A few days before the general elections, The exchange market has shown strong pressures: both in the official dollarwith the Central Bank (BCRA) needing to sell foreign currency, as in the informal and financial markets, where quotes settled into a new range of values (close to $1,000).

It is a process similar to that experienced prior to the PASO, but on a different scale. When these cycles occur, the analysis branches into two. On the one hand, seeking to understand the nominal dynamics of the variables and where the ceilings can be found. On the other hand, there appears long-term analysis, where real and sustainable balances are sought. Probably in these days the nominal short-term vision will continue to prevail.

After several weeks in which investors were waiting, strongly positioned in Money Market Fundswaiting for the asset values to be finished rearranging in pesos, last week he returned with the demand for exchange coverage is quite intense.

This was reflected both in the futures market official exchange rate (Matba-Rofex), in the value of the Dollar Linked instruments and in the pricing of the different financial dollar channels.

Dollar: readjustment in the price of futures

One of the first markets that saw the greatest demand for currency hedging is in the exchange rate futures traded on Matba-Rofex.

If we take the December contract as a reference, that is, expiring after the new government takes office, we see how the traded price, which had reached maximum levels at the end of August and then dropped, reached new record values.

Value of the Exchange Rate Future Contract December 2023

megaqm dollar 1.jpg

That contract It is already operating in ranges of $900 / $950 and may continue to hold down for the next week. This figure implies levels on average 80% higher than those in force pre PASO and 170% higher than the current official exchange rate, which remains frozen at $350. Investors who are operating at these values take coverage with a very high franchise, because clearly they would not perceive that entire first part of an eventual discrete jump in the exchange rate. They are covered with larger figures, making clear a high degree of uncertainty going forward.

Strong demand for dollar-linked assets

After several weeks in which it was difficult to find purchases for dollar-linked assets issued by the Treasury, demand returned in full force. The decision to freeze the official exchange rate until mid-November and even with the possibility of it being extended until the change of government, left these instruments without “deviation”.

That is why a portion of investors were seen positioning themselves in Money Market Funds, to obtain that interest rate while they waited.

Last week, demand recovered very strongly and bonds such as TV24, which adjusts to the official dollar and expires in April 2024, went from accruing effective rates of +3%/4% to negative returns of around 30%. This is explained by strong demand and a direct increase in its price.

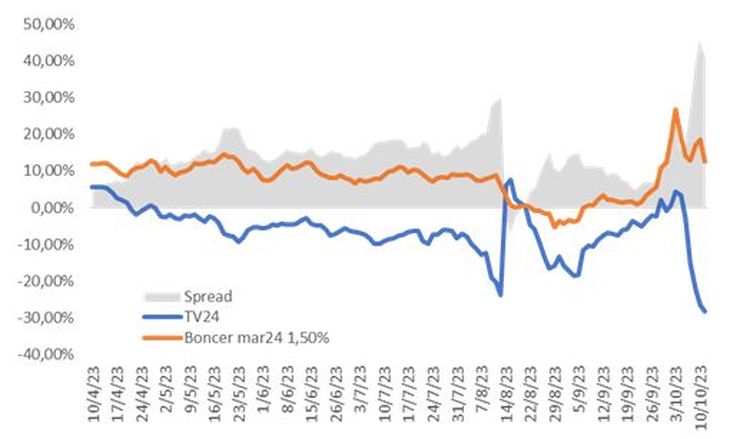

Spread between CER Instruments and linked dollar

megaqm dollar 2.jpg

Although the CER instruments also recovered a little, there has been a strong spread between these adjustment clauses, which makes it clear that The market expects in the future an exchange rate correction with an increase in the real exchange rate, that is, with a greater increase in the exchange rate than in inflation. Although this gap is already at 40%, maximum levels, it may continue to increase if the market accommodates a discrete strong jump in the exchange rate.

Dollar: how far can the gap go?

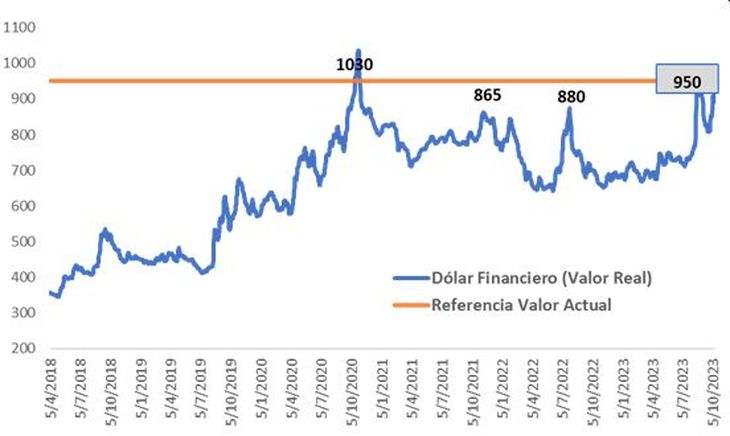

The last point that reflected the demand for exchange coverage was the pressure that was observed on the financial dollar. The values achieved are within the recent maximums and even by above the levels of April – June 2002. Clearly it is about stress levelswhere the strong demand for asset dollarization is clear. The current level was only surpassed by the peak gap reached in October 2020.

Investors who dollarize positions in these values do not operate looking at the real long-term equilibrium, but instead focus on the possible nominal levels that the financial dollar may reach in the coming weeks. That is, they apply a nominal approach.

Value of the financial dollar (CCL) measured in real terms

megaqm dollar 3.jpg

These levels are sustained for short periods of time, but we cannot fail to keep in mind that, at the current nominal rhythms of the economy, reference prices are changing rapidly. That is In the short term, similar or higher nominal values can be seen.

For now they are There are few effective tools available to contain this demand for dollarization.

We see it feasible that they continue to appear official (regulatory) stimuli that seek to increase supply and reduce demand in that market. At least in the short term. For its part, the BCRA increased the interest rate to 133% annually, although it is clear that in these very short-term scenarios and with the risk of shocks, interest rates are ineffective.

Chief Economist at MegaQM

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.