Before the Falling agricultural pricesan immediate recovery is not expected, which depends on geopolitics and other references, somewhat complicating the liquidity of the Argentine government and its external obligations. The internal ones are social, where Milei, after 7 months of government, keeps half of the children living below the poverty line, according to UNICEF-Argentina.

Let’s take a few references to see the field we are moving on: One, the Russia-Ukraine conflict (since 2012); two, climatic events; and three, the FED rate. There are technological advances that could influence the process, but these advances are inevitable because they happen in the economic centre: China, Europe and the United States. These points that mark the field, in terms of impact, do not occur in the same way across the globe. In the case of Africa, famines and droughts complicate daily life, but even with this panorama, some hope still emerges. From Burkina Faso, Ibrahim Traoré said: «We African presidents must stop being puppets that dance every time the imperialists pull the strings» This was during the 2023 Russia-Africa summit.

Africa has, beyond its people and its history, mainly natural resources: metal and non-metal minerals, citrus fruits, which are necessary for the industrial development of central economies. Economic centers plan their production; if the Internet is a characteristic of globalization, capitalism, which has been around for several centuries, continues to demand inputs for its industrialization and subsequent commercialization. This requires a clear knowledge of geopolitics. Economic centers plan their expansion. They train colonial administrators for the 21st century. Is there any difference from those of the 20th century? One, they have social networks. In this year that marks the 50th anniversary of the death of Arturo Jauretche, this phrase resonates: “If the gringo who buys from us is bad, the Creole who sells to us is worse.” Gringo? Yes, in the 21st century, they would be the economic centers: London, New York and Beijing. The diplomacy of the yuan.

Critical minerals are vital to modern technology and their geopolitical importance has increased with the arrival of electric vehicles. One question arises: How is our automotive industry, which generates an average trade deficit of 12 billion dollars, advancing in the development of these electric vehicles for our economy?

The global battery “arms race”, driven by the arrival of electric vehicles, has caused a radical shift in demand for lithium, nickel, cobalt, graphite, manganese and rare earths. More than 75% of rare earths are concentrated between China and Vietnam, followed to a lesser extent by Brazil, Russia and India.

Traditional raw materials have taken a backseat to the raw materials of the future. And lithium-ion batteries and their key raw materials have become central to policy, for example in the US Inflation Reduction Act. renewable energies Like wind power, they also depend on rare earth elements, since the infrastructure for wind turbines would be unviable with large motors made from other materials.

image.png

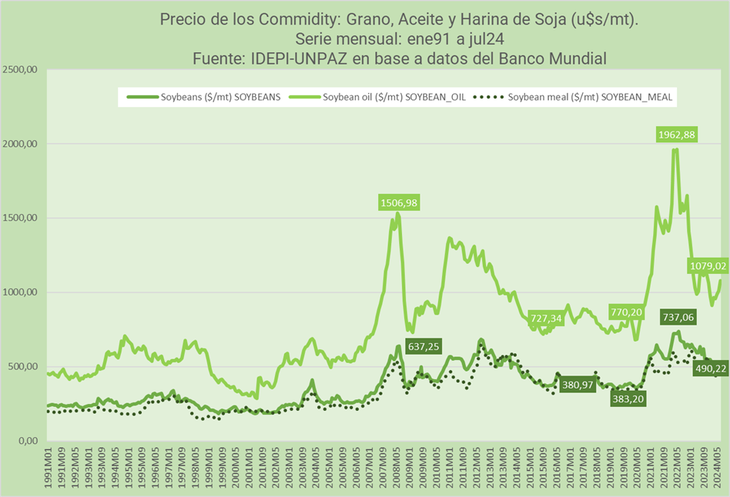

At the other end seem to be the agricultural prices that have suffered a collapse, compared to the peaks of the year 2022, the prices of wheat, corn and soybeans, according to World Bank data, are at a level well below, in the last five years, since the period 2019/20. It is the biggest collapse since the years of the Pandemic. At which time it will accelerate to the peak of 2022. Another question arises, what is happening, will it have to do with the influence of the FED rate or will it be necessary to consider the second place that would be occupying the raw materials in this economic and technological process in which the United States and China are advancing?

In light of this drop in agricultural prices, which is affecting Argentina’s foreign exchange earnings, a credit policy was launched for the sector called “soybean credits.” The installment is set in tons of product and is paid in pesos based on the “Soybean Price” of the day before the time of payment. The loan, intended for investment projects such as the purchase of new equipment and the construction of production facilities, is granted with a flexible term of up to 60 months, that is, it follows the evolution of the price of soybeans. This means that when the price of the product drops, the credit term is extended and when it rises, it is reduced. Could a deeper drop in prices be expected? Will the exchange rate unification requested by COFCO -China-, CIARA-CEC and former official Vilella be ignored? Will the Fed rate remain at 5%? Questions arise at the national level and about the direction the world is heading.

image.png

Meanwhile The Argentine economy is not generating enough incomethe exporting sectors are putting pressure, the IMF too, a pressure that coincides with the COFCO –China-, CIARA-CEC Will Toto Caputo and Milei be able to overcome these pressures? Difficult, the first semester shows the deepening of the social fracture, inequality and impoverishment that account for the “permanent” social crisis since December 2023.

Inflation in July was 263%, in June inflation was 270%, well above the increases in registered employees, which denote a contraction of -20%, public -83%, and unregistered private wages were adjusted by -110%. This salary adjustment due to “permanently” high inflation is reflected in the fall in consumption levels. There is no recovery of wages, there is no drop in inflation. Milei’s stabilization plan is a social failure. Economic sectors, faced with a lack of sales, are liquidating products to try to cover their costs, and there is incipient economic activity. The standstill and recession are evident in this first semester in the data on the use of installed industrial capacity (UCI), which is at the level of December 2023 (54.9%). Compared to June 2023, the ICU for June 2024 shows a sharp drop, 68.6% vs 54.5%.

On the other hand, private sector dollar deposits amount to 17.788 billion dollars, when in December 2023 it was 14.598 billion dollars.

Beyond the current situation of lack of liquidity on the part of the government, which is why it is looking for alternatives for loans or refinancing, the reality is that there are other variables that put pressure onsuch as payment for imports, interest on public and private debt, and the transfer of profits and dividends by multinationals. The Treasury faces foreign currency maturities of almost US$17 billion in 2024. They correspond to commitments with the IMF, public securities, the Paris Club and other organizations. Will the dollars be enough? Milei plans to pay the obligations with a primary surplus. This implies moving towards a greater budget adjustment.

Everything seems to indicate that there will be no change in economic policy, wage, social and labour adjustments. Until when? What spark will complicate everything even more? The perfect liberal storm in this context would be a devaluation and fiscal adjustment, nothing new in the liberal economic script of Alsogaray or Martínez de Hoz.

Economist at UBA. Professor of Latin American Structuralism at UNDAV.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.