The Nikkei surpassed levels not seen in the last 34 years and investors are very excited. Can it surpass the all-time high of 1989?

I want to start with the long term chart:

The Nikkei 225 index is made up of the 225 main companies, chosen from among the 450 most liquid securities of the First Market (First Section) of the Tokyo Stock Exchange (TSE). Every year, the composition of this index is renewed, ensuring the representation of the most prominent companies in the Japanese economy.

In recent years it had a great recovery and was able to overcome the 35,000 point barrier after 34 years. He is 8% away from the 1989 all-time high.

Before continuing, I want to highlight the example of Japan. The fact that the Nikkei is worth the same today as it was 34 years ago offers us a shocking financial lesson about the importance of having an exit plan in the world of investments.

This directly challenges the “buy and hold” philosophy without a defined exit strategy. It is clear that, sometimes, it can work but the key is to avoid these cases and be able to protect yourself.

Just imagine the person who bought the Nikkei in 1989, accumulated a loss of more than 80% and, even today after the enormous recovery, is still below that historical maximum. It is also worth clarifying that this is in nominal terms, without considering inflation.

Japan Bullish Factors

Japan is in a clear upward trend and there are several reasons that can explain it.

Foreign interest: The weakness of the yen has helped boost inflows of funds from foreign investors to Japan.

Let’s look at the relationship between the price of the Yen and the Nikkei, which go hand in hand:

nikkei2.png

Economic optimism: Many Japanese companies are experiencing strong profit growth, driven by the weakening yen and rising exports. This translates into higher stock prices.

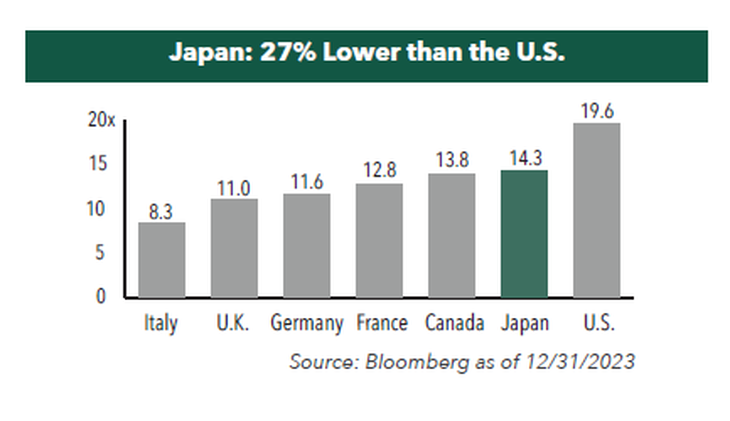

Attractive valuations: Compared to other markets such as the US, Japanese stocks are still considered relatively “cheap.”

Let’s look at the Price-to-earnings ratio, which indicates how much is paid for each dollar of earnings.

nikkei3.png

The Japanese stock market has a Price-to-earnings of 14, which represents 27% less than the US stock market.

An alternative to expose yourself to the Japanese stock market in a US broker is through the EWJ ETF. This fund replicates the behavior of the main Japanese companies, but it is completely in dollars, without taking into account the variation of the Yen, as happens in the Nikkei.

Is it a good idea to invest now? While the future remains uncertain, there are several reasons behind Japan’s good performance. The most important thing is what prices do and, for now, they are telling us that there is a clear upward trend. Therefore, the odds are in favor. As always, prices rule.

Are you interested in knowing more about these topics? I want to invite you to read a report that I prepared with the 22 best finance and investment sites. It is information that in many cases is difficult to find. You can download it at this link: Financial letter – 22 finance and investment sites.

Note: The material contained in this note should NOT be interpreted under any circumstances as investment advice or a recommendation to buy or sell a particular asset. This content is for educational purposes only and represents the opinion of the author only. In all cases it is advisable to seek advice from a professional before investing.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.