The balance sheet season for the third quarter of the year comes to an end in Wall Street. Almost all of the companies that make up the S&P500 presented their reports corresponding to the third quarter of 2023. Of these companies, 82% reported earnings per share above estimatesalso exceeding the five and ten year average (77% and 74% respectively), in a demanding environment for companies facing a challenging 2024.

If we close with these figures, it will mark the highest percentage of S&P500 companies reporting a positive earnings per share surprise since the third quarter of 2021. Collectively, companies are reporting earnings 7.2% above estimates, below the five-year average of 8.5% but above the ten-year average of 6.6%. Thus, the S&P 500 reports 4.8% year-on-year earnings growth, showing a positive result for the first time since the third quarter of 2022.

Cedears: a challenging environment for 2024

Positive surprises in company earnings They did not have the same impact on prices. Considering the reaction in prices one day after the announcement of results by all the S&P companies, these they contracted on average -0.05% while the earnings per share surprise was 7.7%. Zooming in we see a lot of dispersion between the different sectors of the S&P 500.

For example, “Utilities” along with “Telecommunications” were the sectors that had the greatest positive reaction due to the earnings surprise, while Consumer Discretionary and Technology were the two most punished sectors. where despite showing positive surprises that reach 14.8% and 10.5% respectively, prices fell on average one day after the announcement by -1%.

However, in macro terms during 2023 the positive surprises came from both the level of activity and the inflation. The US economy appeared robust with a revised growth for the third quarter of 5.2% year-on-year and a resilient labor market where the unemployment rate remains at 3.9%, although Moving forward, the “landing” of the North American economy can already be perceived.

In November, both labor data and data related to inflation, income and consumption were in line with a slowdown in the economy. The Consumer Price Index fell to 3.2% year-on-year in October, a considerable reduction from 3.7% the previous month. Process that is consolidated with the latest PCE data, where the “core” segment, the main indicator followed by the Federal Reserve, was located at 3% for the month of October.

The drop in inflation was well received by investors as a whole, since the prospect of interest rate increases in the future loses strength. In recent weeks we have observed a decline in yields along the entire sovereign curve in the United States responding to the expectation that the Fed will reach the end of the monetary cycle, boosting stock prices. The market now assigns a 97% probability that the monetary authority will maintain the rate at the next meeting on December 13 and carry out a cut in March 2024.

The market anticipates the rate cut by the FED

criteria 1.jpg

Source: CME Group

Despite the apparent consolidation of a “soft landing” scenario, The possibility of a “hard landing” cannot be ruled out. Not only because of recent economic history, which shows that only two of the last twelve rate hike cycles achieved a soft landing for the economy, but also in the current environment of high real interest rates. This context leads us to contemplate a scenario where the probability of a hard landing of the economy is greater than zero.

Cedears: The choice of portfolio, the great challenge

If the decline in Treasury Bond yields was driven by signs of cooling activity leading the FED to lower rates sooner than expected, It is difficult to see company balance sheets with profits similar to those of the last two quarters. The ratio that relates the share price to its future earnings (price earning) is around 18.7 times according to FacSet, above the ten-year average of 17.6. Thus, the relative valuations for the S&P500 after the November rally are unattractive where the Portfolio selection is crucial.

2023 reveals two stories that seem to be divorced for next year. On the one hand, we see an S&P500 with a return of 19%. On the other hand, the “S&P 500 Equal Weighted Index”, a version of the index that gives equal weighting to the stocks that comprise it, shows a return of only 6.2%. But if we consider The return of the “magnificent seven” the return is 95.2%. Equities have clearly been driven by the Artificial Intelligence (AI) business as the main catalyst.

The Magnificent 7 and the AI boom boost the S&P500

criteria 2.jpg

Source: Bloomberg

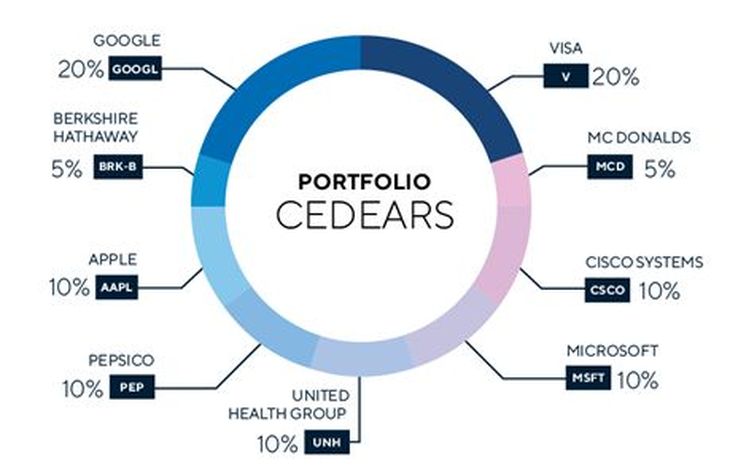

Cedears: the Cedears Criteria Portfolio and businesses linked to AI

Berkshire Hathaway and Cisco presented their quarterly balance sheets, thus completing the companies that make up Cedears’ recommended portfolio.

Berkshire Hathaway (BRK.B): Results in Line with Expectations

Berkshire Hathaway presented results in line with expectations. The company maintains a huge cash balance and strong free cash flow, while its stake in Apple continues to boost its equity portfolio. So far this year, Berkshire shares have seen an increase of more than 15%.

Cisco Systems (CSCO): Solid Results with Cautious Outlook

Cisco Systems reported strong results, although it surprisingly lowered its outlook due to a slowdown in new orders. Despite delivering the best fiscal first quarter results in its history, with an 8% increase in revenue and a 29% increase in earnings per share, the company adjusted downward its expectations for fiscal 2024. Cisco argues that this adjustment is due to the success of customers’ implementation of recent products. We will be attentive to possible revisions in our fair value estimates for the company.

The Artificial Intelligence Revolution

Artificial Intelligence (AI) is presented as the greatest catalyst for economic growth since the dawn of the Internet era, and among the outstanding actions Nvidia It is presented as one of the favorites among investors. The company’s technology plays a key role in the artificial intelligence revolution.

In its recent fiscal third quarter report, Nvidia announced excellent results. The data center business is experiencing notable growth rates, projected to maintain this solid pace in the coming years. The company’s revenue reached a record, tripling in the last year, thanks to the robustness of the data center sector. Earnings increased sixfold from the same period last year, and free cash flow generation remains impressive.

The company continues to demonstrate high levels of profitability, supported by consistent growth in sales and a strong net cash position on its balance sheet. During the first nine months of your fiscal year, Free cash flow reached approximately $15.8 billion, compared to $2.1 billion in the same period last year.

For all these reasons, facing the end of the year the Cedears Criteria Recommended Portfoliomaintains more than 40% of its portfolio in the high-cap and growth segment linked to the Artificial Intelligence business with significant positions in Apple, Google and Microsoft.

criteria 3.jpg

Criteria Asset Management Analyst

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.