There is a lot of debate today Javier Milei’s proposal to dollarize the Argentine economy. And since it won first place in the primary elections, even more attention has been paid to this idea, with a long debate on whether or not it is possible to implement. It is true that the difficulties to carry it out are many. But In this note we will not seek to discuss whether it is possible to apply, but to evaluate the consequences of actually doing so. In other words, we will not evaluate whether it is feasible to carry it out, but rather whether, once implemented, it would be sustainable over time. Well, there are eight fundamental points that indicate that it is clearly a macroeconomically unfeasible measure.

First of all, let’s start by making a clarification. Javier Milei himself just four years ago (in 2019) in a report said that dollarizing was not a good idea for our country. The same was the opinion of what seems to be his main economic adviser with respect to this idea, Emilio Ocampo. Where both warned of the large number of problems that dollarizing would cause and that it would end up being a trap for the Argentine economy.

image.png

With this cleared up, let’s get started. The first point to consider is to differentiate the issue of stock from flow. That is, if even Milei were to find a lender who would give her a stock given to dollarize the Argentine economy (suppose some 30, 40 or 50 billion dollars), the problem would be sustaining the annual flow of dollars used by our country, since there are many exit points.

1) Capital flight. One of them is the flight of dollars. During the four years of Macri’s presidency (2015-2019), in a country without a dollar lock or exchange controls, 86 billion dollars fled from Argentina, according to the Central Bank. That is, almost 22 billion per year. Once the economy has been dollarized, the key question is to know what would happen to said variable, which, not even in the best years of convertibility, managed to reduce the strength of the flight.

image.png

2) Debt in dollars. In turn, secondly, it should also answer how the country would pay the upcoming external debt maturities. Let us remember that from 2027 Argentina will have to pay its creditors levels of 20 billion dollars every year, being a demand for dollars that the Argentine economy, even if the State began to collect in dollars, would not be in a position to face .

3) Trade deficit. The same occurs, thirdly, with the trade issue: during the years that there were no stocks or controls, the country suffered unsustainable trade deficits in the long term. During Macri’s presidency (the annual trade deficit reached 8 billion dollars) and during the years of convertibility (1991-2001) the annual average was 10 billion dollars. Both governments managed to offset said external deficit through indebtedness. But once they failed to get more debt, there were crises, chaos, devaluations, and currency runs.

4) There will be no devaluation. Notwithstanding this, we must add a fourth point: both with Macri and with convertibility, the adjustment mechanism in the face of crises and external imbalances was, finally, the devaluation solution. If measured dollarization were applied, this option would no longer be in force. Which indicates, once again, its unsustainability.

5) Productive break. Fifthly, let’s say that dollarization would imply the immediate bankruptcy of at least 30% of the productive apparatus, with thousands of companies closed, invasion of imported products, destruction of the industry and a strong reduction of the internal market. The countries that are usually given as an example of dollarization (such as Ecuador, El Salvador or Panama) are precisely countries without their own industry or internal market.

6) Unemployment. In turn, the productive and industrial breakdown would take us to a sixth point: record levels of unemployment. With Macri and his “exchange freedom” unemployment went from 5.9% in 2015 to 11.8% at the end of 2019. That is, it doubled in four years. With convertibility it was even worse: it went from 6% in 1989 to 18% in 1995 and to 22% in 2001. Dollarization would take it to at least 30%. We clearly see a social and productive infeasibility.

7) Loss of competitiveness. Seventh, let’s say what many don’t say. The countries that dollarized their economies (the recently named Ecuador, Panama or El Salvador) have much lower inflation levels than the Argentines (this being the only advantage for which it would be worthwhile to dollarize). But let’s also say that having low inflation does not mean that it is zero. Which, having 2 or 3% annual inflation has made these countries lose external competitiveness systematically every year. These small countries managed to compensate by increasing poverty or exporting oil. But neither of these options seems to be viable for Argentina.

image.png

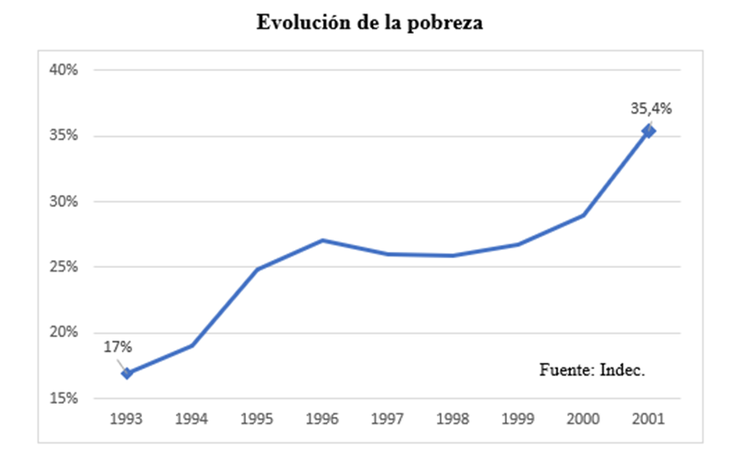

8) Rise out of poverty. Finally, eighth, let’s say something else that liberals forget. It is true that inflation, as it currently happens, can make poverty grow and incomes fall. But having very low inflation or even zero inflation can do the same or be even worse: during the second half of the 1990s, with convertibility, with zero inflation, poverty did not stop growing (poverty went from 17% in 1993 to 35% in 2001, more than doubling) and wages fell steadily. That is to say, it did not manage to solve the social question but to harm it systematically.

In short, if Milei is so determined to dollarize as well as to recover the figure of Domingo Cavallo, he will effectively manage to make the country take over his legacy again, generating worse economic, social and productive consequences for Argentina than those we suffered in the past. year 2001.

* Conicet researcher. author of Argentine Economic Crisis. From Miter to Macri

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.