Beyond the political uncertainty that determines the effective capacity to make economic policy and that influences the behavior of all agents, the exchange rate uncertainty of the dollar It is today one of the fundamental concerns on a strictly macroeconomic level.

If there is one certainty, it is that the “exchange anchor”, which the current administration also fell in love with, is going to become more flexible. Today the exchange rate is at values of December 12, 2023 at 563, that is, a little closer to the 400 at which the previous administration closed than the 820 after the December devaluation. If this dynamic continues in May, all the “competitiveness” achieved after the devaluation would be lost.

Certainly the IMF is promoting an exchange rate adjustment. Internally there is a convergence of expectations that, sooner rather than later, a modification will be made to the current scheme, while the market – through dollar futures contracts – expects an acceleration of the “crawling peg” of 5 %-6% until June reaching $1036 per dollar.

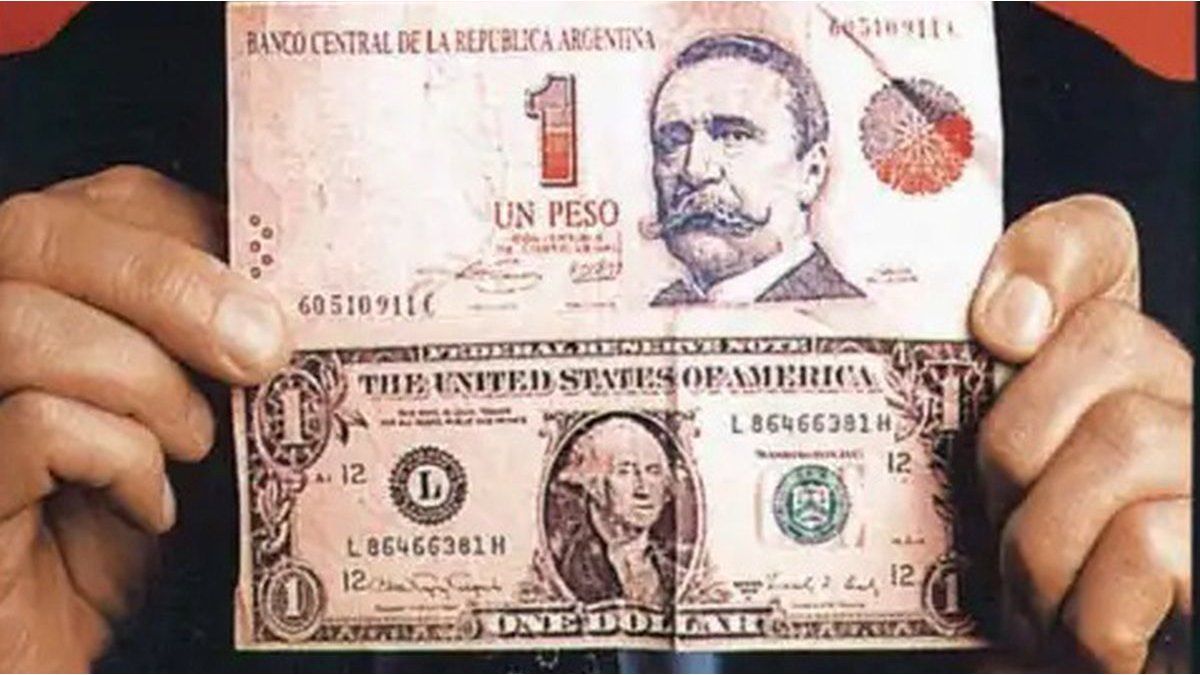

Dollar: can it return to 1 to 1?

This implies a devaluation of 20%, which results in an additional appreciation of 12.3% of the real exchange rate. The market expectations survey (REM) projects the dollar at $1,112 in June, a devaluation of 30% with a lower real appreciation (only 5.4%).

In the negotiation with the IMF, it will be key to see how “advanced” or “behind” the exchange rate is. The current exchange rate is 6% above that of the end of December 2015. The current exporting dollar at $894 is at levels similar to the 1.4 of the exit from convertibility.

pesoss-dollar-dolarizacion.jpg

Depositphotos

A dollar Like the future to June at $1036, it is in line with the current mep dollar and the goods import dollar. An exchange rate like the $1,112 REM is somewhat lower than the $60 dollar at the end of August 2019.

Of course, historical comparison does not capture changing conjunctural and structural situations. The million-dollar question is what would be an “equilibrium exchange rate” given the dynamics of supply and demand in the foreign exchange market and future inflation, which is co-determined with the exchange rate given the degree of dollarization of the Argentine economy. .

The historical experience of our country shows that more than one type of change is needed. The dollar needed by regional economies is not the same as the dollar for importing critical inputs, which can be done, as the “world” does with a unified exchange rate and generating multiple exchange rates through fiscal policy.

It must be remembered that the bulk of the exchange restrictions still remain in place and that import payments remain limited by the schedule. A total opening of the “stocks” in June would generate a high demand for foreign currency, although Bopreals are generated for profits pending remission abroad among other pending payments from transnational companies that limit the demand for reserves.

Milei Dollars Dollarization.jpg

We are likely to see gradual market liberalization between June and December, with a schedule announced within the framework of an agreement with the IMF that increases reserves. The magnitude of the disbursements with the IMF, other International Organizations and income from the sale of assets will determine the equilibrium exchange rate and the sustainability of the exchange rate with a IMF that will not accept a further delay in the exchange rate.

In the short term, even the announcement of a strict monetary rule and pro-market monetary and fiscal structural changes, in addition to privatizations, may not be enough to avoid exchange pressure at the beginning of liberalization. as happened at the beginning of convertibility in 1991, when the BCRA had to intervene strongly to defend the price of 10,000 australes.

The international context will have to be closely monitored, including commodity prices, international interest rates and the evolution of the climate, outside of political developments.

Speaking of convertibility, it is interesting to note that President Milei quantified the amount necessary to get out of the trap at $15 billion.

A President who wants to implement a currency competition and dollarization in the medium term and that values the 90s.

dollar-pesoss-1000.jpg

Argentine News

Let’s do an exercise to project the future exchange rate if the Argentine economy receives that injection of foreign currency. A convertibility that includes not only monetary circulation and bank deposits in the BCRA like that of the 90s, but also repos, LELIQs and other liabilities could be carried out with the current gross reserves at $ 1,551. With an additional US$15 billion, a “plus convertibility” could be made at $1013 per dollar.

The figure he announced Milei and the policy of reducing in any way the monetary liabilities in pesos of the Central Bank (leaving aside the debt in BOPREAL and the thorny issue of “puts”) seems to indicate the desire to impose some monetary rule like that of the original Convertibility.

With a little additional effort, the relationship could be $1000 to $1. Three zeros are lowered to the currency on January 1, 2025 and we return to 1 to 1, which would allow a drop in inflation and a recovery in the short term. economy, after the second quarter of 2025, very appropriate timing to successfully face next year’s legislative elections.

It is true that in the current gross reserves -as established in 1991 by the monetary rule- the swap with China is accounted for. Topic to negotiate. Furthermore, the IMF hardly supports a fixed exchange rate, but a floating convertibility could be established, based on a variable issuance rule and/or adjusted by a basket of currencies that is more flexible.

In the imagination of Milei Instead of devaluing, internal prices could be rolled back (Cavallo did something like this with partial success in 1991)and this is consistent with the “leg” of the State that intervened and summoned businessmen to “exhort” them to lower prices and maintain an eventual 1 to 1 at least for a time.

The dreamed dollarization that cooled Gita Gopinath on her recent visit to Buenos Aires seems further away. Today, dollarizing the M3 could be done at $2,182 per dollar and at $1,426 with increased gross reserves.

In Argentina there is an excessive ideologization of the instruments, but it is clear that the exchange anchor or a “dirty” float can be a variant of the Austrian model, with “vintage” touches from Cordoba and Rioja, outside of the Santa Cruz touches that it is exhibiting. The topic is the future sustainability of a rigid monetary and fiscal rule, a topic that will be the subject of a future article.

Lic. Alejandro Vanoli

Former President of the Central Bank

Director of Synthesis

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.