Currently, there are several series of BOPREAL with different maturities: 2025, 2026 and 2027. They all expire in the current term of the Milei government. That is the first big difference with sovereign bonds. The sovereign bonds mature in 2029, 2030, 2035, 2038 and 2041. That is, outside the current government mandate.

Furthermore, the issuer of these bonds is the Central Bank of Argentina. On the other hand, the issuer of sovereign bonds is the National State.

By having different dates, payment structures and characteristics, the returns of BOPREALs and sovereigns are different.

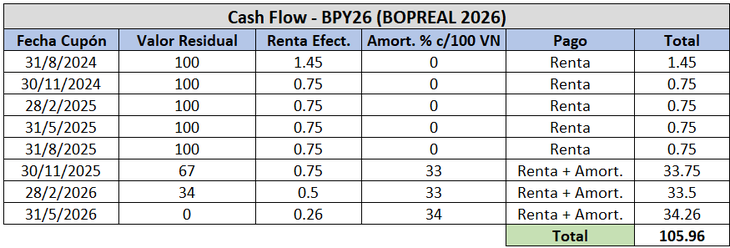

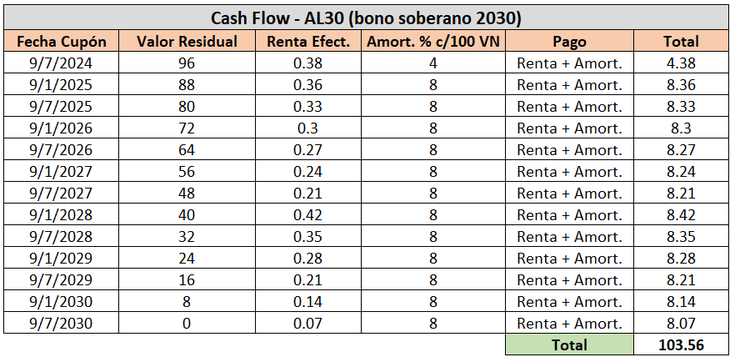

In this note I am going to make the comparison between BPY26 (BOPREAL that matures in 2026) and the AL30 (sovereign bond that matures in 2030). Both bonds are in dollars (although they can also be traded in pesos), but they have different structure, issuer and maturity.

Let’s see their comparison:

B1.png

Let us remember that the “duration” is an estimate of the recovery period of the money invested in a bond, considering both interest and amortization. The more time it takes for the flows to occur, the longer their “duration” will be.

What is the estimated cash flow of each bond per 100 nominal? 100 nominal today represents investing US$78.5 in the BPY26 and US$56.4 in the AL30.

B2.png

B3.png

Assuming all flows are paid, the BPY26 IRR is just under 20%. And that of the AL30 is 24%. What does an IRR of 24% in the AL30 mean? The IRR is the internal rate of return: assuming the coupons are reinvested, one would earn an annual return of 24% until maturity, as long as it is paid on time.

So, Which one suits me? The answer will depend on each person’s risk profile. For someone more conservative, BPY26 is undoubtedly more attractive. Because? Because despite performing less than the AL30, the duration is considerably shorter, therefore the risk is greatly reduced. Furthermore, it expires within this government mandate, a no small characteristic taking into account the political and economic ups and downs of the country.

On the other hand, for a more aggressive profile, the most suitable would be the AL30 in this comparison. Because? Because it offers a juicy yield and continues to have a lot of appreciation potential, as long as Argentina continues to compress its country risk.

For example, if Argentina breaches 1000 country risk points, the AL30 would rise by more than 30%. Can it happen over the next few months? Nobody can rule it out.

Color data for the most aggressive profiles: outside of the comparison of the BPY26 and the AL30, the most advisable thing is to focus on sovereign bonds with longer maturities, such as the GD35, which has a “duration” of 6.2. For what is this? It is explained by the concept of “duration”, which is a measure of the sensitivity of the bond to changes in the interest rate.

Therefore, an aggressive investor has greater incentives to buy GD35 since, if Argentina strongly improves its country risk, the return potential is much greater than in the AL30, for example. Analogously and inversely, the same thing happens: if things get very bad, the GD35 would suffer more.

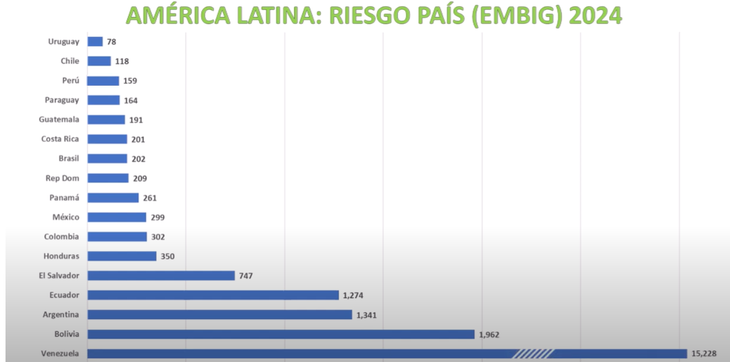

Let’s look at the country risk of our neighbors:

B4.png

It is worth clarifying that Argentina had a fiscal surplus for the fifth consecutive month, an achievement not achieved since 2008. Since Milei took office, the anchor was fiscal and monetary, and the market liked that, which validated a furious rise in bonds in recent years. months (+100%), resulting in a sharp drop in country risk.

Compared to other countries in the region, our country risk remains very high. Uruguay has a country risk of less than 100 points, Chile less than 150 points, Peru is at 160, Paraguay at 164. Brazil is around 200 points, while Colombia is close to 300 points. Argentina? Above 1300.

Apparently, there is still room for an increase. Have bonds already gone up a lot? Yes, they have doubled in recent months. But there is still value, especially in those with longer maturities.

Finally, we cannot forget that they are still Argentine assets, with all the risk that that entails. Therefore, you have to be very careful.

Note: The material contained in this note should NOT be interpreted under any circumstances as investment advice or a recommendation to buy or sell a particular asset. This content is for educational purposes only and represents the opinion of the author only. In all cases it is advisable to seek advice from a professional before investing.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.