From post-pandemic growth to stagflation

Europe’s economy was able to recover quickly from the pandemic crisis. By the end of 2021, activity had already returned to pre-Covid-19 levels.

But since then the European economy has entered a phase of stagflation with high inflation and zero growth. Last year the level of economic activity remained in line with that recorded at the end of 2021.

That is to say, in the last two years the European economy has not grown, widening the divergence with respect to the US. In effect, the American economy registers a new record and is already 15% above pre-Covid levels. while Europe has not grown for two years and is only 5% above the pre-pandemic level.

image.png

Another challenge for Europe has been added to economic stagnation. At the end of 2022, inflation had exceeded 10% year-on-year. On both sides of the Atlantic, the rise in prices is attributed to monetary issuance during the pandemic. Both the FED and the ECB doubled the assets on their balance sheets during the pandemic.

image.png

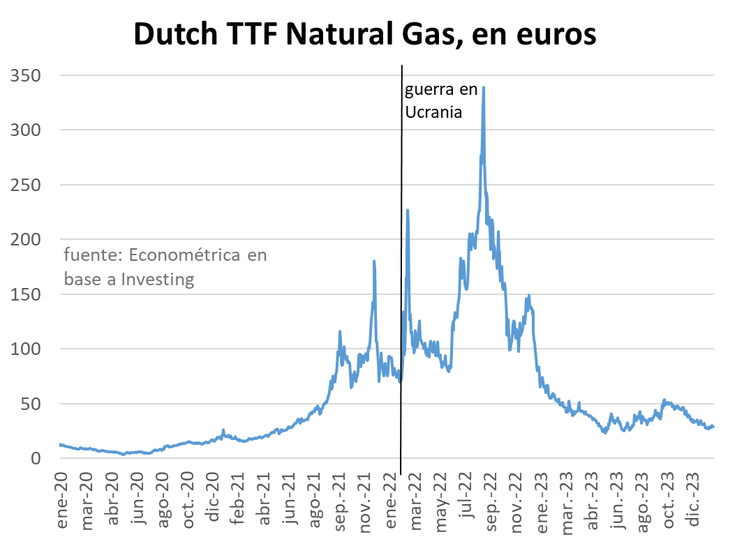

But in Europe the current high inflation environment has also been driven by adverse supply shocks related to rising energy prices.

Before the war in Ukraine, Europe imported 40% of its gas from Russia and, within a few months, the price of gas measured on the Amsterdam Stock Exchange had tripled.

image.png

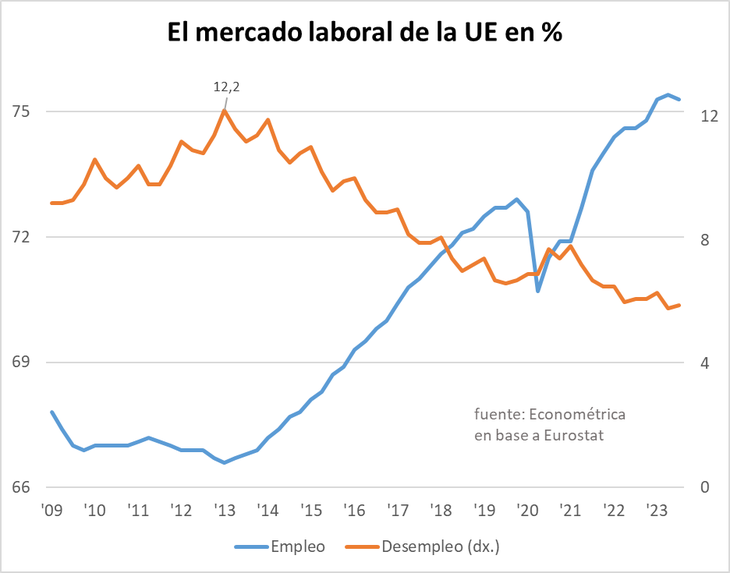

However, despite stagflation, the European Union’s labor market has shown remarkable resilience. Employment rates are at their highest and unemployment rates are at their lowest.

image.png

This can be explained by the conditions of a labor market that is suffering from the aging of the European population. The decrease in people of working age ends up increasing the employment rate.

It is also worth remembering that Europe’s labor market is more rigid than that of the US, and the effects of stagnation in the labor market are likely to appear with a delay.

The response of the policemonetary ethics and consequences

In recent months, inflation has fallen to its lowest level in two years. The main factors of disinflation have been the drop in energy prices and the monetary policy of the European Central Bank (ECB).

The price of gas is now lower than before the war. This is a diplomatic success for the EU, which has managed to replace Russian gas with gas imports from Africa and Azerbaijan and LNG from the United States and Qatar.

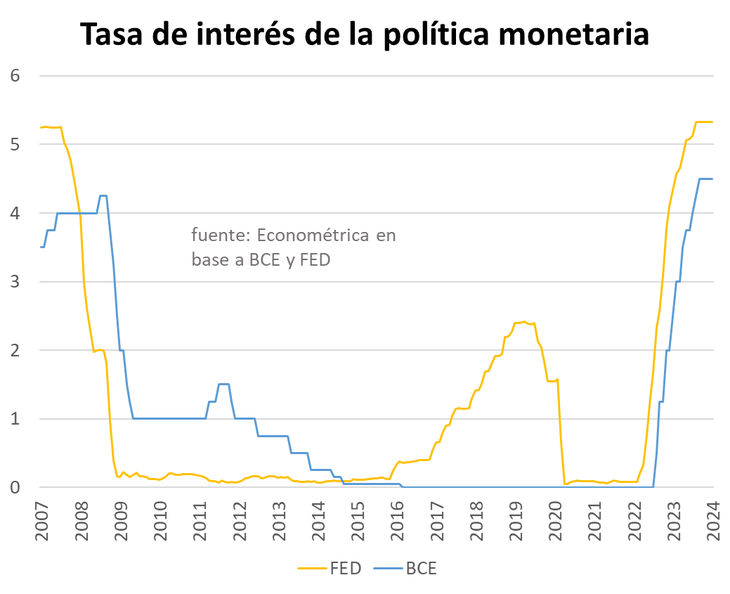

But inflation decreases mainly due to the effect of the ECB’s monetary adjustment. In July 2022, the ECB has started to increase interest rates. After 10 increases, the interest rate reached 4.5% in September 2023, marking the highest value established by the ECB.

image.png

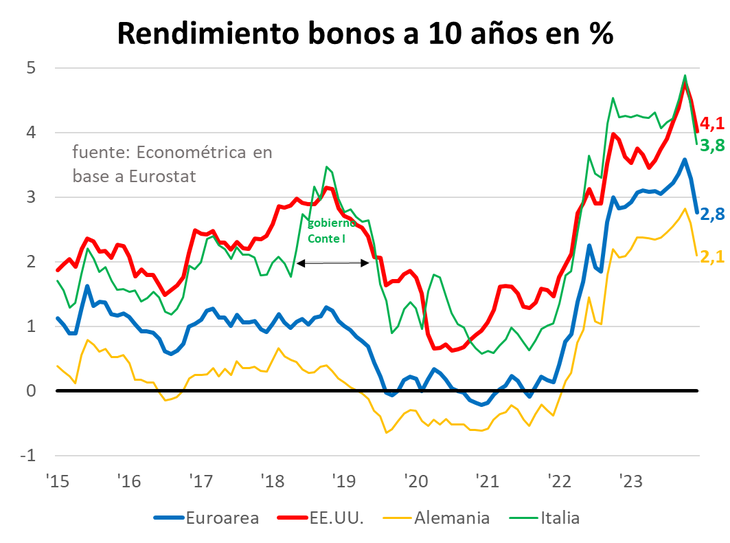

The increase in interest rates has generated three consequences. First, it has contained inflation, although it persists above 2%, which is the objective of the ECB’s monetary policy. Second, it has negatively affected the level of economic activity. Third, it has raised interest rates on public debts.

For years, Italy has been the country that pays the highest interest rates in the eurozone. Thanks to the support of the ECB, between 2020 and 2022, it paid an interest rate of 1% on its debt. But now its debt yields around 4%. For its part, Germany is the country that pays the least to take on debt. Two years ago it paid a negative interest rate on its debt, now more than 2%.

image.png

Fiscal policy

Considering the new financial environment, Italy should hurry to cut its fiscal deficit to pay less interest on a debt of 142% of GDP.

image.png

In contrast, Germany has a public debt that has climbed to 65% of GDP and yet it self-imposes greater fiscal austerity for this year.

In fact, in both 2023 and 2024, Italy, France and Spain recorded a fiscal deficit that exceeded 3% of GDP, which is the limit established by European treaties. Although the EU temporarily relaxed the deficit limit after the pandemic, this clause will be deactivated at the end of 2024.

image.png

But there is an evident paradox among the members of the European Union. While in Italy there is political pressure to borrow more despite its fiscal deficit of 4.4% of GDP and its debt of 142% of GDP, in Germany there are already laws that seek to reduce the deficit from 1.6% of GDP to zero , which ensures reducing its debt from 65% of GDP.

In 2009, Germany implemented a “debt brake” to limit the amount of structural debt that the government can take on.

According to the rules, this debt cannot exceed 0.35% of annual GDP. Recently, the Government attempted to use debt originally allocated for pandemic emergency funds, but not used, to finance other spending plans.

However, in November 2023 the constitutional court ruled that this was illegal. The impact of this decision significantly affected the Government as it now has to adjust to a budget reduction of 60 billion euros.

Outlook for 2024

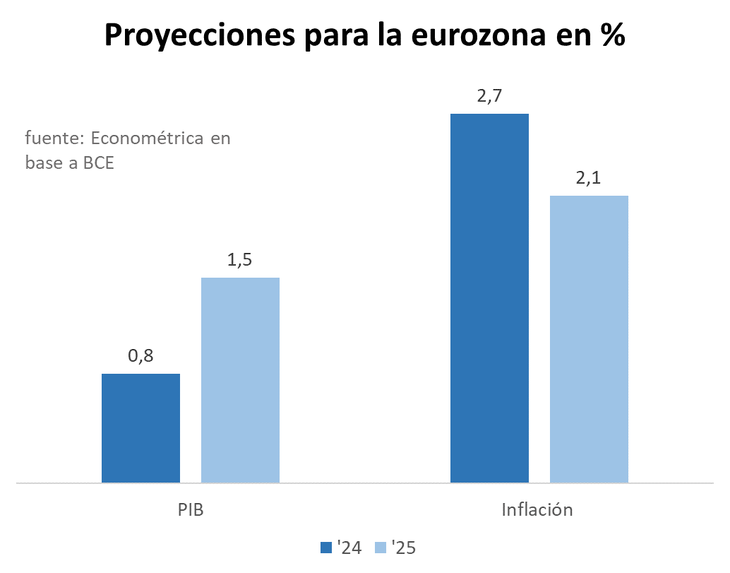

The economic outlook for 2024 continues to be surrounded by high uncertainty. The economy will remain weak due to tightening financing conditions, weak external demand and geopolitical risks. Furthermore, according to many analysts, the rise in interest rates has not yet fully impacted the economy because monetary policy operates with a lag of a few months.

In any case, the market believes that the ECB will soon begin to reduce interest rates as Europe is in a phase of disinflation. If so, the impact of tight financial conditions should gradually diminish.

In the first part of the year, it will be more relevant to monitor inflation data than economic activity data. Lower inflation increases the likelihood that the ECB will reduce interest rates, stimulating economic activity.

image.png

Elections

2024 will also be important because there will be a change in the political and regulatory landscape in the EU. Elections will be held in June to renew the key leaderships of the European Union: the Parliament, the Commission and the Council.

All countries will be immersed in electoral campaigns, which could lead to delaying fiscal adjustment plans and, possibly, the signing of the agreement with Mercosur until June.

Each country will then have to adapt to the new economic governance agreed at the end of 2023. Under the new scheme, each country will have to adjust public finances while the EU will adopt a differentiated approach towards each member state taking into account the heterogeneity of fiscal positions and public debt.

Each member state will have to develop a medium-term fiscal-structural plan, covering four or five years, committing to a fiscal trajectory that ensures a gradual and sustained reduction in debt.

In short, the EU will no longer tolerate the high deficits and debts of some countries. Once the pandemic and energy crisis is over, with high interest rates and new fiscal rules, there will be no more excuses to begin to clean up public finances to avoid a new crisis.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.