Junk companies are taking advantage of the current financial situation to issue bonds at alarming levels, fueled by a market that seems to ignore the risks. I advance you: It is not advisable to buy junk bonds now.

The insatiable demand for US corporate bonds, especially high-yield (or junk) bonds, has reached disturbing levels. This trend, which affects the entire economy except the commercial real estate sector, reflects an extreme easing of financial conditions, despite the Federal Reserve’s efforts to tighten them.

In the first week of May, junk-rated companies have issued more than USD 14B in new bonds, the highest volume since the end of 2021.

Let’s remember the definition of a junk (or high-yield) bond: a fixed-income security that has a high risk of default and that in return has to pay a higher interest rate.

Bankers and investors signal a growing belief that U.S. interest rates will not fall sharply this year. As a result, companies are seeking financing now to avoid facing higher borrowing costs in the future.

In the first quarter of 2024, the issuance of corporate bonds of all types has increased by 38% compared to the same quarter of the previous year, reaching USD 752,000M.

Of these, junk bond issuance has almost doubled. These bonds, rated BB+ or lower, are seeing unusually high demand, which could be indicating reckless optimism.

- Investment grade: USD 635,000M, an increase of 31%

- Junk bonds: USD 117,000M, an increase of 95%

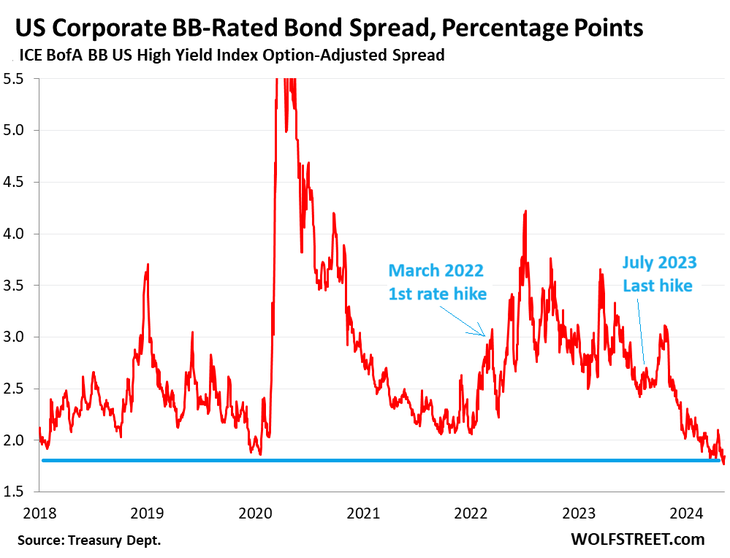

Hopes for the Federal Reserve to cut rates are fading, yet spreads between junk bonds and Treasury securities (spreads) remain alarmingly low. Currently, it has fallen to just 1.85 percentage points, the lowest level since 2007, just before the financial crisis.

This means that investors are taking on large credit risks for minimal compensation. If one wanted to make a rate without assuming those risks, one could buy short Treasury bonds:

rate usa1.png

Let us remember that after three months of bad inflation data, the debate on rate increases has resurfaced. However, the spread between junk bonds and Treasury bonds practically did not move:

rate usa2.png

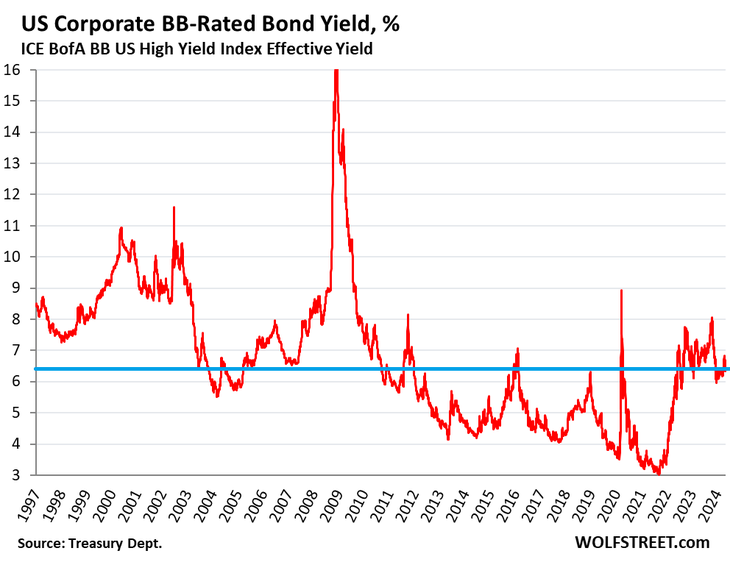

This has led companies to rush to issue bonds. BB bonds are currently yielding 6.4%, the same as in June 2022, even though the Fed has raised rates significantly since then.

In August 2021, BB bonds yielded 3.2%. In June 2022, with the Fed raising rates to 1.75%, the yield rose to 6.4%. Now, with Fed rates at 5.5%, BB yields remain at 6.4%.

This indicates that even though the Fed has raised rates by 5.25 percentage points since August 2021, BB yields have risen only 3.2 percentage points. This low performance is worrying compared to other years:

rate usa3.png

Junk-rated companies are issuing bonds at impressive speed, taking advantage of current yields before financing costs rise.

Investors, for their part, are betting that the Federal Reserve will eventually cut rates, which could lead to an increase in the price of these bonds. This strategy, however, is fraught with risks.

The current situation is very similar to what happened before the 2008 financial crisis, when people underestimated the risks and enthusiasm in the markets that led to an economic disaster. Investors should be extremely cautious in the current situation, as the context for buying junk bonds is far from friendly.

Why is it not a good idea to buy junk bonds? Basically they do not offer a good risk/return ratio. It is a much better idea to buy a short US Treasury bond and lock in a yield greater than 5% than to buy a junk bond, with all the risk that entails, for just a little more yield. To be careful.

Note: The material contained in this note should NOT be interpreted under any circumstances as investment advice or a recommendation to buy or sell a particular asset. This content is for educational purposes only and represents the opinion of the author only. In all cases it is advisable to seek advice from a professional before investing.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.