In a more volatile economic context, with a drop in the value of the dollar since December and greater uncertainty about how activity will develop, it is necessary to rethink our way of investing. Rethinking we find the price of an asset that manages to increase its value.

This scenario opens the debate about what type of assets it is advisable to have in the portfolio and whether putting “all our eggs” in the same basket no longer goes against our investment portfolio or our subsistence portfolio.

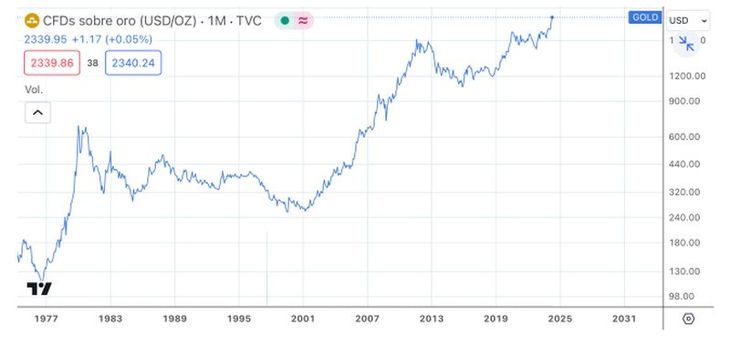

Gold became the star of raw materials for three months. While the dollar has been losing value even against the peso. In a crisis scenario it is important to diversify so as not to lose so much; and seek to balance the profit-risk year after year so as not to encounter moments of low profitability or even loss of capital from our savings.

gold dollar reserves.jpg

The scenario of local crisis and a possible but distant recovery of income in Argentina makes diversification necessary without stopping looking abroad where raw materials come with falling prices in the case of corn, wheat and soybeans but oil and gold with increases, the latter with a record level in history. The situation is more tense in equities, if we look at the fact that the stock market has been hitting highs for more than a year and the bond market has reached higher interest rate levels than two years ago. This translates into a greater probability of a fall in the price of shares, as technology companies have already been experiencing, and a rise in the cost of borrowing for the State.

For Argentina, we must differentiate the dynamics from optimal and/or stagnation simply by looking at the evolution of the real exchange rate. A strong appreciation of the real exchange rate can generate problems of investment income and inability to export industrial origin (higher added value). Although not like this, the problem with exports of primary origin; especially those linked to energy and food.

With twin surpluses that are not yet consolidated and with monetary issuance at the rate it has been since December, the economy will have signs of growth due to exports and investments in the most productive sectors in generating dollars. But these are not enough to improve the exportable balance, recover the assets of the Central Bank and its firepower to intervene in the exchange market and thus unify it. Or perhaps for a short period of time if consumption continues to contract. Which translates to less import.

This is a scenario that favors the adjustment situation that has occurred in the last four months of nominal exchange appreciation if the conditions are met with:

- So that the appreciation of the real exchange rate continues with a fall in consumption and public spending along with positive external indicators: fall in country risk, agreement with the IMF and improvement in public securities. This is the first condition for the model to succeed and be supported by citizens in 2025.

- Lower interest rate in real terms, which has a tacit correspondence with the inflation rate if it slows down to 2021 levels. This would mean reaching the midterm elections with inflation most likely above 100% annually but with strong consumer credit.

- Inflation must go down no matter what and the economic team knows it. But for that to happen, economic activity must continue to decline with a strong social cost that will prevent the poverty rate from falling rapidly in the next 4 years.

With these 3 conditions we could say that in nominal terms the exchange rate should continue on a path of loss of purchasing power. A real and nominal appreciation. Which indicates a strength of the peso at the cost of a drop in the level of activity and against holders of physical dollars.

COLUMA ROA.jpg

In this direction, it is necessary to clarify that the dollar will no longer be a profitable investment, something that it stopped being more than a year ago. For that reason, given the economic situation in Argentina, recovery is slower than expected. And adding, the global economic situation and the perspectives that exist in domestic politics. They have made it seem like an asset that has become taken into account again after a decade of maintaining its price. Gold has been gaining more than 35% annually in dollars above any return on the S&P 500 average.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.