Before beginning, it is worth remembering that there is an alternative for every investor. Each person has different interests, amounts, terms, objectives and risk tolerance. In other words, it has a particular risk profile. Generally, these risk profiles are classified as conservative, moderate, or aggressive (or active). Of course, everyone will choose an investment where they feel comfortable.

So, investing in a fixed term can be attractive, as long as we hope that inflation does not accelerate. However, there are other instruments with similar and liquid returns: mutual funds. By having availability, he could redeem the shares and change the investment strategy immediately, if the dollar escaped, for example. With the fixed term I have to wait a month.

Inflation

Together with the dollar, it is the most important variable because it ends up defining the real performance. The latest data for May showed monthly inflation of 7.8% and annual inflation of 114.2%. Generally, when the dollar rises, prices accelerate for several periods (famous pass through). Today we are with a controlled stock market dollar but with an inflationary inertia that the government cannot stop, causing the ghosts of hyperinflation to return. Price controls, subsidies, agreements with oil companies have no effect.

High inflation is expected for the coming months, at levels close to 100-120% per year (being optimistic), with a peak in the middle of next year, and then start to decline. With elections and a possible change of government, June 2024 is far away. We are not comfortable investing in pesos at fixed rates for such long periods. We prefer CER or UVA instruments.

cuadro1.jpg

official dollar

It is perhaps the variable that is most looked at today in the face of the change of government. Until now, the depreciation rate of the peso has been controlled, smooth and similar to the inflation rate. The current government always set its intention for these variables to converge, although in reality the devaluation was always less than inflation, leading to an exchange rate delay (complicating the competitiveness of our exports). The latter does not seem to matter since the terms of trade have favored us in recent years, but not the harvest, where the field faced the worst drought in 60 years.

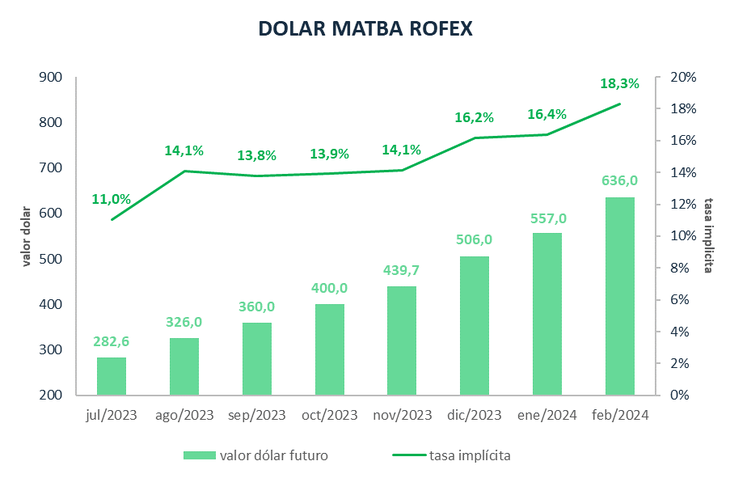

What is interesting is what the market expects for the coming months: until December a higher crawling peg rate compared to the current one, gradual (14%) but with a change of mandate there would be a jump of 16-18.3%. This can be seen in the implied future dollar rates.

box2.jpg

dollar bag

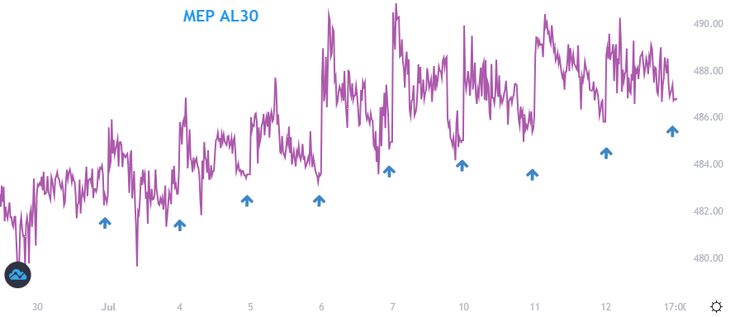

The MEP dollar is stabilized at $485, while the CCL is at $500, moving just 3% in the last month. Large orders are observed daily in the bond market that lead to the assumption that it is the government. And precisely, these orders are usually just before the closing of the wheel, so that the photo of the day comes out well, that is, with a MEP that did not vary so much compared to the previous day. The truth is intraday there is some more volatility. This It can be seen in the following graph where the AL30/AL30D price ratio is represented, in 5 minutes. The losses are seen before 5:00 p.m., when the market closes.

cuadro3.jpg

hard dollar bonds

In the last month and a half, bonds have risen between 35 and 50% in dollars due to the expectation of a change of government, accompanying the rise in emerging market bonds. I mean, it wasn’t just the internal humor. Currently, they are trading at parities of 30% – 36%, moving away from the 20% floors reached in July 2022, post-crisis, Guzman’s departure. Obviously, the recovery was not quick or consistent, as we had several swings in between.

Is it late to enter? It depends on the investment horizon. If one bets on the change of government, a plenary session is being played and it can go wrong. But if this were to happen, many analysts estimate that hard dollar bonds could trade at parities of 40-45% (remember that they were born trading at $40-50 dollars), implying that the bonds still have room to rise between 20 and 30% more. This, as long as the external front does not turn its back on us.

Now, if we look at history, sovereign bonds are in flats. Ever knew how to trade at par. Thinking about this is thinking about staying for years in this investment.

box4.jpg

Actions

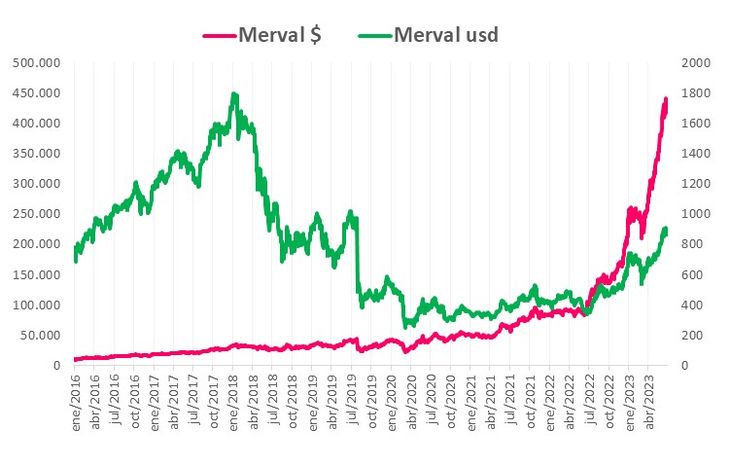

The local stock market has been gaining ground beating all-time highs. It is worth clarifying that these historical maximums are nominal maximums, since in dollars the Merval index is at USD 850, very far from the maximum of USD 1,700 reached in the previous government, when there was free movement of capital and interest on the part of international investors in paper. local. Today the reality is different, we continue to be a standalone market, far from the radar of foreign funds.

However, the stock market rose 135% in dollars last year due to the rally at the end of the year (being the stock market that rose the most in the world), a trend that is still observed in the market. So far this year, the local stock market has advanced 25% in dollars, encouraged by the same factors that boosted bonds: expectations of a change of government and a favorable tailwind for emerging markets.

Anyone who wants to invest in shares can do so through mutual funds, taking advantage of the benefits of diversification or directly on paper.

cuadro5.jpg

cedears

the cedears They play another game. As they are deposits of foreign companies listed on the local stock market, their value in pesos depends on the value of the share abroad and the CCL exchange rate. Therefore, they are tied to what happens with US rates. The Fed, the US central bank, has been following a policy of reducing liquidity and high rates for some time to combat inflation in the northern country. Fortunately, it is succeeding as inflation levels are slowing.

What is worrying now is a possible drop in activity or recession. For this reason, many anticipate that soon the central bank will begin to lower rates. This is a positive factor for financial assets. But when does the rate drop start? The government expressed that it wants to be sure of controlling inflation. The market estimates that rate reductions will begin in about a year.

And while here we celebrate the rise of the Merval, the Nasdaq (which brings together the technological ones) rose 42% in the year, the S&P 17% and the industrial DJIA 4%. Technological ones are preferred, especially those related to artificial intelligence, semiconductors and cloud computing.

Financial Advisor

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.