The traffic light focuses on measuring the current situation of central variables to complete the process of “sincerization and reordering,” to then give way to the second stage of “stabilization and forward construction.”

The first month of the year has already closed and economic measures taken so far by the new management are beginning to impact the different indicators. We understand that we are still in a rearrangement stage, where the key is the honesty of relative prices and the redefinition of incentives for the supply and demand for dollars. If this is so, it may possibly be a two-stage economic plan: the first focuses on the aforementioned reorganization and the second on stabilization and forward construction.

The content you want to access is exclusive to subscribers.

In this idea of understanding the economy in stages, it is key to understand When can the passage from the first to the second stage be? With this objective we have built a traffic light that focuses on measuring the current situation of the variables that we consider central to completing the process of “sincerization and reordering”, to then give way to the second stage.

megaqm.jpg

Imbalance traffic light: information table

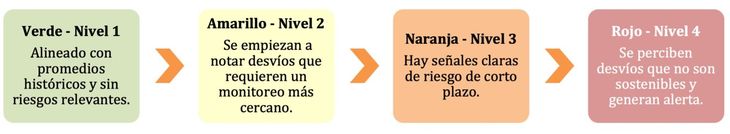

We have selected different indicators that allow us to cover a wide spectrum of variables that contribute to the stability of the main fronts. We have classified these variables into 4 levels depending on the alert level they show:

megaqm2.jpg

Imbalance traffic light: informative table

- Real Exchange Rate: The aim is to identify potential delays in the RER that put at risk the ability to generate a trade surplus. In the current situation, it is necessary to generate commercial surpluses that help rebuild the level of reserves. Although the RER implicit in the official dollar during January has not been bad, it is below the average of the years in which strong trade surpluses have been generated. Furthermore, given the differential in pace between the crawling peg and inflation, short-term warning signs are beginning to be perceived. The other value analyzed is the level of the Financial Dollar (CCL), measured in terms, where it is shown near its maximums, which makes it clear that it has not yet been possible to generate confidence in investors, who continue to pay a high price for dollarizing positions.

- Exchange Gap: The gap is an indicator that serves to measure the magnitude of the effort that must be made if we seek to unify the exchange market. It was very low at the end of December, but in recent weeks it has increased as a result of an appreciation of the official dollar. The trend continues to grow. As long as the current crawl rate is maintained and the real value of the CCL is not lowered, the gap would continue to rise. That is why it is observed that it is at Alert Level 3.

- Retail Inflation: A key indicator due to its impact on the rest of the variables. At current levels it is still at maximum risk level.

- Daily reservation purchases: The BCRA remains active buying dollars daily and seeking to rebuild its reserve position. For now the pace of acquisitions remains very high, but in the coming weeks the pace of payment for imports will normalize and the volume of purchases may decrease. It will be key to understand what the timing is like between the increase in import payments and the beginning of the liquidation of the coarse harvest. For now it is clearly in green.

- Net Reserves: The BCRA is active buying dollars, but it comes from a level of strongly negative reserves and it takes time to rebuild it. Today they continue to be negative by more than USD 8,000 million, therefore, they continue to be a source of economic and financial stress.

- Devaluation Expectation: The exchange rate futures market (ROFEX) shows prices (forward rates between positions) that do not suggest that a discrete jump in the exchange rate is being valued. They seem to reflect an acceleration in the pace of peg crawling that would only occur starting in March. In April and May the figures already suggest a higher pace of adjustment, which is no longer compatible with current interest rates and which could therefore suggest the possibility of a discreet adjustment. That is why a major warning sign is already marked in that section.

- Risk country: Improved substantially at the end of the year, although the tax calendar may have affected it. Although it is lower than the level observed during 2023, it is still perceived to be very far from the levels that would allow a return to the capital market to roll maturities.

- Monetary Aggregates: The objective is to monitor the level of real demand for money and the gap with the total supply of pesos. The demand for money continues to remain at historically low levels. For now, it seems unlikely to expect a recovery until positive real interest rates are consolidated. The excess pesos, identified from the stocks of Remunerated Liabilities, are clearly declining. This has been achieved by the combination of negative real rates and reabsorption of pesos via Bopreal and repurchases of Treasury debt from the BCRA.

- Fiscal Goals: The central objective of these first months of the new management is to achieve sustainable fiscal balance. To measure progress we are monitoring the level of collection with respect to GDP. Especially because if there is a drop in activity level, it can be affected. For now it remains green.

- Household Purchasing Power: The last point we analyze has to do with the consumption capacity of households. The number of people who have income and the average income they generate are measured. The increase in the cost of living is deducted from these total resources. In this way, an index is obtained that reflects global purchasing power and anticipates movements in consumption. It works on a base of 32 million people who receive income (formal, public, informal, independent, retirees, pensioners and beneficiaries of social plans). In January it entered the maximum alert zone, due to the gap that was generated between the cost of living and the level of income.

The exercise carried out seeks to monitor the way in which these indicators are rearranged and to identify the risk factors that may require changes in economic policies.

From this first analysis it clearly emerges a risk signal in terms of the implicit value of the financial dollar, level of gap and potential delay of the real exchange rate.

Furthermore, it is necessary to closely monitor the level of recovery achieved in household purchasing powerbecause if this process is delayed, the impact on the level of activity can be very negative.

Chief Economist at MegaQM.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.