Let’s go to the companies’ results:

Apple delivered solid but unspectacular growth, narrowly beating estimates at $123.9 billion. iPhone sales remained stable and services continued to be a bright spot. While earnings per share beat expectations, investors may have been expecting more significant growth. Its shares fell more than 3% the next day.

Microsoft beat expectations with a massive 18% year-over-year increase in sales to $51.7 billion. Azure, the cloud computing powerhouse, drove the growth. It also showed a large increase in costs due to investment in Artificial Intelligence (AI), a situation that the market did not like. Its shares fell more than 2.5% the next day.

Google posted a 23% sales increase and 52% profit, exceeding expectations. The negative was that the Advertising sector was below expectations. Like Microsoft, it increased its AI investment costs. Let us remember that Microsoft and Google are in a “war” with each other over AI products. Its shares fell more than 7% the next day, a shocking figure.

Amazon surprised everyone with a stellar 19% increase in sales, exceeding forecasts. Both online sales and Amazon Web Services (AWS) saw solid growth, defying recession concerns. Profit margins improved significantly. The market celebrated its balance and shares rose more than 5% the next day.

Meta, the highlight of the week

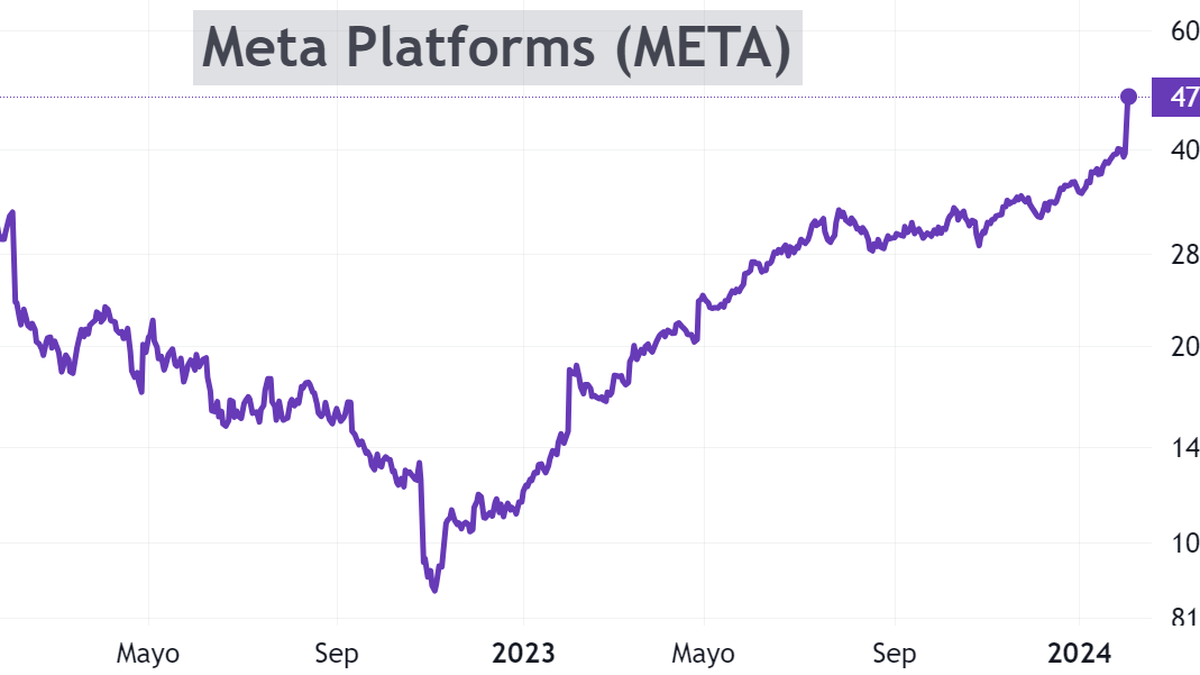

After facing challenges in recent quarters, Meta made a remarkable comeback. And this was demonstrated by his share price.

Let’s look at the graph:

Meta.png

From September 2021 to November 2022, its shares fell 77%. And from those levels it had a magnificent recovery of more than 400% and is comfortably at historical highs.

Meta (formerly Facebook) went through a tumultuous period between 2021 and 2023, seeing a dramatic drop in its shares. The company initially shifted its focus to the metaverse in 2021, neglecting its core apps and facing challenges with Apple’s privacy restrictions, intensifying competition, and the global economic impact.

However, towards the end of 2023, it implemented efficiency measures, focusing on key apps like Instagram and adjusting its advertising strategy. This change, combined with the uptick in user growth, marked a turning point. Although the metaverse is still in development, it has gained the interest of some investors. The third quarter of 2023 was very important: Meta clearly exceeded expectations and affirms its reconversion.

How did your balance sheet go? Sales increased 25% to $40.1 billion. Daily active users across all platforms increased and advertising performance improved significantly.

The company also announced its decision to distribute a dividend of 50 cents per share, for the first time in its history. In addition, it has approved a share buyback program for a total of US$50,000 M.

Zuckerberg highlighted Meta’s plans to focus on investment in artificial intelligence, stating that this will be the company’s main area of investment by 2024.

How did the market react? As anticipated in the previous graph, the market fell in love with the balance sheet results and projections. Meta shares rose more than 20% the next day and added more than $200 billion in market capitalization in just one wheel. This became the largest daily increase in history.

Note: The material contained in this note should NOT be interpreted under any circumstances as investment advice or a recommendation to buy or sell a particular asset. This content is for educational purposes only and represents the opinion of the author only. In all cases it is advisable to seek advice from a professional before investing.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.