The calm in the exchange market was short-lived. Nobody wants pesos, everyone wants the dollar. What is the true value of blue?

Nobody wants pesos, everyone wants the dollar.

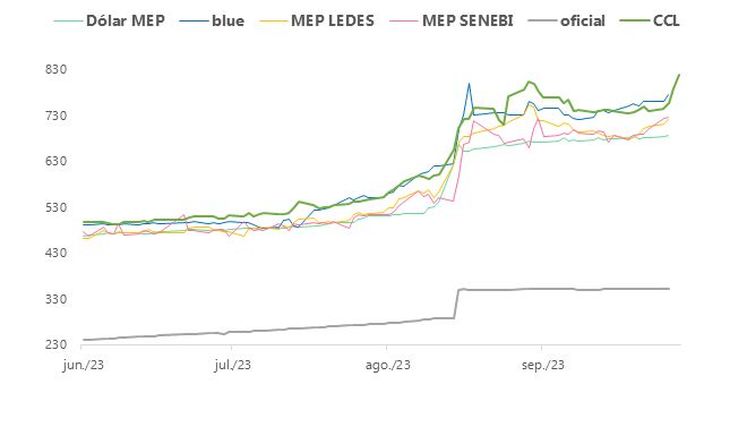

The calm in the exchange market was short-lived. We are not talking about the wholesale dollar, which remains, as the government promised, at $350, but we are referring to the stock market dollar. This week the MEP rose 3.7% to $705 and the CCL, that is, the dollar used to withdraw money from the country, advanced 8.7% to $820.

The content you want to access is exclusive to subscribers.

Let us remember that the price of $705 results from the AL30 bond, the bond in which the government intervenes daily. In other words, it is the subsidized dollar. But buying dollars with another asset, be it a Cedear, a Ledes or a stock, is more expensive and close to $750.

What is the true value of the blue dollar?

Clipboard01.jpg

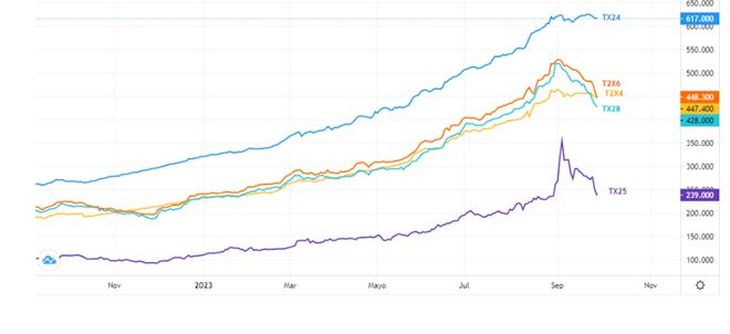

Nobody wants pesos, everyone wants the dollar. The treasury bond curve has been hit hard, with bills yielding over 350%. CERs and duals also suffer declines due to massive exit of investors seeking to reduce exposure to sovereign risk. This month they close in red.

Clipboard02.jpg

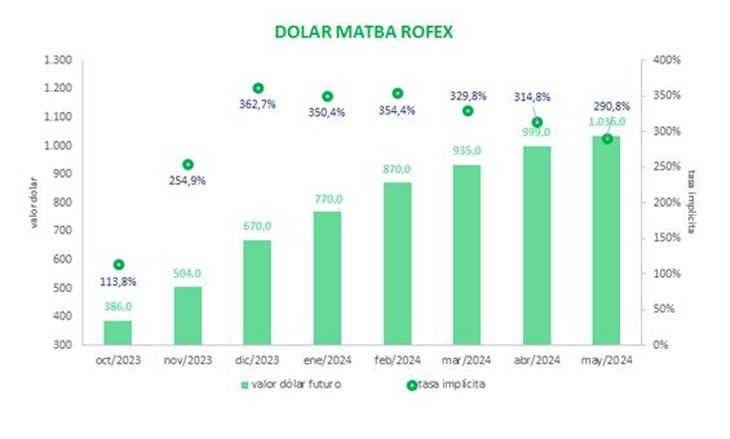

Meanwhile, rates in the Matba Rofex forward market heated up. As you can see, the market expects that in October the official dollar (ref 3,500) ends at $386. Somehow, it does not believe Massa that he promised a dollar at $350 until 10/31. It’s more, There is speculation about the possibility of a slight adjustment after the elections. In short, the soy dollar is ending and pressures on the exchange rate are growing.

Furthermore, in December a dollar is expected at $670, which implies a direct increase of 91% (or TNA 362%). Let us remember that in December there is a change of mandate. In other words, the devaluation would come in December with a jump, and then it would stabilize in the 5-7% monthly area, in line with what is expected for inflation today, but of course, if there is a new devaluation, inflation will slow down. would speed up.

Clipboard03.jpg

Financial Advisor

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.