Let’s start at the beginning. What is an ETF? The abbreviation comes from “exchange-traded fund”, which translates as “exchange-traded fund”. These are investment funds with the distinctive characteristic that their shares are traded in the market as if they were any stock.

What does this mean for the industry? This decision has a great impact for both individual and institutional investors. With the new ETFs, investors can more easily include Bitcoin in their investment portfolios, in the same way they do with stocks. It is no longer necessary to deal with complicated crypto exchanges, but now they have a simpler and more direct way to access this type of asset.

Two months ago he had commented on the expectation that there was in the market for the imminent approval of ETFs. At the time, Bitcoin was trading at $37,000.

Ultimately, approvals were granted to 11 ETF applications, including BlackRock, Valkyrie, Grayscale, Bitwise, Hashdex, ARK 21Shares, Invesco Galaxy, Fidelity, Franklin Templeton, VanEck and WisdomTree.

Let’s see the evolution of the price of Bitcoin:

Bitcoin.png

It is worth clarifying that the approval by the SEC was on January 10 and that on the 11th Bitcoin surpassed the USD 49,000 barrier. From there, it retreated and is currently trading around $43,000. That is, it did not consolidate the rise after the approval of the ETFs and fell 12% from those levels. Classic “sell with the news”.

What can happen to the price?

The bullish trend that Bitcoin is going through is undeniable. From the lows at the end of 2022, it has accumulated a rise of more than 150%.

But one cannot ignore the context of the US market. And the data shows that Bitcoin remains a risk asset that behaves similarly to stocks, beyond the qualities it has, which are truly cutting-edge.

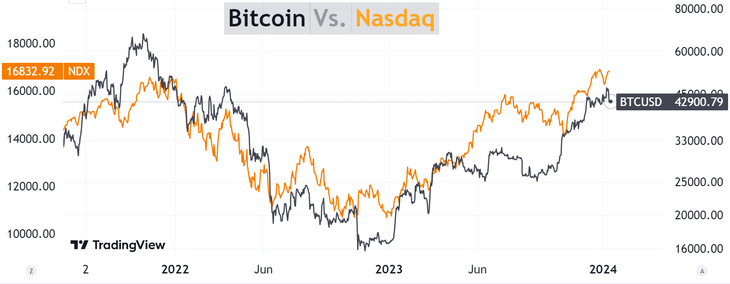

Let’s look at the comparison between Bitcoin and the Nasdaq in recent years:

Bitcoin2.png

The graph speaks for itself. Bitcoin continues to behave as a high-risk financial asset, comparable to the Nasdaq, the main technology stock index.

So, What can happen to Bitcoin? Looking at the chart, one could conclude that it will depend a lot on what happens with the stock market. And the market will be very attentive to how inflation and the economic situation in general evolves.

Those who are bought in Bitcoin, for the moment, have no arguments to sell. But it is important to note that buying Bitcoin (or another cryptocurrency) and holding on without any type of contingency plan, in case the trade does not go as planned, is a mistake.

Beyond how incredible and revolutionary some projects are, you cannot resort to the “buy and pray” method.

Bitcoin is another asset within the financial world, in which trend-following can be done. Using this method is consistent with being profitable in the long term, controlling risk.

Another important event for Bitcoin is the halving, which will occur in early April of this year. This implies halving the rewards for miners and, therefore, the issuance of new BTC. The halving has consistently proven to push the price towards new all-time highs. Although it is worth noting that it is something known by the market, so it is difficult not to imagine that it will not be incorporated into the price sooner, since it is not new.

Will Bitcoin go back to all-time highs post-halving? Nobody knows, that’s why it’s important to have a plan. One as an investor cannot rule out any scenario, including the possibility that ETF approval has been a ceiling and Bitcoin begins to correct. As always, prices rule.

To finish, I want to invite you to download a free report with 7 stocks related to cryptocurrencies, with a lot of potential if the crypto world continues to consolidate. You can download it here: Financial Letter – 7 crypto actions.

Note: The material contained in this note should NOT be interpreted under any circumstances as investment advice or a recommendation to buy or sell a particular asset. This content is for educational purposes only and represents the opinion of the author only. In all cases it is advisable to seek advice from a professional before investing.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.