For the president Javier Milei the Convertibility It was “the most successful program in the Argentine economy.” Possibly, that is the main reason why their policies have great similarities and the same sectors benefited and harmed. However, lacking the financial resources of that process, a much less favorable international context, fragile internal political support and starting from a well not as deep as that of the hyperinflation crisis of the late 1980s, it must settle for a model with similar characteristics but degraded in relation to that of the nineties.

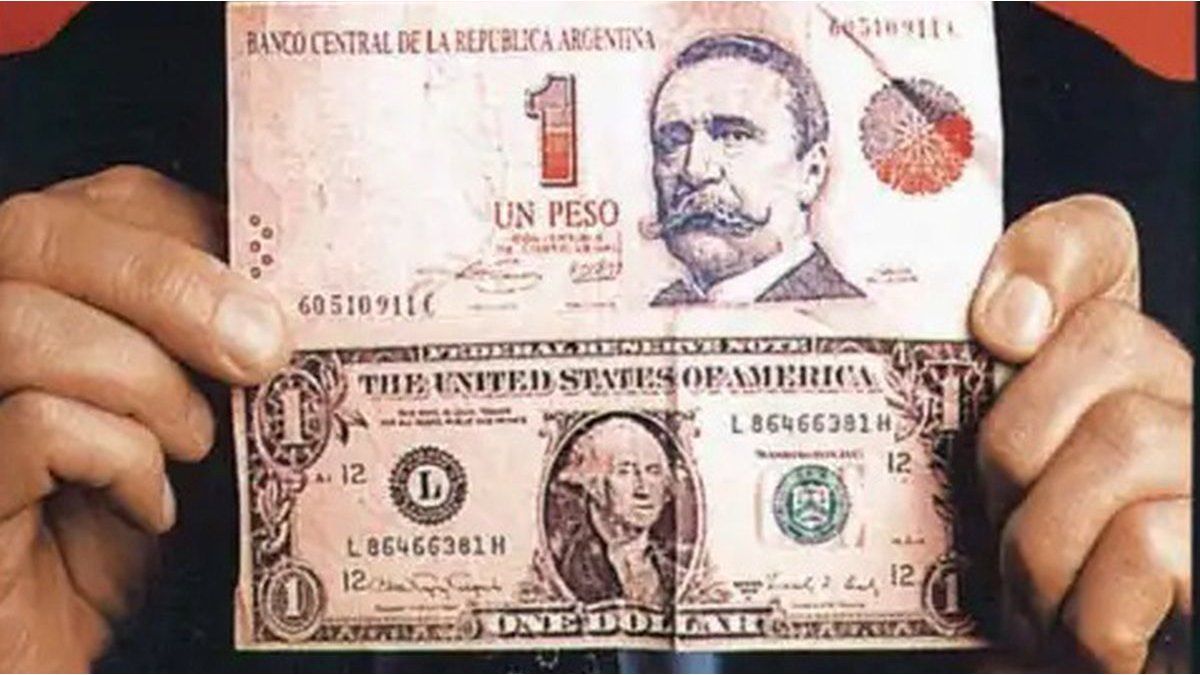

The limitations he faces collide with his great desire, as he insistently stated during the campaign: the dollarization. That path, unlike what has been applied until now, would have been superior to that of Convertibility in terms of a coveted effect, eliminating the risk of devaluation, resulting in a much more rigid and even dependent scheme on the United States. But the foreseeable restrictions force the government to end up having to implement a diluted and less ambitious policy platform with impacts of varying intensity.

The decrease of the inflation achieved during the 1 to 1 was by far the most important in all of history for a Latin American country. In April 1992, twelve months into the program, the result was an interannual inflation of 25%, while in April 1991 it had been 267% and in April 1990 it had reached 16,904%, the second highest level. of national history after the peak of March 1990 when it had reached 20,263%. And, for a better comparison with the current period of disinflation, since the first month of the regime (April 1991), the monthly CPI had fallen to 5.5% from 11% the previous month. And, in the following three months, it remained around 3%. Then it oscillated between 1% and 2% until May 1993 and, starting in June of that year, it definitively broke the 1% floor until the explosion of the model in December 2001.

These brilliant results were based on the credibility provided by the currency board. But there were also other very relevant policies in fiscal matters, debt, external relations and attraction of foreign investments, where Milei seeks to arrange the pieces in a similar sense but, unfortunately for its aspirations, it is once again in a range of inferiority, as if its model was a second or third brand of Convertibility.

A column where this government has a considerably narrower margin in relation to Menem’s is that of privatizations of public companies. Therefore, with a reduced asset endowment due to previous privatizations and without being able to access resources for the sale of public assets that remain and are very attractive such as YPF and Banco Nación and Nación Seguros, the harshness of the adjustment that Milei applies must be much greater to show guarantees of payment of public debt and thus feed financial business.

Just as Convertibility was the master key for a government in Argentina to recover credibility given that it ensured by law that it could not finance its fiscal deficit with monetary emission, the chainsaw and the monetary adjustment of the current government are the expression of the same need. Raising the flag of fiscal solvency led Milei to abruptly go against the grain of his liberal discourse with the increase in the rate of the COUNTRY Tax on imports of goods. That is the most difficult thorn to remove (by a wide margin it is the resource that grows most rapidly and last April it represented 5.9% of total tax collection).

The limited external debt capacity also condemns the model to being, at best, a second brand of Convertibility. The current government even had to resort to mechanisms that border on coercive to take on debt, such as the BOPREAL, which was the only mechanism granted to importers to finance their business or the discussed 2038 bond for the payment of public debt to energy companies.

Regarding external relations, although carnal relations with the United States re-emerge, this government also lacks the great boost to trade that since 1991 was the creation of MERCOSUR. Our regional trade bloc generated great containment for powerful sectors of the industry, especially the food, metallurgical and automotive sectors, which, otherwise, would have suffered like the vast majority of industrial SMEs from more atomized sectors that had to abruptly face competition. external in a scenario of exchange delay and increase in public service rates.

Of course, the exchange rate policy is the most eloquent symbol of the second-rate model into which Milei had to fall with a scheduled depreciation of 2% monthly, which is insufficient as a nominal anchor to appease the inflationary process. Not only because the exchange rate continues to rise, but particularly because it fails to convince price makers that in the short or medium term it will have to be changed sharply again to balance external accounts with competitiveness that continues to deteriorate progressively.

Therefore, to sustain the policy program and the inflationary deceleration, an influx of external capital in any form is essential. These capitals are like water in the desert in this model to sustain the rule of increasing exchange rate delay. They would provide temporary containment and would give rise to the tradable productive sector having to bear an even higher cost, with a subsequent explosion of the model later but also more powerful.

In the interim, large non-tradable businesses, basically in the financial sector and companies that provide privatized public services, such as Convertibility, shine for their profitability in hard currency. The desperation to attract capital was expressed in the Large Investment Incentive Regime (RIGI), misaligned with international parameters in relation to the benefits granted to investors and without commitments to the development of local suppliers. This offer once again highlighted the government’s disinterest in the impact of its policies on the productive structure of our country in terms of its concentration, foreignization, disintegration of its network of SMEs and the capacity for autonomous technological development. It is a crazy cry for the need for dollars to enter the country.

The fundamental pillar of the 1990s model was the recovery of the credibility of the flourishing financial markets with the United States, which had consolidated itself as the great global power, after the fall of the Berlin Wall. In that scenario, the country had plunged into its worst crisis in its history up to that point. The main issue was the poor reputation of governments for managing monetary policy and then the currency board emerged, with the support of the IMF and the financial world, as the great lever to regain confidence.

The result, measured based on the reduction of inflation, the main macroeconomic problem that the country suffered before its application, reflects astonishing effectiveness. However, the outcome of the process also revealed that the recipe was unsustainable and had a very high social and productive cost. In fact, until now, that model ended up causing the worst socioeconomic crisis in our history. It seems that Milei cared little about the costs assumed at that time and tries to employ quite similar policies, but lacking the international support and resources that could be raised in the 1990s. We repeat the experience but with a clearly more flaccid platform. A poor consolation in the midst of the disaster is that, without these supports, this new chapter will be much less lasting.

Economist, advisor to companies and industrial chambers and university professor

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.