We are not in a change of times, we are in a time of changes, today according to our own estimates the peso is the big winner in terms of investments. We believe that this scenario can be reversed in the second semester, for now and in view of the arrival of the harvest, the peso is the big winner, and we expand on this note.

The expected inflation from our subjective projections to March 2025 would be 137.4% annually. Taking this definition, we went out to look for the investment that can yield the most.

The future dollar on average of all series has an effective rate of 128.4% per year, being below the expected inflation rate by 3.8% per year. This is telling us that the market does not expect the wholesale dollar to evolve above the inflation rate.

In this same table you will see that the consulting firm’s projection for one year is a devaluation of the wholesale dollar of 108.9% annually, which would be 12% below the expected inflation. You will see this when we compare the Bonds adjusted by U $S Linked (which would be wholesale dollar).

To finish with the instruments of the dollar area, we show our projection for the evolution of the CCL dollar in one year, and we see that it loses 26.1% compared to inflation. To make these numbers clear, we expect that the linked (wholesale) dollar as of March 2025 will be at $1,830 and the CCL dollar at $1,922.

Regarding instruments in pesos, we see how the traditional fixed term shows the highest positive interest rate compared to inflation, which stands at 20.7% annually, this makes economic agents get rid of dollars and are placed in pesos due to the enormous positive rate offered by the banks, which, by the way, is set by the Central Bank. As long as the rate is so positive, there is no chance that dollar bills will rise in price. UVA fixed terms and UVA Bonds show returns similar to inflation, but in no way like traditional fixed terms.

image.png

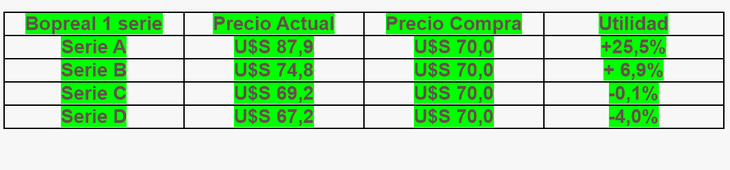

An issue that we had left pending is Bopreal, those who acquired the series were able to purchase it between US$65 and US$72, to carry out the case study we assume that investors bought it at US$70.

The Bopreal series one is April in 4 parts, the first two of 20% and the third and fourth of 30% each. Series A, B and C can be canceled early in 2025 for A, 2026 for B and 2027 for C. Series D expires in October 2027.

As the title was opened in 4 parts, here we show the current price, and its eventual usefulness if we assume that they were purchased at $70. As we can see from 20% of the investment the profit was double digits, from the second 20% 6.9% and we are shoemakers in series C and D, however, we are not far from the purchase prices. These securities are listed on MEP dollar.

We should also look at the possibility of arbitraging these securities versus sovereign bonds, for example, the AE38 bond closed on Friday US$43.8with which we could exchange the Bopreal series A for double the positions in AE38.

We did all this to show that Bopreal is a very good deal for those who invested in a security in dollars, and that it should be measured in dollars and not in pesos, since the fall in national currency is tied to the drop in the MEP dollar in the market.

We remember that when making investments we must not lose sight of the concept of diversification, that we must invest in dollars and pesos, Bopreal as an investment in dollars performed excellently.

image.png

Conclusions

- Argentina already lives in an environment of currency competition. We have 4 currencies linked to the dollar that we call the Wholesale Dollar, MEP, CCL and Blue, while on the peso side we have two currencies that are the traditional peso, and the peso adjusted for inflation.

- Bonds linked to the wholesale dollar called linked show negative rates.

- The bonds linked to the CCL dollar are corporate bonds of companies and yield on average rates between 8.0% and 10% annually.

- The bonds linked to the MEP dollar coexist in two large groups, those with support from the Central Bank yield between 11% and 20% annually for a maximum term of 3 years. While treasury bonds yield between 20% and 30% annually for terms of 6 to 14 years.

- The blue dollar is the popular Argentine joint, which today, projected for one year, yields, according to its own estimates, between 20% and 26% less than inflation.

- The traditional one-year fixed term yields a positive rate of 20.0% annually.

- The UVA fixed term yields 1.0% per year for 6 months, and bonds that adjust for inflation at higher positive rates can be obtained, but they expire in 2033. We believe that positive rates will soon be achieved in shorter terms.

- As long as the Central Bank does not modify the monetary policy rate and the fixed-term rate downwards, we believe that the dollar will be very calm, the competitions of financial instruments show us that the traditional fixed-term easily beats inflation. The dollar in this scenario is the one that loses the most.

- For companies and individuals, we must warn them that loans in pesos and in inflation-adjusted pesos are very expensive, while financing in dollars is much more attractive in this situation.

- The Government loves the positive interest rate against inflation, this is very good for savers, and very harmful for economic activity, which with a small capitalization structure can have severe problems in the months that follow, but we will address this in private reports.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.