Let’s look at the historical graph:

After several attempts to exceed the $2,100 area (during 2020, 2022 and 2023), gold set a record this week, having even reached $2,185.

Gold broke its previous record, largely on rising expectations that the Federal Reserve will cut interest rates. Recent economic data hints at a possible slowdown and explains the big week for gold, which rose more than 5%.

What is the relationship between gold and interest rate?

Let’s look at the graph:

gold2.png

At first glance one can notice the inverse relationship that exists between gold and the interest rate. The reason behind this relationship is due to the incentives that investors have to choose between the two. If treasury bonds decline in yield (interest rate falls), investors will have more reasons to invest in gold, which does not earn interest.

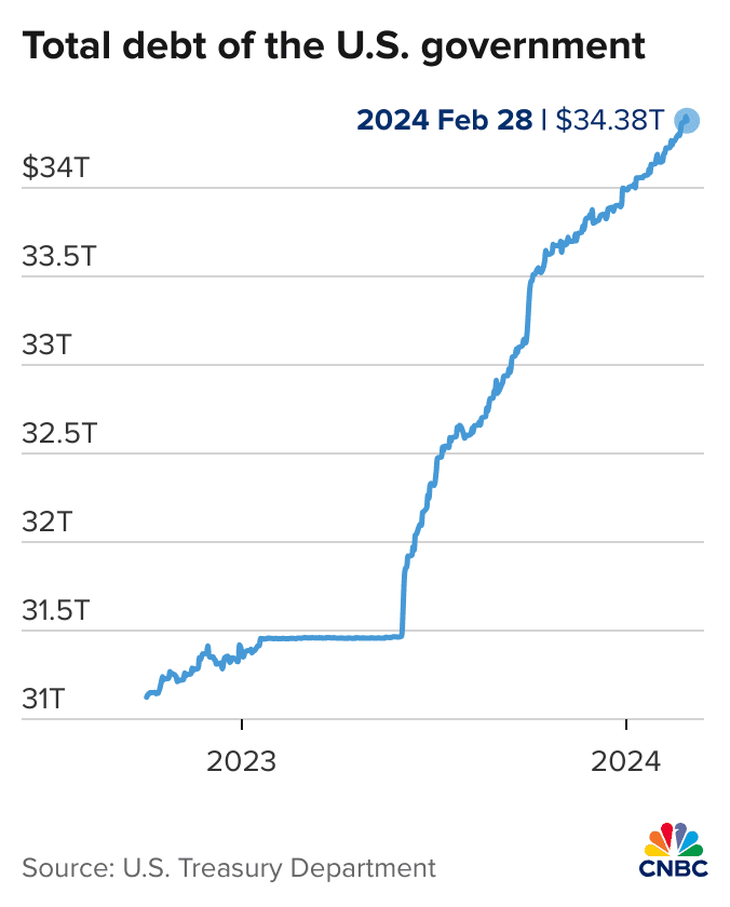

As if that were not enough, the US Treasury debt continues to rise sharply and even exceeded US$34 Trillion. Without solving the deficit, it seems that in order to repay the debt they would have to issue and monetize it. And that would be even more fuel for gold.

gold3.png

Nor can we ignore a very important factor, which is the acquisition of gold by central banks starting in 2022, especially by China, which drives demand. In fact, in 2022 central banks bought more tons than in the previous 55 years. This trend continued during 2023 and extended until 2024.

How to invest in gold?

There are 4 main ways:

- Physical gold: It is the least practical way to buy gold. It has very high spreads and storage costs.

- Gold ETFs: The best known is the SPDR Gold Shares, whose symbol is GLD. What this ETF does is invest in physical gold and can be purchased from any international broker.

- Gold Futures: It is the most efficient way but requires other complexity.

- Related companies: You can invest in gold mining companies individually or buy, for example, a mining ETF (GDX), which includes the main companies in the sector.

How high can gold go? It is difficult to imagine, but everything suggests that the path has been paved to continue having explosive upward movements.

Note: The material contained in this note should NOT be interpreted under any circumstances as investment advice or a recommendation to buy or sell a particular asset. This content is for educational purposes only and represents the opinion of the author only. In all cases it is advisable to seek advice from a professional before investing.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.