He Government continues to maintain the rhythm of crawl to the 2%, even though inflation rates have been falling and may surprise for the better in the next measurements, causing a loss of ostensible currency competitiveness that tends to be increasingly risky. To maintain this assessment scheme, the Executive clings to an implicit axiom: “As long as the BCRA continues to buy dollars, the rate of devaluation of the exchange rate will not be touched.”

This rhetoric ignores countless restrictions that prevent the exchange rate from being truly free. (both official and financial). There is no true market price, while the restrictions to operate in the Free Exchange Market (MLC) and in the financial markets are quite similar to those of the interventionism of the previous Government.

Under this scheme, a megadevaluation first occurred and then proceeded to allow a deep appreciation of the exchange rate. Having allowed such an appreciation to occur with officials who staunchly defend this process should question whether the resulting “overshooting” was truly necessary, thinking about the social costs it entailed or if it was simply an overreaction of economic policy.

Dollar: four antecedents of peso devaluations

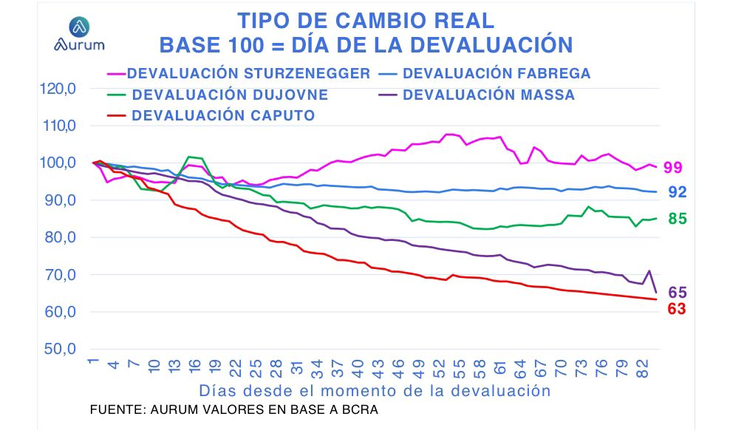

In comparative terms with other processes of discrete jumps in the exchange rate decided by politics (and not by the market as happened in April 2018 and August 2019 with free exchange rates) followed by appreciation processes, we find four antecedents, only 2 of them with a market released while the other 2 episodes remained in stocks in the same way as today:

- That of Fábrega in 2014 (without lifting the stocks)

- The one from December 2015 of Sturzenegger (lifting the stocks)

- That of Dujovne in 2018 when Caputo had to resign for using IMF currencies to intervene (with a free exchange market)

- Massa’s 2023 one (without lifting the stocks)

In the same period of time, since each of the devaluations, Today’s real exchange rate is already below the first two in 2014 and 2018 (that is, it is a less competitive weight than on those two occasions), but it is still higher (a more competitive weight) than after the appreciation following the devaluation of Massa.

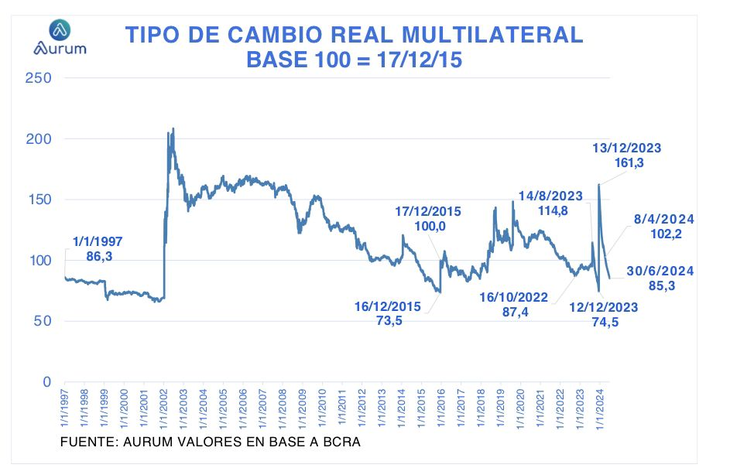

Today, it is located just above the level that the real exchange rate showed these days in April 2016, after the opening of the stocks with Sturzenegger in December 2015. It is true thatl use of the dollar blend and the PAIS tax serve as anabolics, but there are commitments with the IMF to withdraw these multiple exchange rate mechanisms in June and December respectively.

The fact of having devalued so strongly to start with such a high real exchange rate in December 2023 may lead to relativizing the speed of the peso appreciation process from the moment of devaluation. When we normalize the series taking the real exchange rate on the day of the devaluation as a base of 100, this becomes more evident.

image.png

image.png

Although the real exchange rate is still higher than when Massa or Sturzenegger devalued when lifting the stocks in 2015, The speed with which the gain in competitiveness disappeared has been the greatest on this occasion. This leads to cast doubt on the possibility of moving forward with a broad and forceful opening of the exchange rate.

Even more, We see that if the crawling peg continues at this rate with the expected inflation for the coming months, In a short time we will have a real exchange rate very similar to that of convertibility, which in a totally free exchange market we consider very risky.

image.png

As this process consolidates, we see with caution about the “sustainability” of this appreciation process that continues to be leveraged on the crutches of an extremely restrictive trap.

Head of Research at Aurum Valores

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.