The difficulties that exist for build up a stock of reserves that would allow the release of exchange controls without any risk or eventually move towards some type of currency competition or dollarization. But regardless of this stock, it may be even more important to ensure that dollar flows in the foreign exchange market remain balanced, because that is the only way to achieve a certain degree of predictability in the event of a liberalization process of foreign exchange controls.

The expected flows depend on many factors that have uncertain dynamics in the future.This is why we believe it is important to closely monitor how they evolve in order to understand the real possibilities of ensuring that these future flows are balanced and/or allow for the accumulation of reserves.

The supply and demand of dollars for a given period depends on many factors and its future estimation has a high margin of error, but we believe it is necessary to begin to analyze the factors behind these flows, because they will determine the future evolution of the local economy.

The first factor to analyze is the level of dollar supply, where the main source is exports. There we find that several processes intervene, some endogenous and others exogenous. To better understand these factors, we have separated exports into 4 groups:

image.png

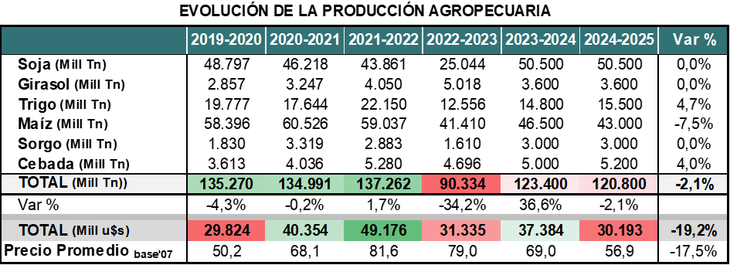

What is happening in the agro-export sector?

The country faces a different challenge than in previous years. This time it does not come from the climate, where the probability of a severe “Niña” effect (drought) has been decreasing. This time the challenge comes from the price side: dollar values in international markets have been clearly declining and are in real terms below historical averages.

At current values, this implies a decrease in the value of the harvest of around USD 7 billion. However, just as this year a higher harvest value did not imply the same impact in terms of exports, the same could happen in the future.

When prices are lower, producers need to sell a larger portion of their crops to cover their costs. Even if they close at a loss, this may mean that they need to sell stocks accumulated in previous seasons.

In short, it is a number that can change depending on prices, profitability and the needs of producers. In any case, even in positive scenarios, we can be talking about a lower supply of foreign currency in the order of USD 2.300 / 2.800 million. This would bring the liquidation to the levels of 2015-2018, the last cycle of prices similar to the current ones (but without CEPO).

image.png

What is happening in the oil sector?

This is the sector that is called upon to offset the negative impact of agriculture, although for now the effect would be felt more by a lower level of imports than by a higher volume of exports.

Although shipments abroad are expected to increase, for now it is at a gradual pace limited by transport capacity.

oil-energy.jpg

Depositphotos

What is happening in the mining sector?

It is a similar case to that of oil, where new projects that are advancing and that should be promoted by the RIGI have a maturation period that makes the impact on exports gradual.

In addition, those who enter the RIGI will have a wide margin to regulate the liquidation of foreign currency, probably limiting the costs and taxes they must pay locally.

What about the rest of the exports?

For now, we do not expect an export boom, the real exchange rate is not at levels that could generate an additional shock; therefore, it will depend on the opportunities and productivity improvements that may occur in different sectors. For now, we do not assign it a positive or negative effect.

In summary, this analysis makes it clear that the total volume of foreign exchange to be settled in 2025 is likely to be similar to that in 2024.

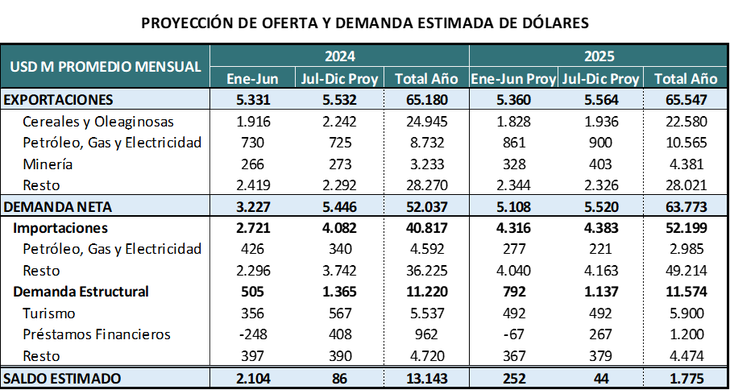

What to expect from dollar demand?

If the currency supply in 2025 is confirmed to be similar to that in 2024, the difference will end up being generated by the rest of the items that determine net demand.

In our case we prefer to use a methodology that groups the rest of the demand factors into 3 groups:

- Energy Imports: The completion of part of the gas transportation network and the reversal of the Northern Gas Pipeline firstly create an opportunity to reduce the volume of gas imports and should then help to increase exports. But the first effect will be felt in the payment of gas imports, where an additional saving of USD 1.6 billion is projected.

- Other Imports: With economic activity slowly recovering, the impact on import demand is also expected to be gradual, despite the lag in the real exchange rate. The most relevant effect is due to the shortening of the payment period and the reduction in the Country Tax rate. They have combined to soften the effect on demand of the transition between the previous 4 months and the 2 months that came into effect.

- Structural Demand: Several areas are grouped here, such as hoarding, tourism or financial loans. Each one has different factors that define it. We see little demand for hoarding going forward, because the PAIS tax would remain in force for these operations. As long as the crawling peg remains at current levels, credit in dollars may reappear in the local financial system, which helps to lower the demand for foreign currency. The greatest factor of uncertainty continues to be Tourism, where its impact on demand depends on the gap between the tourist dollar and the free dollar.

How can dollar flows be?

The way in which the supply and demand flows of foreign currency are balanced will determine the scope that the economic team has to organize a low-risk exit from the current scheme of exchange controls. If the flows are balanced, this option is more likely.

That is why we have analysed the supply factors and identified the fall in grain prices as a very strong negative effect, although its impact can be limited by the financial needs of producers. Oil, gas and mining are the sectors that can help offset this fall in supply, but they have longer periods between investment and settlement of foreign currency.

image.png

The figures will therefore end up being defined by net demand, where the recovery of the level of activity and the level of imports will probably be the most relevant axes.

The projected figures show a scenario in which the foreign currency surplus is significantly reduced. Although the margin of deviation from the projections is high, a base scenario is defined in which each movement in supply or demand will be key to guaranteeing the stability of a market that is the central axis of economic stability and the formation of expectations.

These will undoubtedly be the central issues to monitor in order to define the degree of exchange rate coverage of the different investment portfolios.

Chief Economist at MegaQM

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.