The price of cocoa shot up, in the midst of a situation of shortage of supply. What is happening? It really is a fascinating story.

I want to start with the following graph:

It is not a cryptocurrency, it is the price of cocoa. This year it rose 106% and has accumulated, since 2023, a return of 235%.

How do you explain such an explosion? Due to the great global shortage of cocoa beans, which occurred during the last two years and this trend is expected to continue.

The most important countries in global cocoa production, which together represent 75% of total production, are Ivory Coast, Ghana, Cameroon and Nigeria. Major cocoa processing plants in Africa have stopped or reduced activity due to financial difficulties in purchasing cocoa beans, which is creating a shortage in global supply.

This is causing an increase in prices and, therefore, in chocolate worldwide. The situation is aggravated due to a number of factors, including poor weather conditions in major regions.

Currently, the cocoa bean deficit is the most important in history, exceeding 300,000 tons.

cocoa2.png

As a consequence, both processors and chocolate companies will have to use cocoa reserves to fully satisfy their needs.

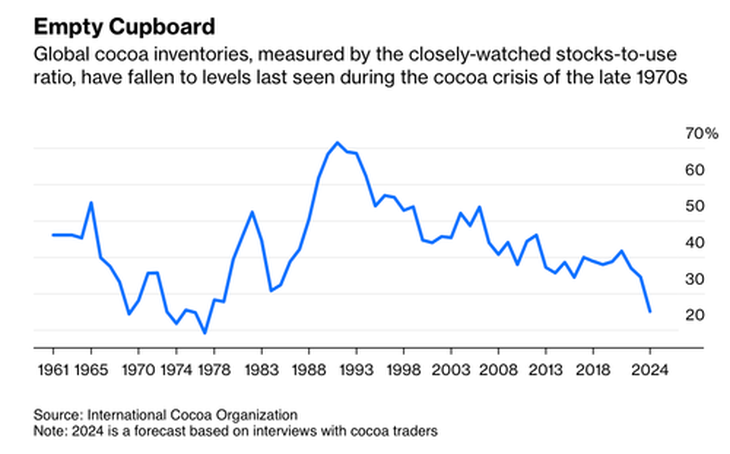

Global cocoa stocks are expected to decline to their lowest level in 45 years by the end of the season, according to projections from the International Cocoa Organization.

cocoa3.png

Chocolate manufacturers have felt the impact of rising cocoa prices and have had to adjust their production processes accordingly. Some have chosen to reduce the amount of cocoa in their products, while others have temporarily suspended operations.

This phenomenon is due to the increasing prices of cocoa beans, which have reached levels that some companies cannot afford.

To balance prices, a significant reduction in demand or a recovery in supply would be needed, which could take a long time considering the current situation.

Note: The material contained in this note should NOT be interpreted under any circumstances as investment advice or a recommendation to buy or sell a particular asset. This content is for educational purposes only and represents the opinion of the author only. In all cases it is advisable to seek advice from a professional before investing.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.