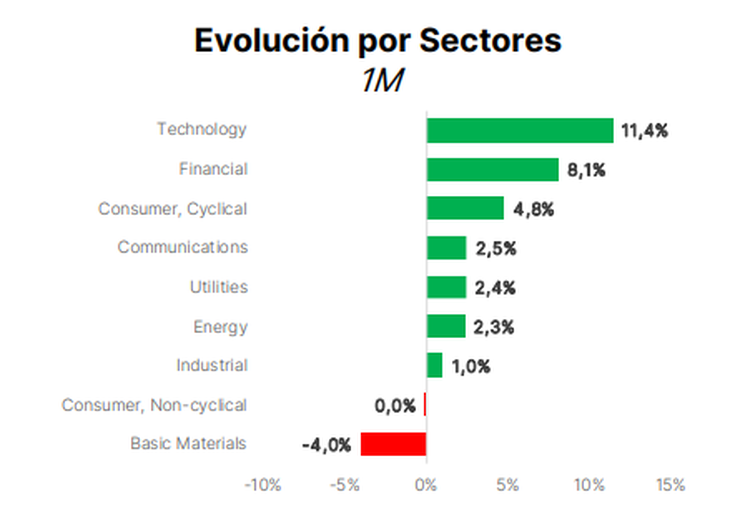

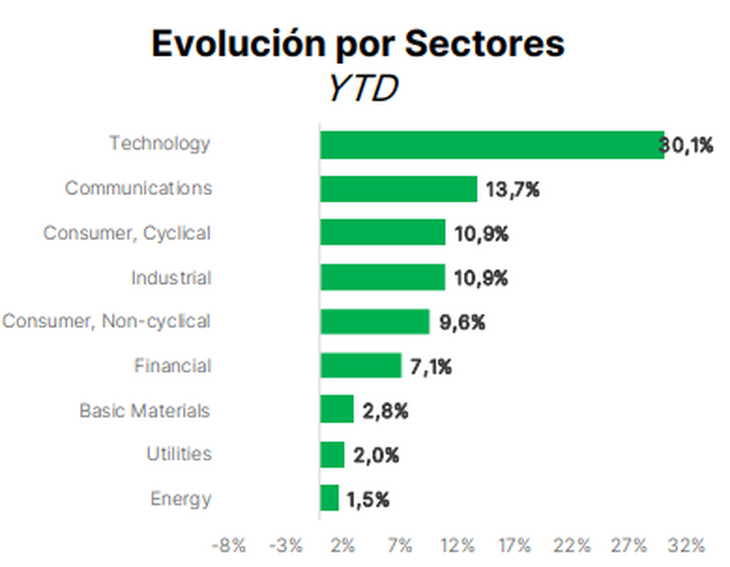

According to him BYMA CEDEAR Index -the index launched in August 2022 that reflects the activity of 90% of the most liquid Cedears in the market-, the average performance in the last year is 194%a yield of nearly double year-on-year inflation according to the latest data published -specifically, the INDEC CPI, of 114.2%-. Even so far this year, this index accumulates a little more than 103% (to June 15).

image.png

To further understand the magnitude and relevance that these assets have taken on, it is also important to mention the size of the market volume currently operated by the Cedears, which have been gaining ground and the market for local shares.

Based on the IAMC updated information (Argentine Institute of Capital Markets), which prepares daily and weekly reports, in the last 4 weeks the traded volume of Cedears amounts to approximately 223,000 million pesos and that of Shares to 111,000 million pesos, which gives a proportion of the 67/33%.

How to invest in CEDEARs?

For those investors who have not yet traded Cedearsand that they want to do it, the first thing is to have a principal account in an ALYC (financial broker), transfer their pesos (or dollars, since it must also be mentioned that there is a Cedears market in dollars) from their bank account, and choose between the more than 200 Cedears de Empresas options outside that exist – or between the 9 ET CedearsF that currently without possible to operate-.

To clarify, also, although there are multiple options, taking the average of the last month, there are only between 10 and 15 Cedears that concentrate 50% of the total traded. Consequently, the liquidity of each option is important when making a decision, especially if times are short.

On the other hand, it is additionally important to know that buying a unit of a Cedear does not mean that we are buying exactly one share of the company it represents from abroad, but that there are conversion rates. What are these ratios? How many local Cedears constitute an original action from abroad. For example, the conversion ratio of the McDonald’s company is 24 to 1; that is, 24 local Cedears are equivalent to 1 McDonalds Corp. share in the United States market where it originally operates.

Finally, let’s look at examples of some of the most recognized and operated Cedears on the market:

1. SPDR S&P 500 ETF TRUST (SPY)

This is the cedear that represents the ETF of the S&P500 index, one of the best known and most operated exchange-traded funds in the world, which replicates the performance of the largest 500 companies in the United States. It currently has a cumulative variation so far in 2023 of 72%, and it is one of the most operated Cedears in the local market. A Cedear of this ETF is trading at $11,200 pesos as of 06/16.

CEDEARs1.PNG

2. APPLE (AAPL)

The leading technology company in the industry, recognized worldwide and with the largest market capitalization, is one of the most operated at the Cedears level and has performed very well so far this year (+111.4%). As of 06/16, you can access an Apple Cedear for $9,300 pesos.

CEDEARs2.PNG

3. GLOBANT (GLOB)

Globant is a technology services company born in Argentina and with a global presence. With more than 16,000 employees in 17 countries, this company specializing in software development and digital transformation has achieved significant growth in recent years. The price has increased by 65% accumulated so far in 2023, and still has high development possibilities, given its focus on innovation and the delivery of cutting-edge technological solutions for companies from various sectors. His Cedear is listed at $5,300 as of 06/16.

CEDEARs3.PNG

4. Invesco NASDAQ 100 ETF (QQQ)

This Cedear represents the exchange-traded fund that replicates the Nasdaq 100 index, the most important technology company worldwide. The main companies included in this index are, among others: Microsoft, Apple, Amazon, Nvidia, Meta, Alphabet (Google), Tesla, and others. In other words, by acquiring Cedears from this ETF, we will be indirectly investing in the largest technology companies in the world. A unit of this Cedear can be purchased at 06/16 for $9,400, and in the year it rises a little more than 105%%.

CEDEARs4.PNG

PPI Senior Analyst.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.