From the National Economy Research Center (CIEN) we understand that the economic policy of Javier Milei and Luis Caputo Since December, it has implemented three interrelated anchors: recession, exchange rate appreciation and reduction in money creation. In this note we address the first two.

The economic recession, despite the slight recoveries in some real variables in April, it is today a fact that is verified in the high interannual falls in activity that persist. In other words, for now there is no V-shaped recovery, in any case the trajectory followed by the activity indicators is more similar to those of a letter L or Nike pipe. This phenomenon is functional for the government because it contributes to reducing inflation: if businesses are not selling, there are fewer incentives to raise prices compared to a context of economic recovery.

Interannual variation of the manufacturing industry, construction, RIPTE and EMAE

image.png

Source: INDEC and Ministry of Human Capital

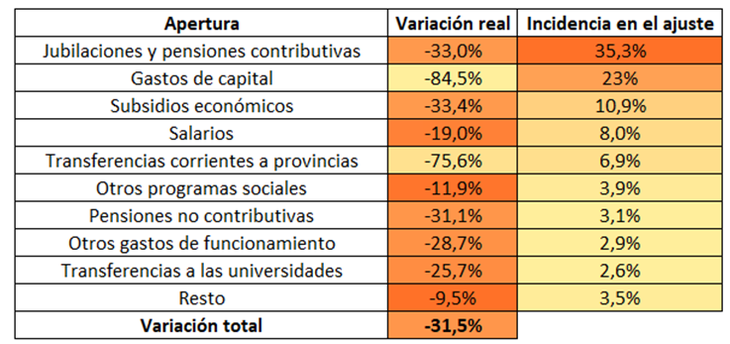

The fall in economic activity is a consequence of the exchange rate jump in December that led to a liquefaction of the income of the salaried sector. It is also a consequence of the reduction in public spending in real terms that the first quarter of this year was 31.5% lower than in the first quarter of 2023, which is mainly explained by the drop in retirements, the freezing of public works, the removal of energy subsidies, layoffs and liquefaction of salaries in the public sector and current transfers to the provinces.

Real variation in public spending (first quarter of 2024 versus the same quarter of the previous year) by opening

image.png

However, the economic recession alone is not enough to guarantee a process of disinflation. An example of this is the years 2018 and 2019, in which we witnessed a strong economic recession with an increase in inflation. The exchange rate anchor is essential to prevent company costs from increasing and with them prices. This is the second anchor that the government implements when the official dollar increases at a rate of 2% monthly, markedly below the inflation.

However, for the appreciation process to be sustainable, it is necessary for the Central Bank to accumulate reserves, that is, to sustainably supply of dollars is greater than demand. This was possible due to the pronounced drop in import payments, which, measured in dollars, fell by 56.16% in the first quarter of 2024 compared to the first quarter of 2023. This drop is due to two factors: the already mentioned recession, but also to the full validity of the stocks that, in combination with the Bopreal, continues to appeal to the indebtedness of importers. In this way, it is clear how the fall in activity is functional to the exchange stability achieved.

The scheme of the dollar Blend which guarantees a dollar flow in the CCL dollar market through export liquidation. Keeping the gap between the official dollar and the parallel dollars low is a necessary condition for the Central Bank to continue accumulating reserves.

The aforementioned anchors are clearly related to each other, and in this way they constitute a macroeconomic scheme that has been inducing the reduction of inflation. However, This scheme is not exempt from a series of risks and costs that could make this dynamic unprofitable in the medium term.

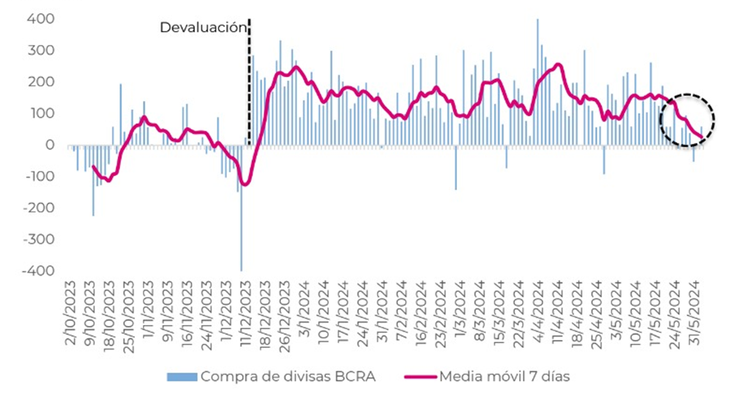

The first and most notable risk is the exchange rate appreciation. To the extent that inflation does not converge towards the 2% devaluation rate, the official dollar could become cheap in a short time, stopping the recession, encouraging imports and making it difficult to accumulate reserves, and ultimately giving rise to a new devaluation that reverses part of the disinflationary process. In fact, the Central Bank’s foreign currency purchases are markedly lower than a couple of months ago. Given that utility rates are likely to be updated in the coming months, it is likely that the monthly inflation rate is maintainedat least throughout this year 2024, above 2% monthly.

Evolution of the Central Bank’s foreign currency purchases in the MULC (in millions of USD)

image.png

Source: Central Bank

Another risk lies in the fact that the drop in activity is deteriorating the State’s tax revenues, especially those associated with VAT, social security and credits and debits. If collection deteriorates excessively, the fiscal surplus obtained during these last months can be reversed and lead to a return to monetary issuance, as well as going backwards in the process of cleaning up the balance of the Central bank.

The great weakness of the government’s anti-inflationary program is the lack of addressing the inertial component of inflation. To the extent that indexed contracts persist, the inflationary phenomenon is persistent and has a floor that is difficult to break without coordination of prices and wages ordered by the State. A policy of these characteristics could contradict Milei’s liberal ideology. For example, convertibility implied the prohibition of the figure of the contract indexed by inflation, that is, it restricted the individual freedom to establish contracts under a modality that explained the persistence of inflation.

To the extent that the government does not address inertia, the disinflation process is slow, costly, and difficult to implement, since it requires many months of fiscal surplus, recession, and exchange rate stability. How long can society endure a collapsed economy? What is the economic cost of paralyzing public works for months? Despite the official narrative, the economic situation remains fragile.

Economist at the National Economy Research Center (CIEN).

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.