Inflation in the United States accelerated at the end of 2023, with the consumer price index increasing 3.4% in the year to December, the largest increase in three months, where monthly variation was also greater than expected. The CPI excluding food and energy (core inflation) increased 0.3% in December compared to the previous month. In annual terms, the increase is 3.9%, well above the monetary authority’s objectives.

In December, 216,000 jobs were created, exceeding expectations. Of the total, 164,000 jobs belong to the private sector, while 142,000 correspond to the services sector. However, looking at the trend, the slowdown continues to consolidate. In this way, the year 2023 concluded with the creation of 2.7 million jobs, the most modest variation since 2019 if we exclude 2020 with the impact of the pandemic.

However, the unemployment rate remained stable at 3.7%, contrary to expectations that anticipated an increase to 3.8%. The increase in salaries in the private sector also exceeded expectations, where annualized quarterly variation stands at 4.3%, exceeding the 4.1% of the last 12 months and exceeding the 3% objective established by the FED, in line with the 2% inflation goal.

Under this environment, 2023 leaves us with a very positive balance as investors. The S&P500 exhibiting returns of 26.8% but the version of the index that gives equal weighting to the stocks that comprise it, that is, the “S&P 500 Equal Weighted Index” with returns of 11.6% suggests paying attention to sectors and assets that are really generating value, and that allow us to remain aggressive when putting together our investment portfolio.

Cedears: The reasons to remain aggressive in 2024

Based on a recent article by Brian Nelson, CFA head of independent stock research company Valuentum, we rescued ten reasons to remain aggressive in 2024 on our Cedears portfolio:

1 – The Federal Reserve considers initiating rate cuts with inflation slightly above 2%, allowing you to take preventive measures. This benefits those stocks whose cash flows are expected over the long term, especially large-cap technology and large-cap growth stocks.

2 – Unemployment at a minimum of 3.7% strengthens the markets, Since employees injecting money through retirement and retirement accounts, they create a solid foundation for the stock markets.

3- Notable and continuous wage increases boost consumer spending, while nominal GDP remains strong, regardless of the discussion about a “soft landing” or “forced” of the American economy.

4- Given that currently only about 10% of trading comes from discretionary investors who pay attention to fundamentals, We live in a market environment where investors are investing in indices. This should continue to benefit the largest companies in the most representative indices, with the large-cap technology and large-cap growth categories being the two most favored.

5- Since the 10-year Treasury yield is significantly higher than the average dividend yield of S&P 500 companiesthe market continues to price stocks reasonably, providing a rational backdrop to remain aggressive in generating ideas.

6- The performance of 2023 gives confidence that 2022 was a passing moment in long-term trends, where large-cap technology and large-cap growth predominate. Thus, our favorite stocks are back in fashion.

7- As the rising tide of prices flows throughout the economy, we expect a benign multiplier effect to continue to amplifye, paving the way for what could be a similar increase in nominal share prices. It wouldn’t be surprising to see the stock double in the coming years.

8- More than half of households do not have a mortgage and are benefiting from the enormous wealth effect that has taken hold not only in stocks over the last decade but also with respect to house prices in recent years. Household balance sheets remain healthy, which is positive for the economy and stock markets.

9- Artificial intelligence (AI) continues to be a huge potential source of growth. Microsoft has already begun monetizing AI in Copilot, and while Nvidia and AMD will benefit by providing the computing power behind the AI revolution, many more companies will tangibly monetize AI starting in 2024.

10- Although certificates of deposit at a local bank offer rates of 5% or more2023 showed that stocks could still generate big results on a relative basis, with the S&P 500 up 26.8% in 2023. It wouldn’t be surprising if the S&P 500 overall generates double-digit annual returns for years to come.

Cedears: two favorites for 2024

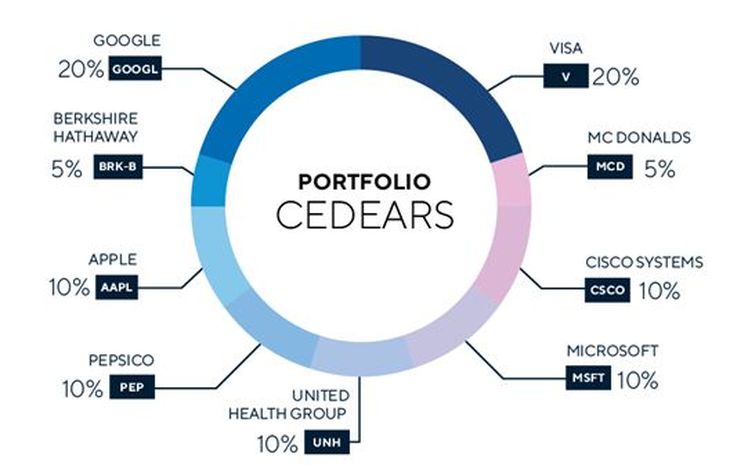

Considering the reasons that allow us to continue being aggressive in 2024, Visa and Alphabet They are two of our favorite Cedears with the greatest participation in our recommended portfolio. Both stocks have just hit one-year highs in their prices.

Alphabet (GOOGL) and Visa (V) hit one-year highs

alphabet.jpg

Source: Bloomberg

Over the past year, Visa shares are up almost 20%, while the actions of Alphabet climbed more than 60%. If we consider the Cedears in local currency, these returns translate into a 349.5% and 259.7% respectively in pesos.

Visa is influenced by the trend towards a cashless society and benefits from the proliferation of e-commerce. The company’s operating margin and its cash flow margin stand out. It is expected to generate considerable free cash flow in the coming years and its dividend growth prospects will benefit as a result.

For its part, Alphabet (Google) ended its third quarter of 2023 with a huge net cash position. Total cash, cash equivalents and marketable securities exceed its long-term debt by more than 8 times. This technology giant probably has the best balance sheet out there given the financial flexibility it has. The company’s free cash flow during the first nine months of 2023 grew 40% over the same period a year earlier. Thus, it has all the characteristics to become one of the best performers in 2024.

It is difficult to know exactly what 2024 will bring in terms of market profitability, But certain aspects of the stock market and the American economy make us think of opportunities to remain aggressive in our choices. Visa and Alphabet remain two of our favorite ideas in the market today.

At the beginning of 2024, the Cederas Criteria Recommended Portfolio maintains 40% of its portfolio between these two value alternatives.

cedarsssss.jpg

Criteria Asset Management Analyst.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.