Javier Milei (JM): …The dollar is just another price. It is the price of the United States currency. What happens is that, since it is a financial asset, it goes up first. I mean, all that pass-through stuff is atrocious nonsense.

ET: The transfer at prices…

J.M.: Exactly. It implies ignoring the foundations of the theory of value. It implies ignoring Menger’s principle of imputation. I’m not going to get into all the things that imply brutality in the precariousness of the analysis of many Argentine economists, I would tell you about the vast majority. What you see in the dollar is an early indicator of what is happening to you with prices because it is a financial asset so it comes first. In that sense, it seems to me that what is happening with the dollar is remarkable because what it is telling you is, given that it is the currency that appreciated the most in the world and that it fell like a piano, that would be showing you that from now on, at some point, inflation is going to collapse like a piano… That is going to happen at some point.

ET: If I ask him when, he’s going to tell me that I’m not a magician…

J.M.: No, because time belongs to the creator.

It is even disturbing to have to clarify that the dollar It is not simply another price with an anticipatory movement. It is by far the variable with the most influence on the functioning of the local market.

The episodes of strong inflationary acceleration and subsequent recession have been preceded by un rise of the dollar and, in the rare moments in which the US currency lost value significantly compared to the peso, they were transitory situations and did not result in inflation “collapsing like a piano.”

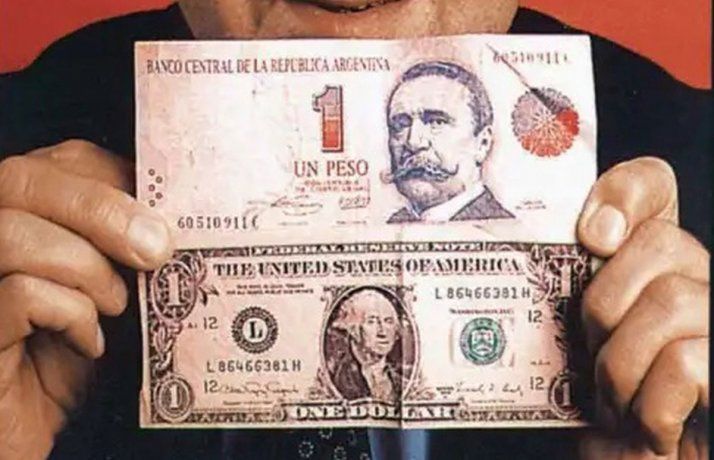

Javier Milei dollars.jpg

The Nationalist

The only exception was convertibility which, with formidable international financial assistance and the massive sale of public companies, generated fertile ground for a colossal speculative financial business like the one that exists today. Milei intends to replicate.

Firms form their prices by observing the dollar. It is a structural determinant of the country’s development possibilities. And the drama of our economy is that the genuine generation of dollars or currencies (via exports) tends to be insufficient to sustain its growth, due to the weak historical capacity of the governments in power to direct these currencies to the requirements of productive development.

It is not even necessary to go back in time to find multiple traumatic events when the price of the dollar varied substantially. What is not so recurring are the significant drops in its value in Argentina, such as the last month and a half, but you do not have to go back too far to record history. It usually happens after mega devaluations, as a result of the well-known overshootings or, in Spanish, reactions from the financial markets.

The last occasion of decrease in the price of the dollar coincided with the previous beginning of a neoliberal cycle, after the presidential inauguration of Mauricio Macri. Its official price had risen from $9.76 on the day of the swearing-in to $16.09 on March 1, 2016 and then fell to $14.09 on June 7 of the same year, which implied a drop of 12.4% .

Luis Caputo Javier Milei

With a inflation on the rise – it had reached 41% in that year – the delay in the real exchange rate caused a growing loss of competitiveness aggravated by other policies also disregarding productive development, such as trade liberalization, sharp tariff increases and the loss of access to credit on favorable conditions for SMEs.

Thus, the economy became increasingly dependent on external debt and, when the current account deficit It was no longer possible to continue financing abroad – in the first three years of that government it aimed to accumulate the equivalent of 14% of the GDP-, the devaluation and recession They became inevitable with irreparable consequences for the productive and social fabric of the country.

Although the current scenario is different because the official value of the US currency continues to rise slightly and what has fallen are the parallel quotes, the comparison makes sense because the level of inflation is considerably higher and, furthermore, these alternative markets have gained good preponderance in recent years in price formation.

Does the INDEC overestimate inflation by more than 30%?

Unfortunately, the facts do not fit the speculations of Milei and, given the first data for March that reveal that inflation is rising again, a second episode of ruinous madness seems to have triggered it.

Now on a practical level and presented in another interview given to the same medium four days later. Milei said that the inflation data reported by the INDEC It does not fall faster because the official index does not capture the effect of promotions subject to a minimum number of units purchased (2×1, 3×2 or a high percentage discount on the purchase of a second unit). He maintained that, if it were not for these promotions, the index from last February would have been in single digits.

Inflation Inflation Prices Consumer Supermarkets

Mariano Fuchila

That deduction looks like a desperate and childish attempt to want to be right at any cost. But he is wrong for several reasons: The discount scheme referred to is not newis concentrated in supermarkets (they represent around 25% of the sales of promoted products), the portion of promoted goods at the same time is marginal in relation to the universe of goods and services measured in the index and the depression of income means that many Families can no longer access these promotions.

What is true is that these types of incentives have increased in the last two months, but their impact is insignificant. In fact, it is more likely that the return of VAT on the products of the basic food basket that the previous government had resolved has had a greater impact.

What should concern the President when it comes to promotions are the signals it provides about two degrading phenomena that the model entails. The first is its regressive income distribution effect. The growth of this promotional scheme is an indication. It emerges as a defensive strategy of supermarkets, originated not only because the drop in consumption exceeds expectations and businesses accumulate perishable products, but because this sales channel is losing market share.

The impoverishment of the population means that more and more families can only go to local stores to purchase the minimum and essential things. So the supermarkets, guided by the invisible hand of the market as they like Mileiseek to seduce consumers with a certain financial capacity.

dollar peso convertibility.jpg

At the same time, the products promoted are not the most basic and popularly demanded foods, such as meat, vegetables, fruits, flour, rice, salt, oil, sugar or grass. Thus, as happens with card discounts, consumers with greater purchasing power can access more advantageous purchasing conditions and inequality increases. Furthermore, in this kind of squid game imposed by the savage rules of deregulated markets, what rises in price with the greatest intensity is the most essential for households.

The second phenomenon that can be glimpsed under the promotional strategy of supermarkets, derived from the current exclusionary model, is the deterioration of the competitiveness of the economy. In a context of increasing fixed costs, businesses in general need more sales scale to prorate their growing expenses and the fixed cost of a supermarket is enormous.

The case of these businesses is just an example, the economy as a whole loses competitive capacity due to the brutal drop in consumption, which is particularly harmful due to its delicate health. Will the distributive regressivity and competitive erosion of the model be seen by Milei?

We are facing a big problem when the President is unable to understand the country he governs, trapped in the rigidity of a theoretical framework. Due to his expressions and policies that reveal his arrogance and social insensitivity, the increase in inequality should not affect him.

However, if it wants to maintain power, it should address the erosion of competitiveness that its measures cause and that its capricious manifestations unrelated to reality undermine its credibility, when the levels of inequality and social conflict are already alarming and anticipate a chaotic end.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.