The current earnings reform that awaits approval or rejection in Deputies has several implications that are interesting to analyze.

Firstly, the reform implies increases and decreases in tax pressure at the individual level. The first important one is the increase for a group of employees and the decrease for the self-employed. Among employees, not all cases are raises, since there are also cases of declines.

As a net result, the change in profits implies a greater effective tax pressure for the economy, estimated at 0.5% of annual GDP. Indeed, in current currency, the increase is on the order of $3,100,000 million. This figure arises from assuming that the reform discussed by Deputies is the one originally approved by that chamber, that is, the changes that were in the opinion of the bill in the Senate of the Nation are not considered. In short, it is assumed that Deputies insist on the reform that they approved at the time.

The distribution of surplus collection between the Nation and Provinces

Given that the income tax is a co-participating tax, approximately 60% of what is collected goes to the provinces and CABA and the remaining 40% goes to the Nation. In effect, of the 0.5% of GDP with the highest potential revenue, 0.30% will go to the Provinces and CABA and 0.2% will go to the Nation.

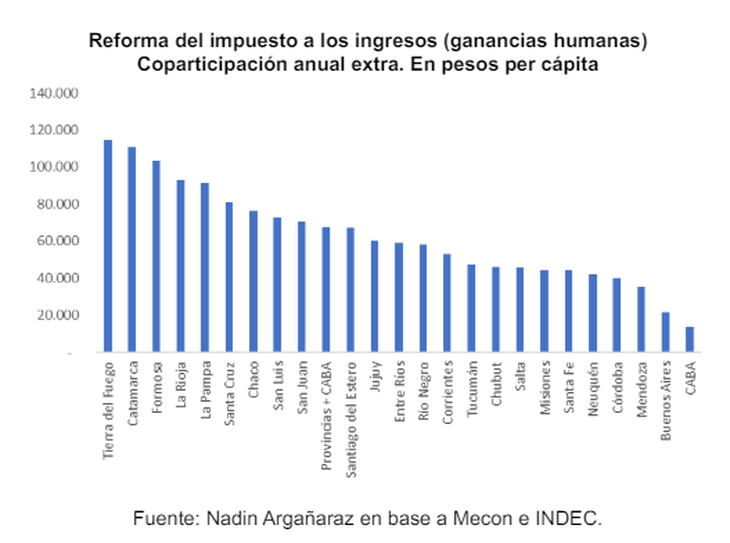

What is evident is that the result of the reform is different by province, with the amount per inhabitant being the most appropriate for measuring the impact. If the extremes are taken, the inhabitants of Tierra del Fuego, Catamarca and Formosa would benefit the most from the distribution of the collection since they would receive an additional $115,000, $110,000 and $103,000 annually, respectively. For their part, the inhabitants who would receive the least would be those of CABA, Buenos Aires and Mendoza, with $13,600, $21,600 and $35,000, respectively.

Nadin1.png

On average, the additional transfer would be $67,500. The provinces of Santiago del Estero and San Juan would have an extra income from co-participation of $67,000 and $71,000, respectively.

In all cases, a governor must analyze the comprehensive impact of the tax reform that is in Deputies, which in addition to profits, is personal assets, moratorium and externalization of assets. If what the inhabitants of the province put in is greater than what they are going to receive, this reform is not favorable.

Nadin2.png

In the case of provinces such as Catamarca and Formosa, the earnings reform is clearly favorable. If the case of Catamarca is taken, the provincial government will receive an annual amount per inhabitant of $110,000, a figure that results from the combination of an extra income of $47.5 billion and a population of 429,500 inhabitants. This amount of money is much greater than the contribution that Catamarcans who will have to pay a higher income tax as of the reform will make.

In the rest of the provinces it is necessary to make a comparative calculation between contribution and receipt, both in the short and long term, and it is necessary to mention again that it should be that of the entire legislative package that is in Deputies.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.